CORRINA: Hello, I’m Corrina Sullivan … and welcome to the Super Stock Summit.

Today, Charles Mizrahi — the only investor crowned Wall Street’s No. 1 trader by Barron’s AND top market timer over a seven-year period — is going to reveal why he’s putting his own money in a group of investments he calls … Super Stocks.

Super, because you can invest in them before Wall Street, giving you the chance to flip the script and stack the odds in your favor.

Super, because they’ve trounced the market 6-to-1 … not just for the last 10 years or even 20 years … but for close to a century.

Super, because the likelihood of them going up 1,000% is a lot more common than you might think … making them more attractive than IPOs, Private Equity and, yes, even SPACs.

In fact, as Charles is about to show you, investors in Super Stocks over the last decade have had the chance to bank gains of 1,000% or more … get this … 440 times.

That’s 440 opportunities to 10X your money.

He’s also going to reveal all the details on his No. 1 Super Stock … a tiny pharmaceutical company whose game-changing drug was just approved by the FDA.

It’s an innovation 120 years in the making … and 30 million Americans could be lining up to get it by the end of this year.

Charles predicts this single stock has more upside than any other stock he’s seen in the past 10 years and could go up 1,000% from here.

If he’s right, every $10,000 you invest could turn into a $100,000 profit.

So this is for you … regardless of whether you’ve been following his insight for three years or three weeks.

With that said, Charles, wonderful to see you again.

CHARLES: Nice to see you too, Corrina. You sure know how to talk a guy up. It’s a pleasure to be here … and it was great catching up with you earlier. I also want to thank you, our viewers, for joining us today. Without you, none of this would be possible.

CORRINA: Before we get started, Charles, I just want to tell our viewers … Charles and his team have been working on a presentation about Super Stocks, which was scheduled for next month.

But I convinced him to get the news out early … today … so you can get access right away.

Our incredible production team … you guys rock! … they’ve pulled a few all-nighters, getting everything ready for us today.

CHARLES: They deserve a raise, for sure!

CORRINA: Absolutely. So please bear with us if we have any technical issues or bloopers.

OK. Back to business. By the looks of it … tens of thousands are joining us. They’re still flooding in. Charles … everyone wants to hear what you have to say about these Super Stocks.

And why wouldn’t they? Most people watching … my guess is that they’ve made money with you over the last three years. A lot of money.

CHARLES: It’s one of my favorite things, Corrina. Hearing from people … the thousands who are watching right now … who are growing their portfolios.

CORRINA: And they’re making a lot of money. Charles, 86% of the stocks in your Alpha Investor service portfolio are up…

86% … dating back BEFORE the 2020 crash.

And we’re not talking about small gains. We are talking about recommendations up over 100%, 150%, even 200%. It’s an amazing feat when you think … as you’ve told me before … that 9 out of 10 professional investors can’t beat the market.

CHARLES: Amazing isn’t it? Nine out of 10 PROFESSIONALS fail to beat the market. They have one job … one job … and they have a hard time doing it.

CORRINA: But you aren’t just beating the market. You’re crushing it.

CHARLES: Yes we have. But really, the credit goes to those watching. Look, you folks had the confidence to invest your hard-earned money based on my recommendations ... even during the COVID bear market, for some of you.

You’ve done what most investors can’t do. You stayed the course and reaped the rewards.

And for that, you should be proud.

CORRINA: And now they want to hear what you have to say about these Super Stocks. Because several of these stocks, well, they’re primed to start moving right now.

CHARLES: For sure. I think I mentioned in one of my videos that I’ve been watching a key microcap indicator. For the past five years, it’s been going nowhere.

But in the year following the pandemic lockdown, this indicator has more than doubled!

THIS is the time to get in.

CORRINA: And again, we’re talking about the kind of stocks that have seen 1,000% gains here … the chance to turn every $10,000 into $110,000. And many times, they move even higher.

CHARLES: These Super Stocks … they knock the socks off IPOs, SPACs and the like.

Because with those investments, Wall Street gets there first.

They take the main course for themselves. You get left with the scraps.

But with these Super Stocks … you’ll have a chance to get in way BEFORE Wall Street.

CORRINA: So, for once, we get the upper hand!

CHARLES: Heck yeah. It’s a massive advantage, as I’ll show our viewers in a moment. But almost no one knows about it.

CORRINA: Now … I took a sneak peek at your No. 1 stock earlier, and … well, I’m not an expert like you, Charles … but even I can see why you think this is going to be incredible.

CHARLES: Right. The company is practically unheard of.

Yet, its recently FDA-approved product is going to change the lives of tens of millions of Americans.

CORRINA: Is that what you have in that little bag you kept teasing us about?

CHARLES: It is. Take a look…

These little pills treat chronic pain. That might not sound like a big deal. But about 30 million Americans suffer pain on a daily basis. For them, this is a game-changer.

Now they’re able to get relief, without the dangerous side effects that painkillers often cause.

CORRINA: That’s incredible. I have two friends who deal with chronic pain … and I’m sure once they hear about it, they’ll be lining up to get their hands on this drug … just like the other 30 million Americans who need it.

CHARLES: Right. And with demand like that, the stock price could shoot up 1,000% or more.

CORRINA: But Charles … for some of the people watching right now, well … they might not know you like I do, and a return like that may sound too good to be true.

CHARLES: I totally understand. But keep in mind, with these Super Stocks, we have the chance to invest before the big Wall Street firms come in with their billions of dollars.

This is the ONLY place in the stock market where the odds are heavily stacked in our favor.

That’s exactly the type of opportunity you have with Super Stocks.

CORRINA: So, to be clear, we will have the chance to invest in these stocks BEFORE the big funds, and that’s not possible anywhere else in the market?

CHARLES: That’s right. And that’s just one of the reasons why these Super Stocks are better than IPOs. Better than private equity. Better than SPACs.

Way better, frankly, than any other investment out there.

It’s why I’ve been investing a percentage of my portfolio in them. Not all of it. Enough to make a significant impact on my net worth.

CORRINA: Well if you’re investing in these Super Stocks, Charles, I’m investing in them. Seriously. I’m “all-in.” And I say that because, having worked with you for so long, I trust you.

CHARLES: I greatly appreciate that. Your trust, and the trust of our viewers, means a lot to me.

CORRINA: Well, you’ve earned it. Thousands of your subscribers are making money thanks to you. I printed this out … one of hundreds of emails I’ve seen … because it’s important for our audience to remember that you’re changing lives here.

This one is from William in California. He wrote to you to say:

Wow. 155%. That’s incredible.

Not on one stock or just a few stocks. His entire account is up 155%.

It takes most people a decade to make these kinds of gains. But thanks to your guidance, William did it in a year.

CHARLES: That’s what it’s all about. Helping people like William. And William, if you’re watching right now … congratulations. But hold on to your hat, because we’re just getting started. There’s a lot more money to be made from Super Stocks.

CORRINA: I like the sound of that. And I just want to remind our viewers. Charles is the only person crowned Wall Street’s No. 1 trader by Barron’s AND was named top market timer over a seven-year period.

Mike Huckabee, the former Governor of Arkansas, calls him “one of the top investment gurus in America.”

Former VP candidate Sarah Palin was frustrated with her financial adviser and disappointed with her investments. So Charles, you said you’d pay her to try a different approach. And it paid off. You helped her make bigger gains in two weeks than most professionals make in two years. Here’s what she said…

“I enjoy investing now. It’s not a task, it’s not stressful. Making money is fun. The gains rolling into my brokerage account are bigger than I could have anticipated.”

CHARLES: One thing I’ve noticed over the years is that no matter what their background is, most people face the same challenges. Most of them, they don’t know where to invest their money.

CORRINA: Well, that’s why we’re here today. Because these Super Stocks … they’re next-level investments.

CHARLES: That’s right. Over the last few years, my team and I have been researching the “DNA” of these Super Stocks … and what we found is incredible.

Investors in Super Stocks over the last decade have had the chance to pocket gains of 1,000% or more … 440 times.

CORRINA: So, let me get this straight. 440 of these Super Stocks went up 1,000% or more over the last decade. That’s 440 opportunities to turn every $10,000 into $110,000. A 10X return.

CHARLES: That’s right.

CORRINA: So, if I just break that down per year, that would mean someone could have made 1,000% or more, roughly 44 times per year, on average.

CHARLES: You could say that. It usually takes a few years for the gains to stack up. And, of course, some years have more than others, some less.

Now don’t get me wrong … hitting a 1,000% gain is a rare feat for any investor. But my almost 40 years on Wall Street has taught me how to uncover the best Super Stocks in the market — the diamonds in the rough.

CORRINA: What do you see for next year?

CHARLES: Corrina, it looks extremely promising. Many businesses closed down when the pandemic hit. But by mid-2020, American ingenuity kicked in ... and now we're seeing an explosion in new startups.

That's where the best Super Stocks are found. That's where we'll find the next Amazon.

In fact, I’m expecting a bumper crop of Super Stocks this year. Because when you can get in before Wall Street … before it starts investing billions of dollars into buying these very same stocks … driving the stock price up…

CORRINA: That stacks the odds in your favor in a big way.

CHARLES: It does. And my No. 1 Super Stock … boy, they’re knocking the lights out. This company just developed a patent-protected way to treat a condition scientists have been trying to figure out for the last 120 years.

CORRINA: 120 years.

CHARLES: 120 years. They’ve finally done it. No one was able to do it … until this company came along. It’s monumental what they’ve done. And some folks are going to make a fortune.

CORRINA: Like I said, Charles, I’ve known you for quite a while. And I can’t recall ever seeing you so confident about an investing opportunity. But for the skeptics watching, there’s a chart I want our production team to put up.

Wait a second … that’s not the one we’re looking for … guys … OK, there it is! I knew they’d be able to handle any glitches on the fly.

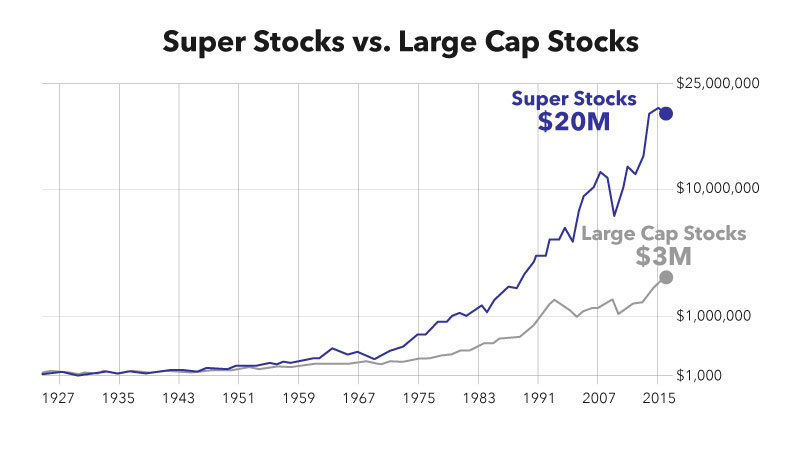

These Super Stocks … they have trounced the market by 600% ... not just in the last year, 5 years or 10 years … but going back almost 90 years.

CHARLES: That’s pretty amazing stuff, huh?

CORRINA: I just want our viewers to soak this in. Historically, these Super Stocks, as a whole, have returned six times greater gains than ordinary stocks … for almost a century.

Add to that, Charles and his team have a proprietary blueprint that helps them find the TOP Super Stocks … giving us the best chance at even bigger gains.

I’ve seen his blueprint. I’ve seen his team in action. And … after being in this industry for a very, very long time … I can say that this is as good as it gets. This is truly a once-in-a-lifetime opportunity.

CHARLES: It is a once-in-a-lifetime opportunity.

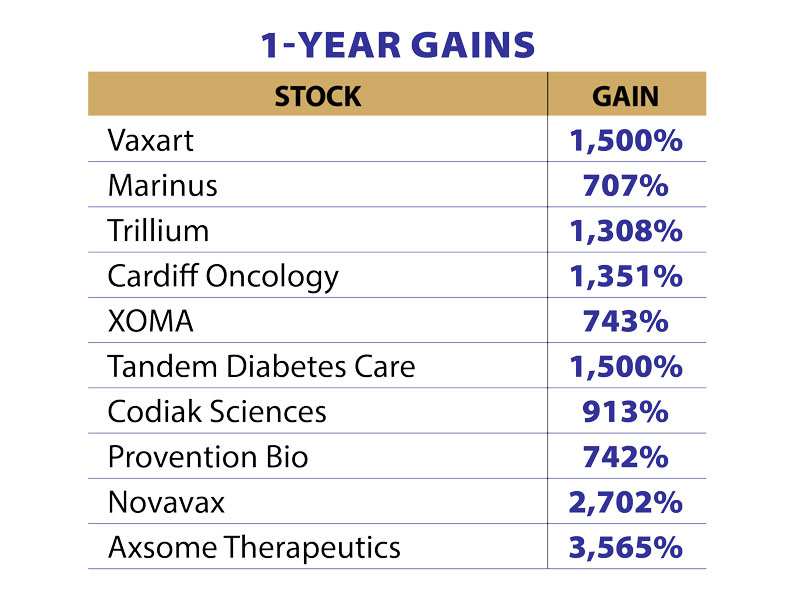

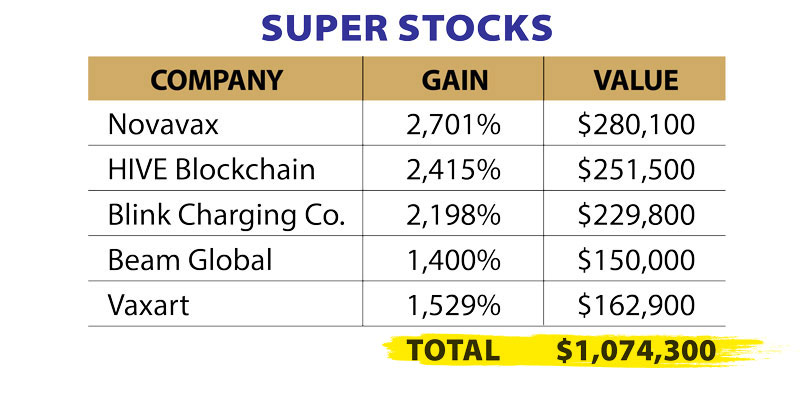

CORRINA: You actually have a few examples for our viewers from the last few years … examples that compare the top-performing Super Stocks with other top performers.

CHARLES: Sure do. Let’s put them up.

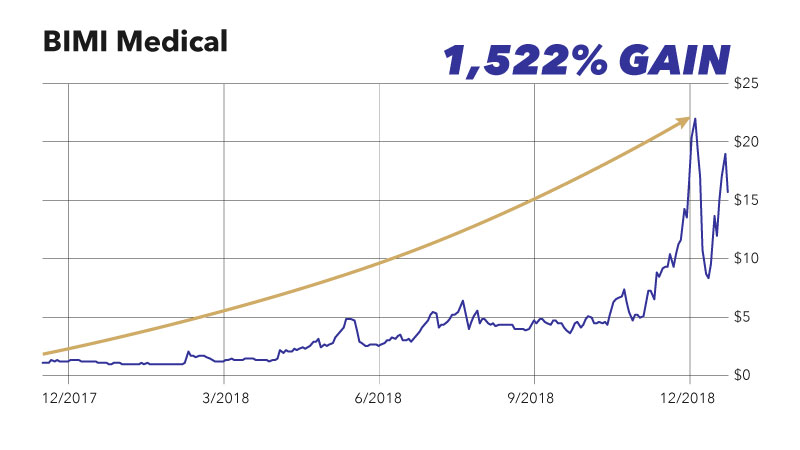

This one is from a few years ago in 2018. BIMI Medical went up 1,500% — 38 TIMES the gain for Merck, the top-performing stock in the Dow.

In 2019, Axsome Therapeutics was the best-performing Super Stock, soaring 3,500% — 24 TIMES the gain of Advanced Micro Devices, the best-performing tech stock of the year.

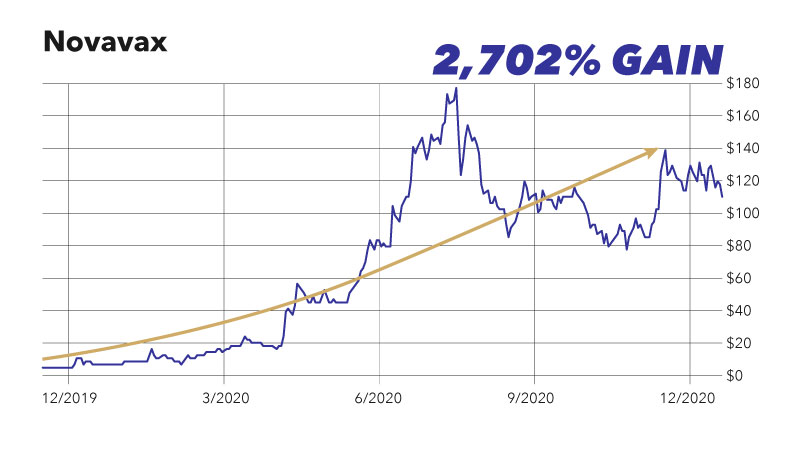

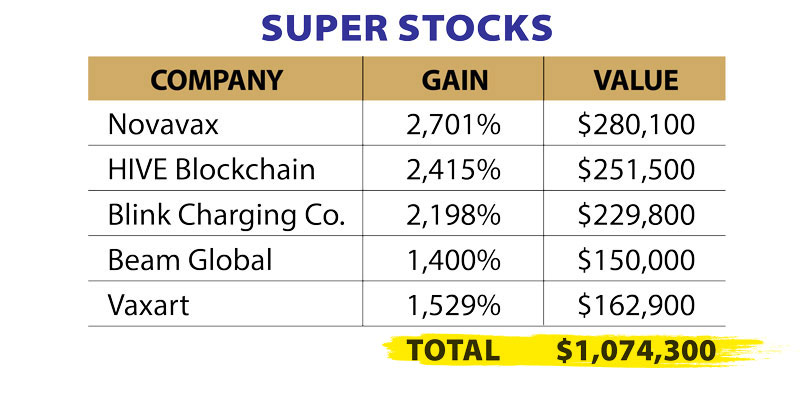

In 2020, the top Super Stock, Novavax, went up 2,700% … 30 TIMES more than Apple, the top-performing large-cap stock.

CORRINA: It happens again and again. The top Super Stocks absolutely clobber their larger cousins in the S&P 500 and the Dow … because with Super Stocks, investors can get in BEFORE Wall Street drives the prices up.

CHARLES: Right. And it happens every single year.

Let’s take it one step further…

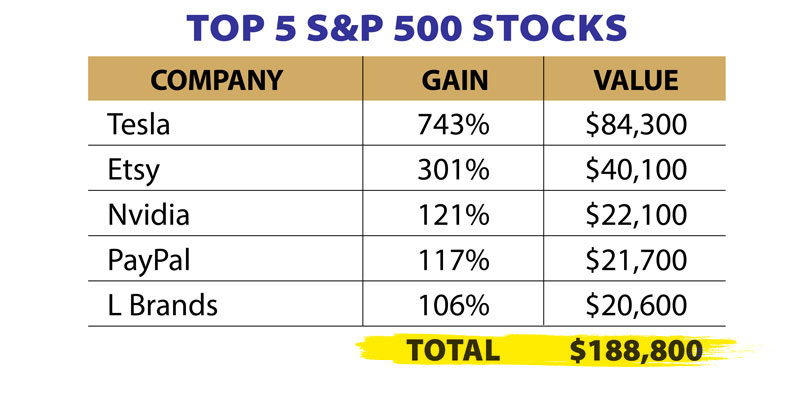

If you’d been lucky enough to invest in the top five stocks of the S&P 500 — that’s Tesla, Etsy, Nvidia, PayPal and L Brands — between January and December of 2020, a $10,000 investment in each stock would be worth more than $188,800.

CORRINA: That includes a 700-something percent gain on Tesla, which had an amazing year. So we’re talking way above average returns.

CHARLES: Yes we are. But … if you had invested $10,000 in each of the top five Super Stocks of 2020, well, you would’ve done a whole lot better. Your investment would be worth more than $1 million.

CORRINA: Charles, that’s incredible. You’d be a millionaire! In just one year!

And that’s why we want our viewers to know about Super Stocks.

Now folks, I don’t want you to be spectators today. We want you to join in the conversation. On your screen is a form where you can submit your questions, and when we are done, you’ll be able to ask Charles anything you’d like in a live Q&A session.

In fact, it looks like we already have a lot of questions coming in. And our production team, thank you guys, they moved this one to the top … so let’s have at it.

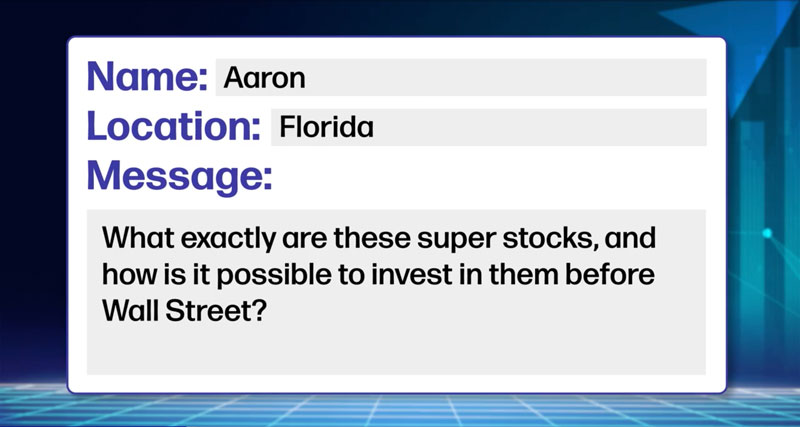

Aaron, in Florida … he asks:

CHARLES: Thanks for your question, Aaron. For anyone who hasn’t seen my recent videos about Super Stocks, let me add some color for you…

Imagine you are Warren Buffett, and you have hundreds of billions of dollars to invest.

Would you be interested in investing $10,000 in the coffee shop on the corner of Main Street?

Even if it was generating $100,000 in profit?

CORRINA: Well, it sounds like a great investment for me. I could put $10,000 in it and rake in some nice money. But, for Buffett … who has hundreds of billions to invest … why would he want to invest in something that doesn’t move the needle on his performance.

CHARLES: Exactly, Corrina. For most of us, to invest $10,000 and make $100,000 … that’s a pretty big deal. That works out to be a 1,000% return.

CORRINA: A huge opportunity.

CHARLES: But for Buffett, he wouldn’t be interested because it’s not even a rounding error on the hundreds of billions he has to invest.

CORRINA: A $100,000 profit wouldn’t be worth his time.

CHARLES: But let’s say in our coffee shop example, it sells a unique blend of specialty coffees from around the world and created an amazing customer experience. The business is expanding around the world and is now generating billions of dollars of profit. It’s an even better version of Starbucks.

CORRINA: Well, Buffett might be interested at that point … because that much money would move his bottom line.

CHARLES: And we … as early investors in the coffee shop … would make a fortune.

CORRINA: But this is just a hypothetical. These Super Stocks, they aren’t private investments. They are publicly traded companies.

So our viewers, including Aaron, want to know, what are we talking about here, Charles?

CHARLES: We’re talking about microcap stocks. Companies with market caps of $500 million or less.

CORRINA: $500 million. For a lot of people watching, that might not sound small … $500 million sounds like a pretty big number.

CHARLES: It sure does. But for perspective, the average market cap of a company in the S&P 500 index is $72 billion. That’s the average. A $500 million stock is a rounding error for investors like Buffett.

CORRINA: So, these microcap companies, we’re talking about … they have a market cap that’s just a fraction of that amount?

CHARLES: A tiny fraction. That’s why they are called … “micro” caps and not “large” caps.

CORRINA: So, to your point, like the coffee shop on the corner of Main Street, the big Wall Street Investment banks, and investors like Buffett, don’t bother with them. They’re way too small.

CHARLES: You hit the nail on the head. But … there’s another reason…

Some investors are actually restricted from investing in microcaps. In fact, in 2018, Merrill Lynch instituted a rule that prohibits its employees from investing in microcaps under $300 million altogether.

CORRINA: This gives Main Street investors a huge opportunity. An INCREDIBLE edge.

CHARLES: It sure does. While venture capital funds and big Wall Street firms have the advantage and reap the rewards of IPOs … leaving the “little guy” fighting for the crumbs … these microcaps … or what I call Super Stocks … give US the edge.

CORRINA: We can get in first and reap the lion’s share of the gains.

CHARLES: You got it. They couldn’t invest in them even if they wanted to. They’d have to wait until the microcap grew from a $500 million company into a $5 billion company.

CORRINA: 10 times bigger. 1,000% growth.

CHARLES: 10 times bigger. And like I mentioned earlier, in the past 10 years, 440 microcaps saw their share prices surge tenfold.

CORRINA: An average of about 44 every year. That’s incredible. That gives you, and your team, a lot to work with to find these potential 1,000% winners.

CHARLES: But I want to be crystal clear, we wouldn’t want to invest in all of these microcaps. We’re only looking to find the best 12 to 15 opportunities each year.

CORRINA: Got it. You’re looking at the best of the best. Now, in a minute, Charles is going to reveal his blueprint for finding these Super Stocks … and you’ll even see the details on his No. 1 Super Stock — a tiny pharmaceutical company that just got FDA approval for its revolutionary new technology which is already in drug stores across the country.

But first, Charles, let’s dig deeper. We’ve seen a few of these Super Stocks from the past few years, but perhaps talk about some companies that took this massive leap from microcap to large cap, from $500 million to $5 billion, $50 billion, to even a trillion dollars. Ones that our viewers might be more familiar with.

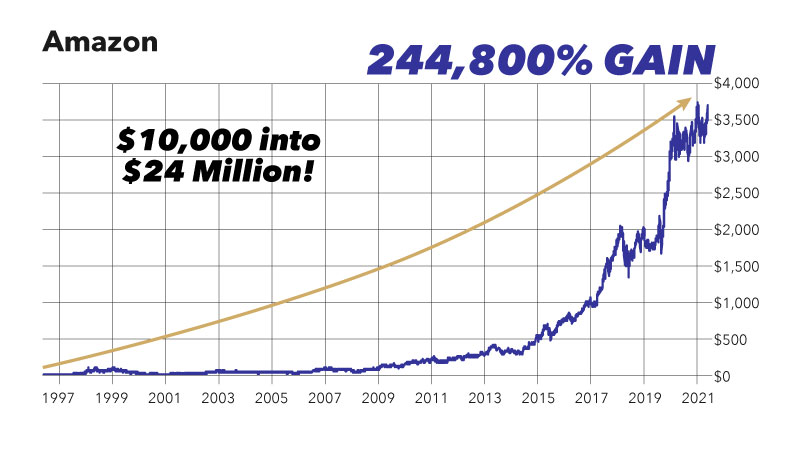

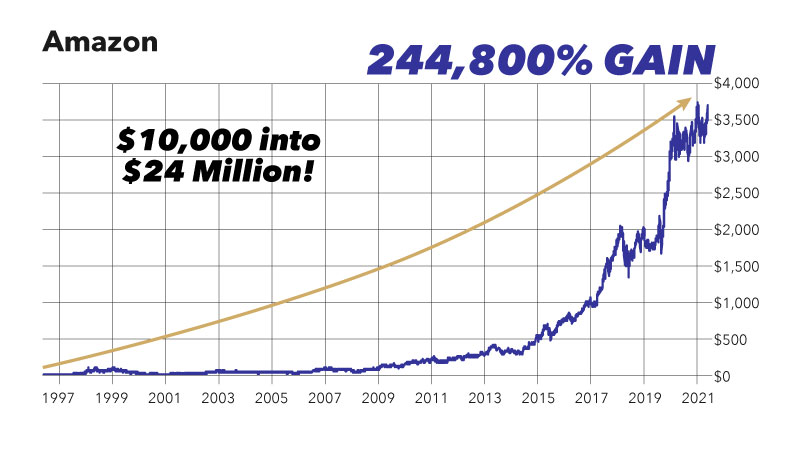

CHARLES: Sure. One of the most outstanding examples is Amazon.

Back in 1997, Amazon was a microcap … worth less than $500 million.

CORRINA: Hard to believe Amazon was once a microcap stock. That was back when it was just selling books over the internet, disrupting book retailers like Barnes & Noble, Waldenbooks and the like.

CHARLES: Back then, most hedge funds and institutional investors didn’t buy shares because the company was too small to invest in. Or they were straight up restricted from doing so. Many of them had to wait until the market cap got to at least $1 billion before buying shares.

CORRINA: But everyday Americans could — and did — buy shares long before Amazon became a household name. Before it disrupted brick and mortar retailers. Just look at this chart…

CHARLES: That’s right. They did. They were able to buy shares for as little as a split-adjusted price of $1.38. And as the market cap grew over time from $450 million to more than $1 billion, Wall Street started to buy shares.

That’s when they started piling in, all along here, driving the share price into the thousands.

CORRINA: $1.38 a share. Today, Amazon trades for over $3,400 a share, and the market cap is approaching $2 trillion making Amazon one of the largest companies in the world. We’re talking about a 244,800% gain here. That’s mind-boggling.

CHARLES: The stock soared.

CORRINA: You can say that again!

CHARLES: Main Street investors who got in the weeks after the company went public were able to turn every $10,000 investment into $24 million today.

CORRINA: That’s hard to process, Charles. I mean, you hear all the time about how much money people made on Amazon. But turning $10,000 into $24 MILLION?

CHARLES: $24 million.

CORRINA: Ha. With a windfall like that, I’d take a month-long vacation in a new yacht.

You know … these kind of big gains are new to me, but they’re not to you. And I want to take a moment to brag about you a bit … because while most people would spend lavishly on themselves, you still wear a $20 watch.

Now, most of you know Charles for his uncanny ability to recommend stocks. Not only has he shown his subscribers how to profit, he was also an investor in dozens of companies like Microsoft and Apple, which have gone up more than 1,600% and 800%, respectively, since he recommended them 10 years ago.

So he could be sitting on a private island beach right now, sipping a martini. But you’re not, Charles, you’re here, today, to help our viewers access these Super Stocks.

CHARLES: I couldn’t even imagine sitting on a private island for longer than a few hours. Even going on vacation for more than a few days gets me stir crazy. Look, even the camera crew is laughing over there.

CORRINA: OK, bad example. Because I know you don’t sit still. You are always busy on the phone or researching companies.

CHARLES: You know, Corrina, most people would consider what I do for a living “work.” But for me, researching Super Stocks, or any stocks for that matter, is my passion. I enjoy doing what I do so much, I don’t consider it work. Many years ago, I took the advice of one of my mentors. He said: “Choose a job you love, and you will never have to work a day in your life.” And that is so true.

CORRINA: With that said, you just gave us an amazing example. As we showed everyone, those who invested early in Amazon could have turned every $10,000 into $24 million. But this is probably THE best example out there. Do you have another?

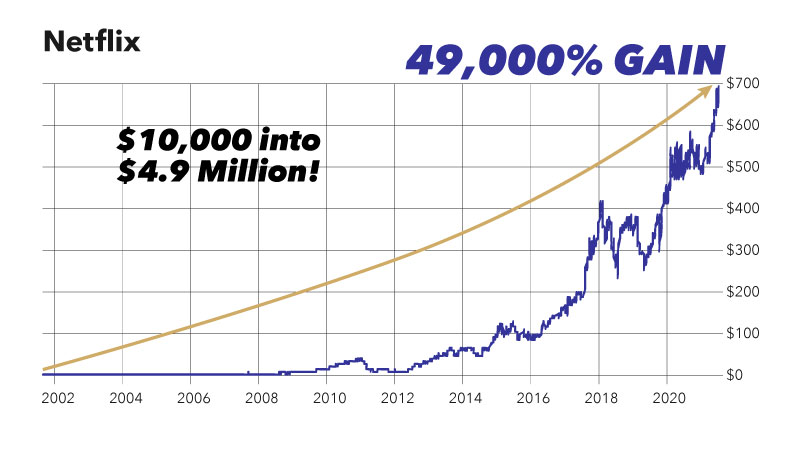

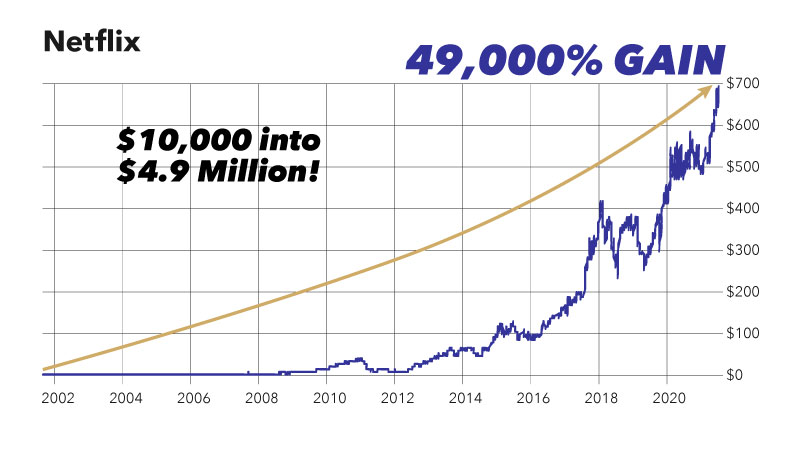

CHARLES: Another? I have hundreds. This is one of my favorites … Netflix.

Reed Hastings, CEO of Netflix, founded the company after racking up $40 in late fees at his local video rental store.

When it first listed in 2002, the company had a market cap of around $250 million. It too was a microcap.

CORRINA: Back then, it competed with Blockbuster.

CHARLES: It sure did ... but many funds were restricted from investing in Netflix, or … just didn’t bother since it was so small. But early investors had the chance to invest in it back when Netflix was still a microcap.

CORRINA: So, they had the chance to invest BEFORE Wall Street. Before Netflix pioneered the streaming industry. What price was it trading at then?

CHARLES: As low as a split-adjusted price of $1.20 a share.

CORRINA: $1.20. I didn’t know that…

CHARLES: But it didn’t stay there for long. As it grew from a $250 million company, to a billion-dollar company … Wall Street started piling in.

Today, Netflix trades for well over $600 a share and now has a market cap of more than $270 billion.

The stock is up more than 49,000%. That’s pretty amazing … 49,000%.

CORRINA: Incredible. Every $10,000 would turn into what … $4.9 million?

CHARLES: Correct. $4.9 million. And as for Blockbuster … well, it’s pretty much game over. It went from 9,000 stores in 2004 to just one.

CORRINA: That’s just mind-blowing. Of course, Amazon and Netflix are some of the best examples, but … to think, this is the kind of opportunity you think you can give our viewers today.

CHARLES: That’s right, Corrina. Right now … at this very moment, there’s another Netflix and another Amazon out there somewhere.

In fact, my No. 1 Super Stock could be the next company to disrupt the bulk of an entire industry. And I want to get the details into the hands of our viewers today.

CORRINA: Well, I can’t wait. I’m all-in. I mean, Amazon and Netflix have shown us that historically, it took just one investment to turn tens of thousands into millions. It’s a no-brainer to have someone like you, giving someone like me, your top Super Stock recommendations.

Again, in a moment, Charles is going to walk you through his blueprint for finding these opportunities, including his No. 1 Super Stock recommendation. And don’t forget, if you have questions for him, fill out the form on your screen. We’ll be putting him in the hotseat in just a few moments.

So, Charles, Amazon and Netflix are two great examples. Do you have another example … perhaps one that is in a more traditional industry?

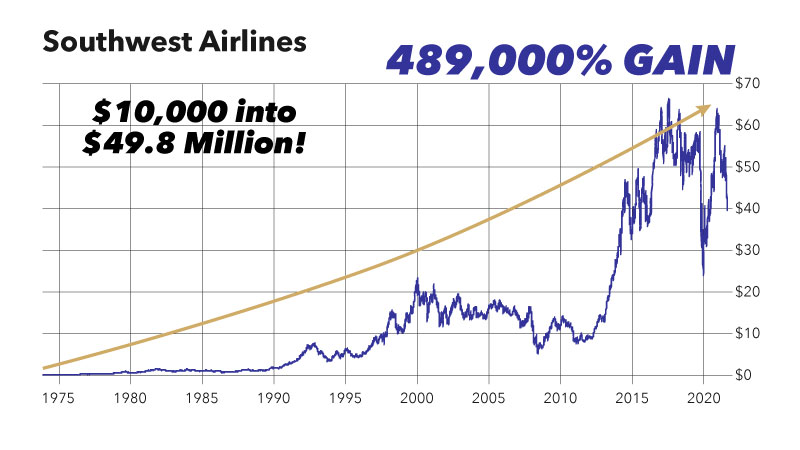

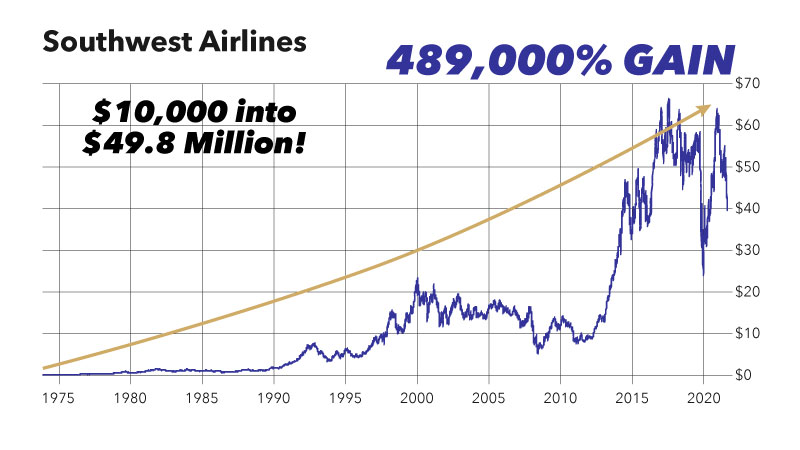

CHARLES: Of course. Here’s one everyone will be familiar with … Southwest Airlines.

CORRINA: Southwest was a microcap stock?

CHARLES: Yep, it sure was. And it didn’t take some new technology to disrupt the airline industry. All it took was a focus on customer service, and a great CEO that turned the company into the No. 1 low-cost carrier in the world.

That alone took it from being less than a $10 million market cap, a really small microcap, to a $30 billion company. To date, the stock is up a staggering 498,000% since 1971.

CORRINA: So, once again, investors were able to get in back here, BEFORE Wall Street had the chance to make these massive gains?

CHARLES: Yes. 498,000% is enough to turn a $10,000 investment into over $49.8 million.

CORRINA: It took a long time, for sure, but … I mean … turning $10,000 into almost $50 million? Charles, these gains are life-changing. That’s even better than Amazon and Netflix, combined. It’s no wonder why microcaps, as a whole, beat the overall market 6-to-1. That’s six times the returns.

CHARLES: Right. And historically, an average of 44 microcaps per year have gone up over 1,000% in the years that follow. And as you’ve seen … many go on to make much, much, bigger gains. The best part is, you’re getting in these stocks BEFORE the big funds on Wall Street or great investors like Warren Buffett.

CORRINA: Speaking of that, isn’t this how Buffett made his millions?

CHARLES: That’s right. When Warren Buffett started out, he did so with a small partnership of only $105,000. Early on, he invested in microcap companies ... which is why he was racking up massive gains throughout the 50s, and 60s. But, as his managed more money, he had to focus on companies with larger market caps.

In fact, Buffett recently admitted that he can’t get the same returns anymore because he can’t do what you and I can do.

CORRINA: Invest in these microcaps. So Buffett is jealous of us.

CHARLES: He sure is. He said that “size is the anchor of performance.” So investing in microcaps is ancient history for Buffett now that he has to invest hundreds of billions of dollars. Can you blame him for wanting to do what we can do?

CORRINA: I can’t. With so many Super Stocks to choose from every year, going up 1,000% or more … it’s easy to see why he would love a piece of the action.

Charles, you have several other examples, and I think it will really help our viewers understand the opportunity before us today.

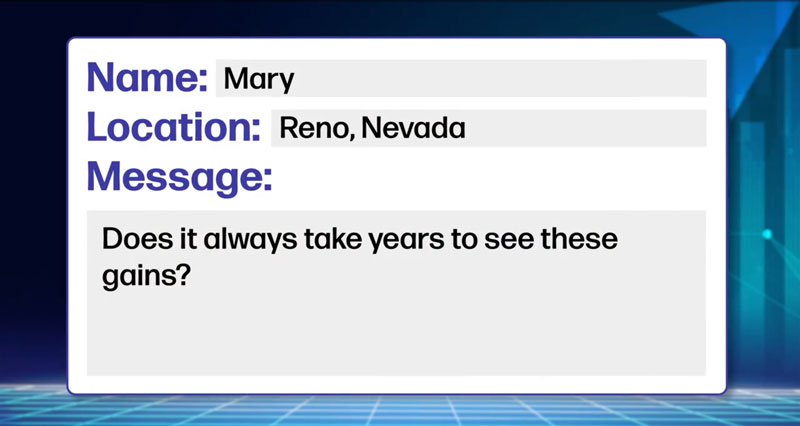

I just saw a question come in from Mary in Reno that relates to what we’re talking about.

She asks:

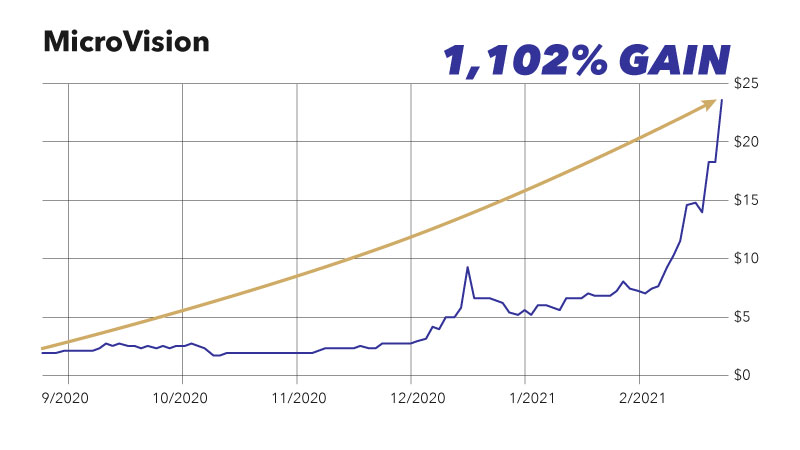

CHARLES: No, Mary it doesn’t always take years for the gains to come. In rare cases, they can come in just months.

Let’s pull up an example or two.

This is a chart of the stock MicroVision.

It’s a small company that makes lidar technology. It basically enables your car to “see” … so it can brake before you have a fender bender…

CORRINA: Or when a person walks behind you as you’re backing up.

CHARLES: Right. So a little over a year ago, it was a microcap, with shares trading for about $2.

CORRINA: Just $2. And I could have invested in it back there.

CHARLES: Yes, and … as sales picked up steam, Wall Street started buying. Within just five months, it traded for over $24 a share.

CORRINA: What is that … a 1,000% gain, in just a few months? That’s amazing.

CHARLES: Here’s another example…

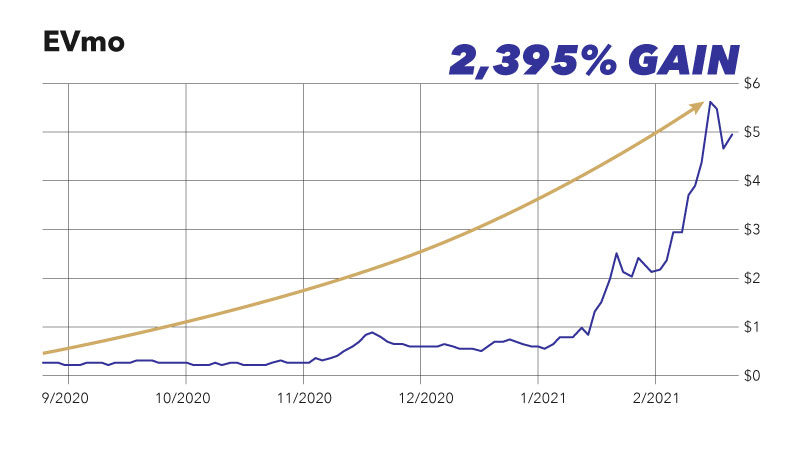

A company called EV Mobility, or EVmo, makes an app that allows Uber, Lyft and DoorDash drivers to rent its cars instead of owning them.

CORRINA: So, I could potentially list my car, and rent it out to an Uber driver … and make money.

CHARLES: Exactly. And for a lot of people, that might sound crazy. But think about those of us who live in a city. In New York City, it costs a small fortune just to park your car.

CORRINA: I read an article about someone who paid $225,000 for a parking space in New York City. That’s enough to buy a nice house in some states.

CHARLES: Right. It’s expensive. I have a car, but I don’t drive it much. Much easier to walk or take the subway.

So, if I wanted, I could lease my car out to an Uber driver and collect nice passive income. People are doing this in the city a lot now.

EVmo simply created the app that makes all this possible.

Shares were trading for as little as $0.22 a year ago.

CORRINA: $0.22 … so, this is tiny. Tiny. And I could have invested back here, long before Wall Street.

CHARLES: It was a $6 million company. Then, as the economy picked up, sales took off, Wall Street took notice and started piling in, and the stock soared over $5.

CORRINA: So, anyone who got out at the top was able to make, what … a 2,300% gain?

CHARLES: Yeah. A little over 2,300% in just five months.

Here’s another example…

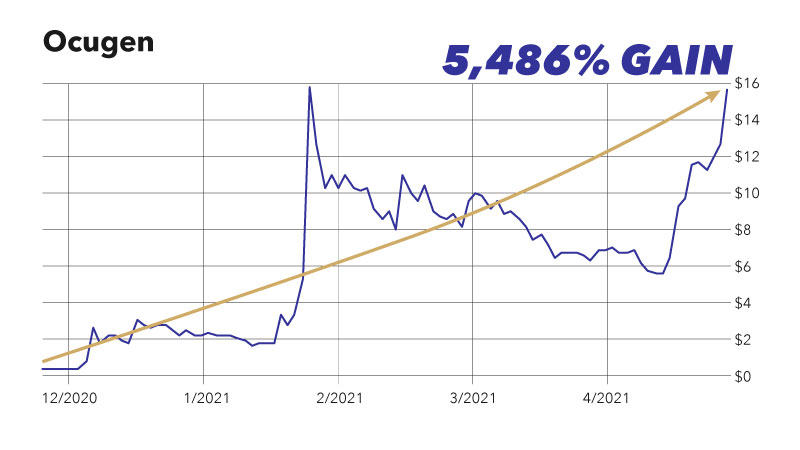

There’s a little-known biotech company called Ocugen that focuses on developing gene therapies to cure eye diseases.

Less than a year ago, it was trading at just $0.29. You could have bought right here, Corrina. Just a few months later, Wall Street piled in and the stock skyrocketed to over $15 — an incredible run-up of 5,400% … in a matter of months.

CORRINA: Charles, this is amazing. Clearly, there’s a lot of money to be made by getting into these companies BEFORE Wall Street.

CHARLES: With roughly 44 stocks shooting up over 1,000% in the years that follow, we have a lot of options when we’re looking for the best Super Stocks.

CORRINA: It’s no wonder you are putting some of your own money into companies like these.

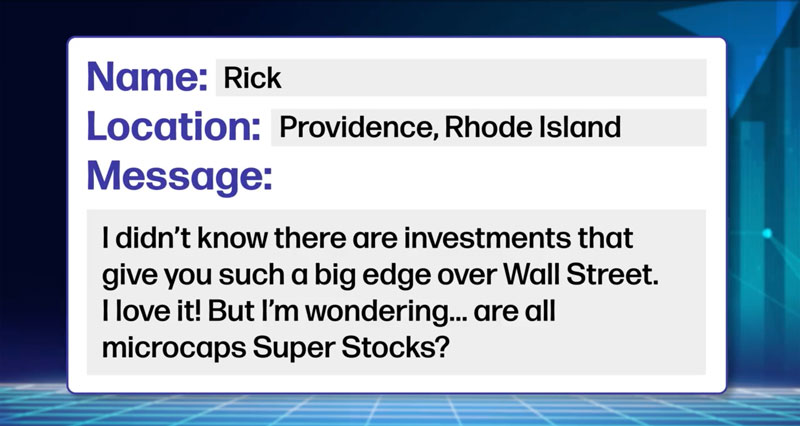

But, Charles, before we go any further, we have a question from Rick in Providence. He says:

CHARLES: Thanks, Rick, I’m very glad you raised that point. The answer is no. Not all microcaps are Super Stocks. Some of the tiniest microcaps aren’t stable businesses. Some are still in the product-development stage, others are losing money hand over fist. We don’t want to go anywhere near those microcaps. We want the best of the best.

CORRINA: And you have to know what you’re looking for. That’s what you detail in your blueprint.

CHARLES: It’s all in there. Look, Corrina … after being in this industry for close to 40 years, I know how to tell the difference between the BS and reality. And this blueprint allows me to spot the winners from the losers … before they skyrocket.

CORRINA: On that note, Charles. Our viewers are smart … so it almost goes without saying … but I’ll say it anyway. You should never invest more than you can afford to lose. Some stocks will skyrocket, while others won’t … because as good as you are, Charles, you won’t get it right every time.

That’s something Lawrence from Pittsburgh asked a few seconds ago. “Aren’t microcaps risky?”

CHARLES: Well of course there’s some risk, especially with microcaps. Driving a car comes with the risk of a fatal crash. But wearing a seat belt reduces that risk considerably. And that’s what this blueprint does for us. It helps us shrink the risk.

CORRINA: I know it is proprietary. Our viewers can get a copy of it at the end of this presentation. But perhaps, right now, you can cover a few points from your blueprint.

CHARLES: Absolutely.

One of the first things I look for in a microcap is how many votes a business gets.

CORRINA: VOTES? What on earth do you mean, Charles?

CHARLES: Well, if you think about it … sales are a lot like votes. It’s how the marketplace decides for or against your product or service. Every time you buy something, you’re voting in favor of the business’s future.

CORRINA: So as an investor, you follow the sales.

CHARLES: You got it. You follow the sales.

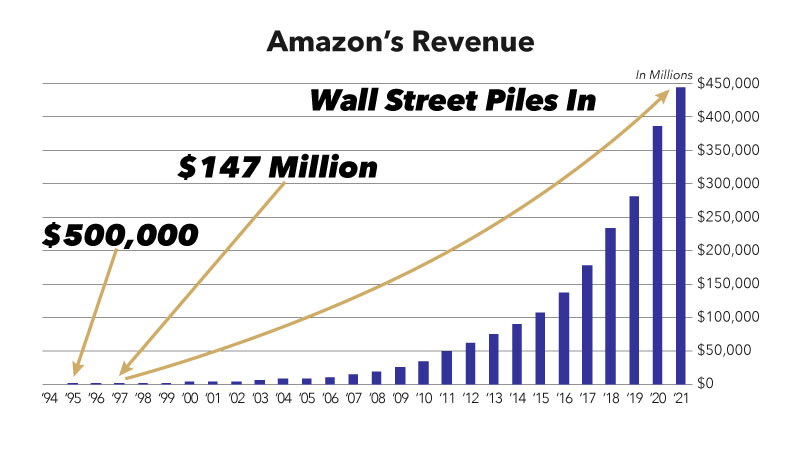

Let’s go back to the Amazon example I talked about earlier.

The share price went from $1.38 to $3,400 — a gain of 244,800%.

What drove the stock up? Take a look at this chart…

In 1995, Amazon had just half a million dollars in revenue. By the time it went public in 1997, revenue jumped to $147 million. A huge jump like that tells me consumers are voting with their dollars … and really like the company and its products. That’s why I follow the sales.

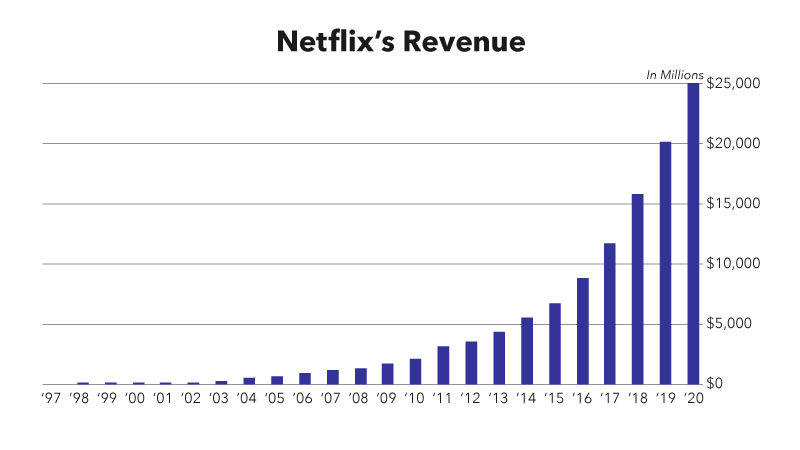

CORRINA: OK, what about Netflix?

CHARLES: Well, since 2002, the stock is up 49,000%, roughly.

CORRINA: So what’s behind that staggering gain?

CHARLES: Well, sales! Revenue grew from $1.3 million in 1998 to $152 million by the time they went public in 2002. That’s just shy of a 12,000% gain in revenue … in just four years.

CORRINA: That’s a LOT of votes. Or rather, a lot of sales.

CHARLES: That’s right. Consumers loved that they could order movies, watch them and hold on to them for as long as they like and never pay late fees. All you needed to do was follow the sales.

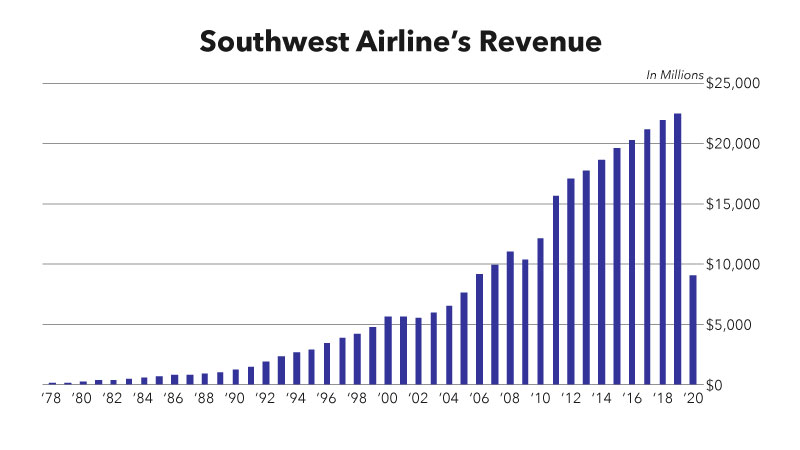

And the same thing happened with Southwest…

In 1971, the company was operating at a loss. By 1978, sales were over $80 million. And in the first three years after, when it went public in 1978, sales TRIPLED.

CORRINA: And if you got into those stocks BEFORE Wall Street could, you would have made a fortune!

CHARLES: One thing to keep in mind. A company’s sales grow fastest when they are still small. Once a business starts to grow, it’s a lot harder to increase sales at a rapid pace. For example, Coca-Cola can’t double its revenue over the next few years. There is limit to how many beverages a person can drink in one day.

It’s much easier to double sales when a company is tiny. But try turning $1 trillion into $2 trillion. It’s a lot harder. That’s another reason why microcaps can be so profitable.

CORRINA: OK. So you start with sales — how many “votes” the company gets. What’s next? What’s the second thing you look for when you’re on the hunt for Super Stocks?

CHARLES: Well, this might sound familiar to some of our viewers. The second thing I do is make sure the company is in an industry that is growing — FAST. Such as biotech, 5G, EVs and so on.

CORRINA: These are cutting-edge industries. Got it.

CHARLES: I’m also looking at leadership. I zero in on companies with great CEOs. CEOs who have a strong track record … or who have skin in the game. This is really important when you’re investing in smaller businesses. More than anything, you’re backing the CEO.

Let’s look at Amazon again. Jeff Bezos got the idea to start Amazon when he came upon an amazing statistic: Internet usage was growing at 2,300% per year! He wanted to start a business that would ride this huge tailwind and invested a $10,000 investment in his idea.

He was so confident in it that he convinced his parents to invest $250,000 in his new startup.

CORRINA: So there was a lot riding on the success of the company. He had some serious skin in the game.

What about Netflix?

CHARLES: Reed Hastings was a successful entrepreneur before he founded Netflix. When he was just 31 years old, he started a company that later sold for $750 million. So Hastings had a track record of success. He later went on to build Netflix into the No. 1 media company of its kind in the world.

CORRINA: So you’re saying he already had a proven track record prior to starting Netflix. The guy had a successful history of starting and growing companies.

CHARLES: Correct. Certain people, like Jeff Bezos, Reed Hastings or Bill Gates … would’ve turned any business they started into huge ones regardless of the industry.

CORRINA: And I’m betting Southwest is more of the same…

CHARLES: Yes it is. Southwest’s Herb Kelleher is one of the greatest CEOs of all time. He built a business that returned more than 100X in about 10 years — a phenomenal feat.

CORRINA: All this makes sense. And I know your blueprint goes into a lot more detail, but I think this gives our viewers a few key points. You’re looking at microcaps that have strong sales, in growing industries that are run by CEOs who have experience growing great companies and often have skin in the game.

CHARLES: That’s it in a nutshell, Corrina. Those three things allow us to find the very best Super Stocks — and invest in them BEFORE Wall Street is allowed to get in. BEFORE they drive the stock price up sky high. That’s exactly what I see happening with my No. 1 Super Stock, which I’ll reveal in a moment.

CORRINA: Charles, before that, let’s just take a moment to answer a question from a viewer about these stocks.

Michael from Arizona asks:

CHARLES: Absolutely, Michael. Remember, there are about 44 stocks that start their 1,000% climb every year. A lot of them are biotech stocks.

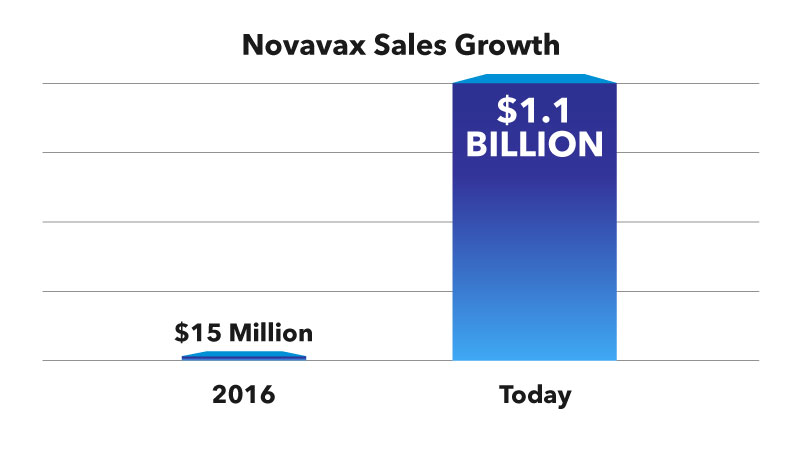

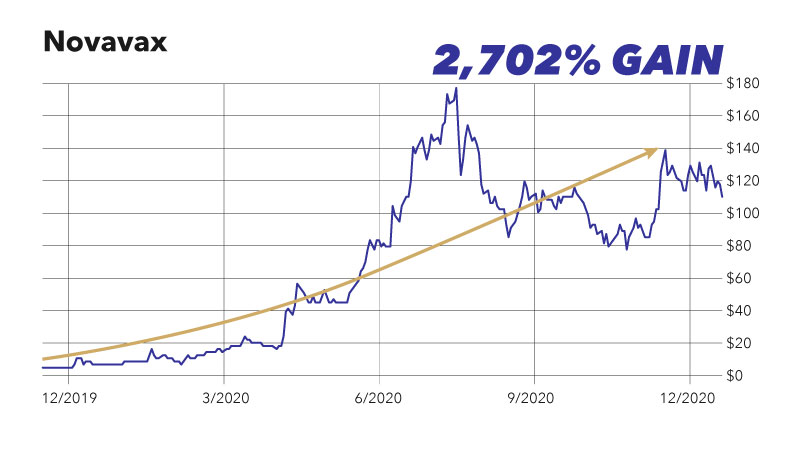

Let’s look at Novavax, a stock we mentioned earlier.

CORRINA: It’s been in the news quite a bit, lately, for its COVID vaccine.

CHARLES: That’s right, but back in 2016, the company’s sales were just $15 million. Today, the company’s sales are more than $1.1 BILLION.

CORRINA: That’s MASSIVE growth … and in just five years.

CHARLES: Sure is but it’s really no surprise. The biotech industry is growing at warp speed.

And its CEO, Stanley Erck, has decades of experience in the industry. He’s developed multiple drugs from early start-up to FDA approval, and bringing them public. And financing deals from Series A through IPOs and acquisitions.

CORRINA: So the company was a microcap … operating in a growing industry … with explosive sales … and a rock star CEO. That’s exactly what you look for in Super Stocks.

CHARLES: And we have the results to prove it. Novavax was the top-performing microcap in 2020, showing a 2,700% gain in just one year.

CORRINA: OK, let’s give Michael and other viewers another example.

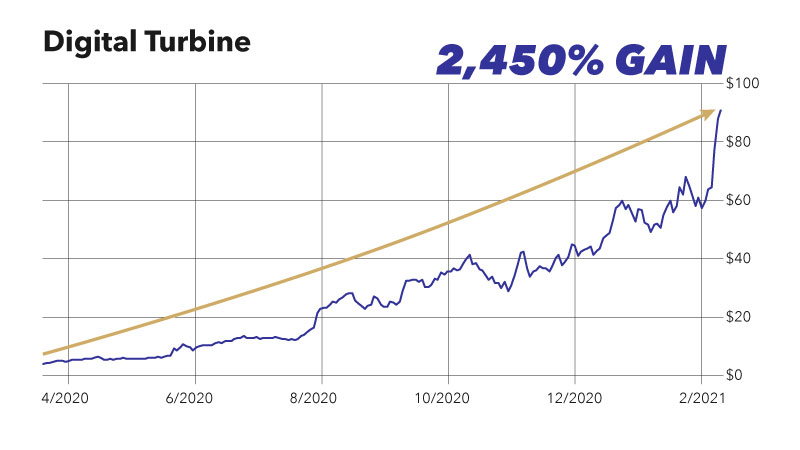

CHARLES: Sure. Let’s look at a company called Digital Turbine — a microcap software company that soared 2,400% in less than a year.

If you take a look at the company’s sales starting in 2017, it went from a little less than $25 million to more than $460 million today.

IT, of course, is a rapidly growing industry.

And the company’s CEO, Bill Stone, was senior VP of Qualcomm — one of the most successful semiconductor companies of all time. He was also an executive at Vodafone and Verizon. So Stone had a great background.

CORRINA: If you bought shares of this Super Stock, BEFORE Wall Street piled in, you could have turned a $10,000 stake into … what, a quarter million dollars…

CHARLES: That’s the secret sauce, Corrina. Growing sales. Growing industry. Rock star CEO.

CORRINA: One more, Charles.

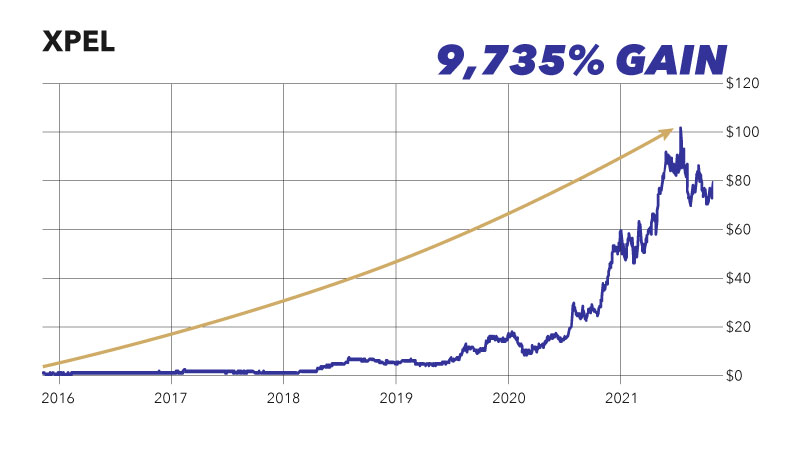

CHARLES: XPEL is a company that got its start making paint protective film for cars.

But in recent years, it has branched out into rapidly growing markets. It now sells protective products for luxury boats … granite counters and cookware … window film that protects against UV rays … antimicrobial film for touch screens … and a whole lot of commercial and office products.

CORRINA: What about the leadership, Charles?

CHARLES: So Ryan Pape worked his way up the corporate ladder until he became CEO. The guy clearly knows what he’s doing.

Since 2016, the market cap has gone from $20 million to more than $2 BILLION.

Sales have more than doubled.

And the share price has gone up more than 9,700%!

CORRINA: Holy cow. That’s in just five years. So again, it meets your criteria for a Super Stock. A microcap … in a growing industry … with growing sales … and a great CEO. If you’d invested $10,000 back in 2016, before Wall Street piled in, your stake would be worth … what … over $970,000. Almost a million dollars.

CHARLES: Pretty incredible, right? But one thing before we go on.

Just keep in mind, the stocks I’ve just told you about have seen tremendous gains. But I’m not recommending you buy them.

All three are now billion-dollar companies … they are too big. When it comes to Super Stocks, we always want to get in while the companies are microcaps. Before Wall Street can pile in.

CORRINA: Like the No. 1 Super Stock you’ve found, which you’ll tell us about in a moment. But first, Charles, we have another question from a viewer. Derrick from Utah says: “I’m a huge fan, Charles.”

CHARLES: Thanks, Derrick. I appreciate it.

CORRINA: He asks:

CHARLES: Derrick, it does sound simple, but it’s not easy. It’s actually a lot of work … and much more difficult to research than regular stocks. In fact, I went out and hired an analyst that has an extensive history of analyzing microcaps and added him to my team. He has connections to top management of some of the best Super Stocks and knows the space really well. His experience and expertise will give us an even greater edge when we research the next 10X opportunity.

CORRINA: And more than that, there’s one thing you have that most of us don’t. Experience. Forty years of experience.

CHARLES: Close to 40. Don’t make me any older than I am, Corrina!

CORRINA: Okay, close to 40. And you’re in New York. You’re in the thick of it. You’re a part of that inside crowd. The inner circle, so to speak.

CHARLES: Look, you can’t do all this behind a computer monitor. There’s something to an old-fashioned Rolodex where I can call up a colleague, chat over drinks, talk about ideas over a cup of coffee and find out information that doesn’t show up on the balance sheet. Those connections took me a lifetime to develop.

CORRINA: I get it. My friends are teachers and media experts. Your friends are CEOs, hedge fund managers and professional investors. That gives you an edge for sure. It allows you to find the best-of-the-best Super Stocks.

With that said, your No. 1 Super Stock … it’s in one of the most exciting industries out there…

CHARLES: Biotech.

CORRINA: Biotech … the gains are big and fast. Extremely fast. They seem to make 1,000% moves all the time.

CHARLES: You’re right. Let me give you a couple of examples.

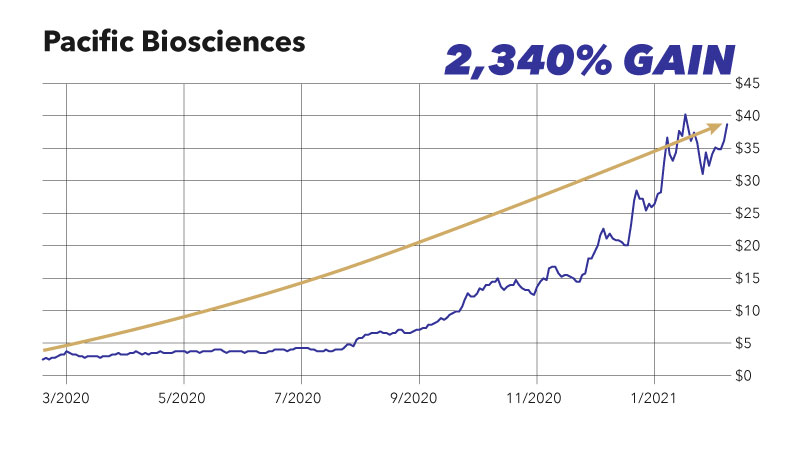

Take a look at Pacific Biosciences — a company focused on curing rare genetic diseases in children. Those who got in back here, long before Wall Street, were able to see a 2,300% gain.

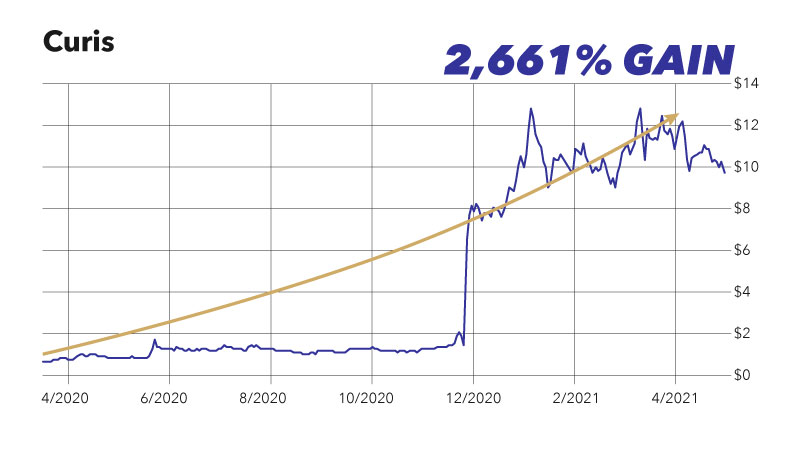

Curis is a company that is striving to create new cancer therapies. If you got in back here, again … before Wall Street, your shares would have skyrocketed 2,600% in a little over a year.

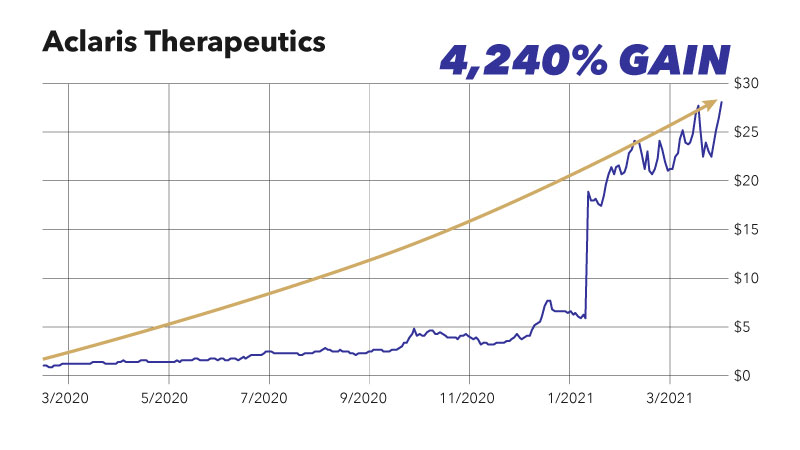

And Aclaris Therapeutics is developing new treatments for autoimmune diseases. Those who got in before Wall Street saw shares shoot up more than 4,200% in just over a year.

CORRINA: So the blistering pace of innovation in the biotech sector makes it fertile ground for Super Stocks. These are three examples, but … there are tons. Can we put that list up for us?

This list is insane. All these gains have come in just one year.

The list goes on and on.

CHARLES: Those are some really great gains. And, anyone who got in BEFORE Wall Street, made a very nice profit — to say the least.

Look, capturing 1,000% gains is no easy feat anywhere, but biotech is one place where the potential is sky high.

CORRINA: I looked through this file … and there are tons of examples in the biotech sector, Charles. Tons. All of them microcaps. All massive winners. Biotech is where it’s at. And that’s where you found your No. 1 Super Stock. Everyone is writing in, asking about it. So, tell us more about this stock, Charles.

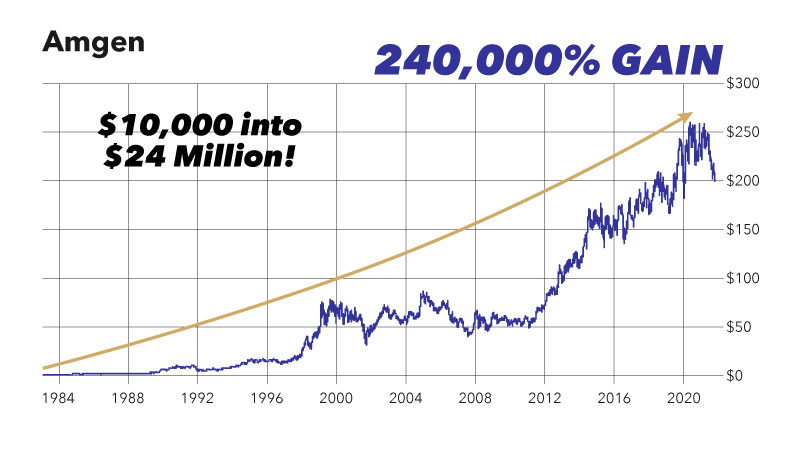

CHARLES: Well, to show you the potential this company has, I need to tell you about a similar company that made investors a fortune starting in the 1980s. This one is going to knock your socks off, Corrina. And it really adds color to the opportunity I’m talking about today.

CORRINA: So, it’s similar to Amazon, Netflix and Southwest?

CHARLES: Better, in some ways.

CORRINA: OK, now you’ve got me interested. What company could possibly be that good?

CHARLES: Well, back in the 1980s, a little biotech company came on the market. It traded as low as $0.08 a share.

CORRINA: $0.08? So you could buy 10 shares for less than a buck.

CHARLES: It was a Super Stock, but nobody on Wall Street was paying attention to it.

Initially, the company resembled the type of Silicon Valley start-up you see in the technology industry. Back then, to keep costs down, the CEO’s office was housed in a trailer to keep costs low, and each scientist had just two feet of lab bench to work with.

CORRINA: Charles, I’m always amazed at how many super-successful companies started with two or three people working in their garage or basement. Like Apple. Amazon. Microsoft.

CHARLES: And this biotech company was no different. It flew under the radar for a few years. But as the market cap grew from less than $300 million to $500 million to $5 billion, Wall Street woke up … and started piling in.

Of course, it took decades … but the company went on to become the largest biotech company in the world.

CORRINA: I’m guessing Gilead? Or Celgene?

CHARLES: Nope. I’m talking about Amgen.

Incredibly, investors who got into Amgen BEFORE Wall Street, and didn’t sell, saw staggering gains of as much as 240,000%!

CORRINA: 240,000% … so, I can’t do the math in my head ... every $10,000 turns into what?

CHARLES: About $24 million.

CORRINA: Charles, are you really saying that your No. 1 biotech Super Stock will do the same? That it’s the next Amgen? Because that’s one very bold prediction.

CHARLES: I don’t have a crystal ball — but it’s certainly possible. And my No. 1 Super Stock … it’s already on the move. It’s up almost 200% already over the last year.

You folks need to look at this stock today. That said … don’t get me wrong. These gains do not come overnight, and nothing is guaranteed. Like Amgen, Netflix, Amazon and Southwest … it may take a few years to get there.

CORRINA: But you’re saying this stock … your No. 1 Super Stock … has a lot in common with Amgen, back when it was a microcap … and there are massive profits to be made in the short term?

CHARLES: Yeah I think there are, and here’s why…

Amgen’s goal was to find and clone a single gene … on a single fragment of DNA … among 1.5 million fragments of the human genome.

CORRINA: That’s a tall order, especially back in the ‘80s. A needle in a haystack, as my grandma would say.

CHARLES: Incredibly, they did it in two years. Just two years! And that discovery would lead to one of the most successful drugs in history, Epogen, which treats symptoms of chronic kidney failure.

CORRINA: And now, your No. 1 Super Stock has made a discovery on a similar scale to Amgen?

CHARLES: Right. I won’t get into the weeds with the science. But let’s just say, the company has created a new drug that does what no other pharmaceutical company has ever succeeded in doing. And it is going to revolutionize the treatment of several ailments, including chronic pain and even diabetes.

CORRINA: OK, can you tell us how your blueprint helped you identify this Super Stock … a stock that is primed to skyrocket?

CHARLES: Sure. First, I look at growing sales. In this case, the drug is new. But like I said earlier, the company has already signed retail agreements with Walgreens … Walmart … Rite Aid … and CVS. These retailers wouldn’t put a product on the shelves if they weren’t certain it would sell like hotcakes.

Second, I look at the industry the company is operating in. In this case, the biotech industry is predicted to more than triple in size by 2028 … thanks to the rise of personalized medicine … genomics … robotics and other breakthroughs.

CORRINA: Got it. Biotech is a rising industry, big time.

CHARLES: Then I look at the CEO. In this case, the CEO has 40 years of experience in the health care industry. He successfully launched and marketed over-the-counter blockbusters like cough suppressants Mucinex and Delsym. And he has well over $9 million invested in the company.

CORRINA: $9 million invested in the company and he has a great track record of success.

CHARLES: Corrina, the company’s innovation is a monumental breakthrough on the same scale as the invention of insulin. I’m not exaggerating. And yet, nobody on Wall Street, or in the media, is talking about this company.

CORRINA: And that gives us a window of opportunity to get in BEFORE Wall Street wakes up.

CHARLES: Exactly. This could be the next Amgen. Charles predicts those of you who get in now — and I mean NOW — could make life-changing wealth. But folks, that window of opportunity could slam shut any day now. The stock is already on a tear … and it won’t be long before Wall Street is investing its billions of dollars.

CORRINA: Well you’ve got me convinced, Charles. Let’s do this. How do I get all the details?

CHARLES: I’ll show you in just a moment, Corrina.

But here’s the thing … I want to make this even better. I’ve actually uncovered not one, but two additional stocks I want to get into our viewers’ hands today.

CORRINA: Well, that’s awesome news. Two additional Super Stocks.

CHARLES: Two stocks that, well, frankly, I’m every bit as excited about.

CORRINA: So, tell me more about them…

CHARLES: The second stock is a microcap that’s disrupting the fintech industry.

CORRINA: That’s financial technology.

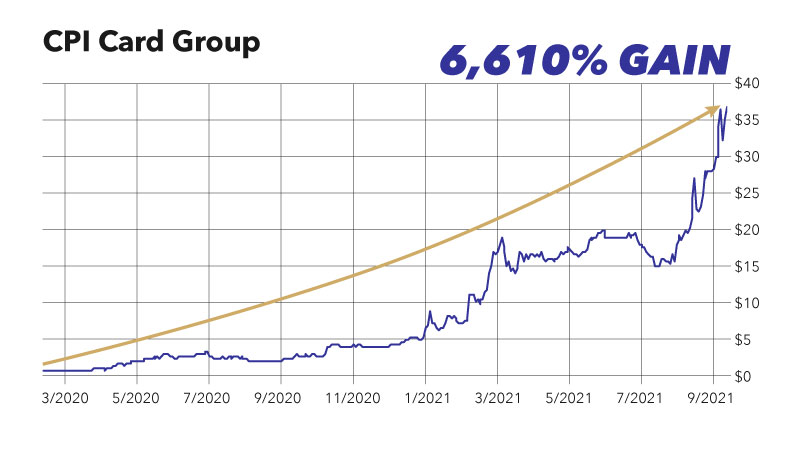

CHARLES: Yes, financial technology. Now, I know we are running short of time, so … let’s take a look at just one example in fintech. CPI Card Group…

CORRINA: CPI Card Group.

CHARLES: Yup. It’s a small company that makes credit cards. Last year, during the pandemic, it partnered with Visa to roll out a new type of touchless credit card.

CORRINA: That’s brilliant.

CHARLES: It is. Early investors who bought shares BEFORE Wall Street started piling in, saw the stock surge 6,600% in a year and a half. Remember, it’s important to get in early.

CORRINA: 6,600%. Wow. And your No. 1 fintech Super Stock, it could do the same?

CHARLES: Well I can’t guarantee anything. But fintech is where some of the best Super Stocks are found. And we’ve researched this stock from every angle. I expect it’s going to do very well.

CORRINA: I’m on the edge of my seat, Charles. What fintech stock are you referring to?

CHARLES: Well, the company provides solutions for a problem that spiked during the pandemic. You see, Americans spent $79 billion on e-commerce during the pandemic, up 32% year-on-year. And that caused online fraud and identity theft to more than double.

CORRINA: I suppose lowlife criminals were bored during the lockdown.

CHARLES: Well, the $9 fintech stock I’ve found helps fight fraud and identity theft. It has a unique, 99% effective verification platform that is used by banks … any place that asks for verifiable ID, like bars and liquor stores … and is even used by law enforcement during traffic stops.

CORRINA: So the bottom line is that there’s a huge, growing market for that software. And with a tailwind, as you call it … with a tailwind like that … this industry is set to explode. What about the company’s sales, Charles?

CHARLES: Since 2017, sales have gone up more than 270%. So things are ramping up. Remember, we need to get in early … before Wall Street starts investing.

And as for the CEO … well, he’s a legend in the business. He has over 30 years’ experience in fintech. Before he joined the company, he oversaw the growth of another fintech company that saw a 492% increase in a four-year period.

CORRINA: So this guy’s a pro.

CHARLES: Right. But again, as with my No. 1 biotech stock, no one is looking at my No. 1 fintech stock. It’s just too small for anyone on Wall Street to take notice.

CORRINA: Which means we have the chance to get in BEFORE Wall Street does.

CHARLES: The sky’s the limit on this one, Corrina.

CORRINA: OK, we’ve talked about your No. 1 biotech Super Stock and your No. 1 fintech Super Stock. What’s the third stock you’re going to tell us about today? Which industry are we talking about?

CHARLES: Well, it’s in one of the most exciting areas of IT … information technology. As everyone knows, tech stocks are on a tear. And that’s where I find some of the best Super Stocks.

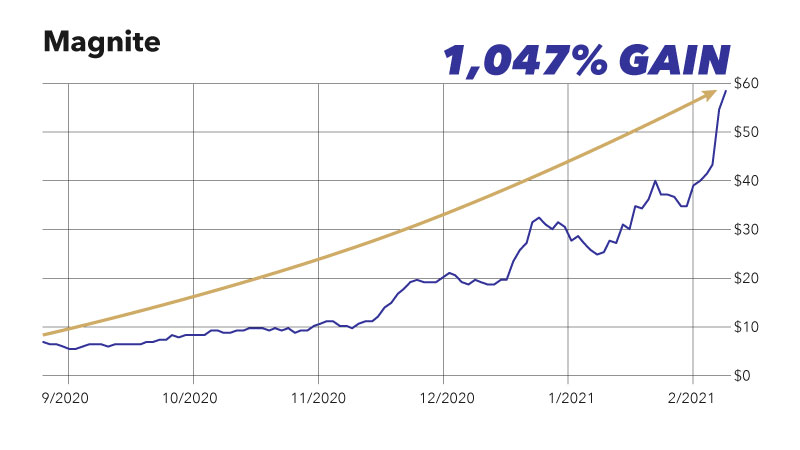

Look at Magnite, for example. A company that operates an advertising platform. It shot up more than 1,000% … in just five months. Again, if you’d got in before Wall Street, you’d have made a small fortune.

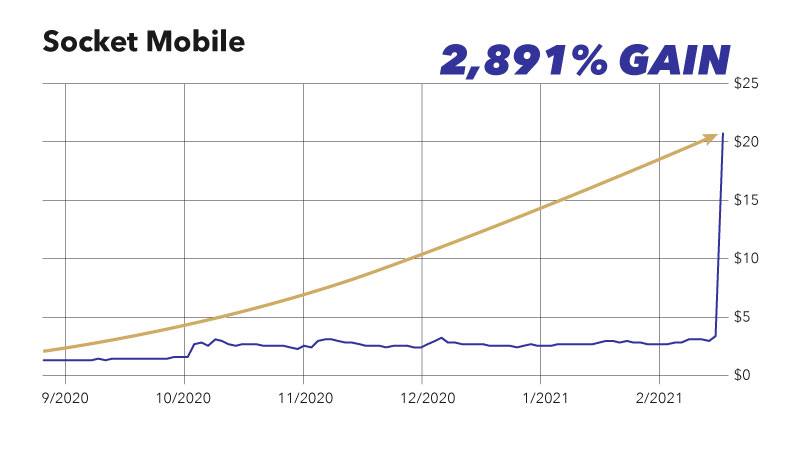

Here’s another one … a mobile software company called Socket Mobile.

In less than six months … six months … the stock shot up 2,800%.

CORRINA: If I didn’t know you better, Charles, I’d think you’re making this up. I mean, I know Super Stocks have outperformed their large-cap cousins by 6-to-1 over the past 90 years … but these gains are stupendous. So, tell us more about your No. 1 tech stock.

CHARLES: This one is small, Corrina. And I mean very small. Only a $50 million market cap … and trades for $2 a share.

The company is a Cloud Communications provider with strong ties to Microsoft ... and offers anti-fraud solutions to Fiserv — a $73 billion financial services company.

Between 2017 and 2020, sales have been climbing. And with new products in the pipeline, I’m confident that the share price is just getting started.

CORRINA: What about the CEO?

CHARLES: The CEO, he has 25+ years of experience in the software and communications industries. Most specifically, he has a proven history of leading smaller, fast-growing companies. That’s great news for anyone wanting to invest in this Super Stock.

CORRINA: Meaning we can get in BEFORE Wall Street … and potentially make a ton of money. OK, so … you’ve described your No. 1 biotech stock, your No. 1 fintech stock and your No. 1 tech stock. And you’ve included all the details of these stocks in a new special report.

CHARLES: That’s right. It’s called Microcap Millionaires — 3 Super Stocks to Buy Right Now … and I want each of our viewers to get a copy as soon as possible.

CORRINA: This report is valued at $995. Which is fair, considering any one of these stocks could make our viewers a ton of money.

CHARLES: Yes, however, I don’t want to charge that today. In fact, Corrina, I want them to have it for free.

CORRINA: For free.

CHARLES: And I want them to have it along with this…

CORRINA: Your Super Stock Blueprint. I’ve been through this, Charles. And it’s super enlightening. I love it. I learned a lot. But, I have to be honest with you … while some people could use this to invest in these Super Stocks, I can’t. I simply don’t have the time to do all the research on these stocks.

CHARLES: I agree. And that’s why I have been working on a new project called Microcap Fortunes.

CORRINA: Microcap Fortunes.

CHARLES: That’s right. I’m starting this new service because so many of you have told me that you are looking for more. And while I’ve been investing a small portion of my portfolio into these stocks for years now, I knew … for you … I’d want to reduce the risk and increase the reward even more.

CORRINA: Charles, I love what you’re doing. I really do. I love it. Each month, you’ll send your best Super Stock recommendation … the same kind of stock that has been known to surge hundreds … even thousands … of percent.

CHARLES: That’s right. If you want to take on some more risk for a LOT of reward … and you don’t want to wait years to see it … Microcap Fortunes could be a good fit for you. We target the market’s biggest potential winners … and when you pair that with the chance to get in BEFORE Wall Street — you have an advantage you won’t find anywhere else in the market.

CORRINA: Charles, our viewers shouldn’t forget. You were named the No. 1 market timer over a seven-year period. You were named the No. 1 investor by Barron’s. You spent almost 40 years on Wall Street.

CHARLES: Well, it’s true that I spent most of my career on Wall Street. But my real passion is helping Main Street investors take control of their financial future. And for the past 15 years, I’ve been sharing my top stock recommendations with them.

CORRINA: You should be proud, Charles. You’ve helped folks make bigger gains than they ever thought possible … and faster too.

CHARLES: My subscribers are the reason I tap dance to work every morning. And now, moving forward, my goal is simple. To find those truly exceptional Super Stock opportunities and share them with you every month. Remember, close to 44 microcaps start their 1,000% climb every year.

CORRINA: Charles, you’ve shown me dozens of examples of microcap stocks that can double in price in just weeks or months. But the Super Stocks you’re after are poised to go up even more.

CHARLES: Exactly. With 12 opportunities every year to invest BEFORE Wall Street piles in … causing the stock price to skyrocket … this could be the year for our viewers to make life-changing profits.

Again, I want each of you to get a free copy of my new report: Microcap Millionaires. In it, you’ll find my No. 1 biotech stock … a company with a patent-protected, FDA-approved technology that hit the shelf in pharmacies across the U.S. just weeks ago.

And when tens of millions of Americans start using it — which I’m sure they will — I expect the stock to go through the roof. In fact, this could be the next Amgen, which went up 240,000%.

CORRINA: And … your special report, Microcap Millionaires — which is free when you subscribe to Microcap Fortunes — the report also includes two bonus recommendations. Your No. 1 fintech stock and your No. 1 tech stock. Stocks you think are poised to soar in the months ahead.

CHARLES: It does. But folks, I urge you to act today. Don’t sit on the sidelines on this opportunity. Super Stocks can come and go very quickly, and latecomers could miss out. You want to get in BEFORE Wall Street invests. Like I always say: Procrastination is the thief of all profits.

CORRINA: We don’t want to miss the boat.

CHARLES: Yeah, don’t be Don Keough.

CORRINA: Don who?

CHARLES: Don Keough.

Back in the 1950s, he was approached by one of his neighbors — a guy whose kids played together with his own kids and was into model trains.

The neighbor offered Don the chance to invest with him, but he didn’t. He told his wife: “The guy works out of his bedroom. He’s nice enough, but I’m not investing with him.”

That was his biggest regret.

CORRINA: Go on, tell us. Why?

CHARLES: Don’s neighbor was none other than Warren Buffett. He lived right across the street.

CORRINA: Oh, wow, that was one bad decision that cost Don millions of dollars.

CHARLES: More than that. A $10,000 investment with Buffett back then would be worth well over $267 million. But don’t forget, with Super Stocks, you can potentially make a ton of money … without waiting decades to get there.

As I showed you earlier … can we bring that graphic up again?…

CORRINA: There it is.

CHARLES: If you had invested in the top five stocks of the S&P 500 in 2020, a $10,000 stake in each stock would be worth more than $188,800 in total.

But … if you’d invested $10,000 in each of the top Super Stocks of 2020, your investment would be worth $1,074,300.

And that sort of opportunity — like the one before you today — can make fortunes for early investors. Because they can invest before Wall Street piles in.

CORRINA: Now … getting down to brass tacks. Charles, you’ve built an incredible team to work with you on this project … and they don’t come cheap. And you said earlier, the amount of work that goes into each recommendation is huge.

That’s why, moving forward, one year of access to Microcap Fortunes will retail for $5,000. Even at that price, it’s an absolute bargain. I mean … even if just one of the stocks in your new report goes up 1,000%, you’ll cover the cost of the subscription with a tiny $500 investment.

CHARLES: But this is a brand-new service, Corrina … and I’ve worked out a special arrangement to keep the price of Microcap Fortunes as low as possible.

CORRINA: That’s right. So if you sign up today, you’ll get an entire year for just $2,950. In the larger scheme of things, Charles, that’s nothing, considering what you get for that price. Everything we’ve heard today shows it’s not easy to find Super Stocks with massive growth potential ahead of them. It takes a month or more of deep-level research to uncover these gems and get them to your subscribers quickly.

CHARLES: I truly believe you will not find this kind of access anywhere else. This is your chance to zero in on what could be some of the largest gains this year and in the years to come.

CORRINA: OK. Just to recap, here’s a summary of what you will receive if you accept this offer today:

CHARLES: I think that about covers it, Corrina. This is a once-in-a-lifetime opportunity.

But there’s one thing I must mention before we get to some more questions. Microcaps tend to be thinly traded. What that means is if too many investors get in at the same time, it could artificially inflate the stock price. And anyone who doesn’t act right away won’t be able to take advantage of the opportunity.

CORRINA: That’s why Charles has to limit the number of spots for Microcap Fortunes. It’s unfortunate … because there are thousands of people watching right now … and many of them could miss out. And already, we’re seeing a flood of orders coming through. So if you’re ready to snap up one of those spots, you really should click the button below right now.

But Charles, we still have a lot of questions coming in … and as I promised viewers, this is their chance to put you in the hot seat. There’s still time to send us your questions, folks. So stick around and Charles might answer one of your questions.

CHARLES: Let’s do it.

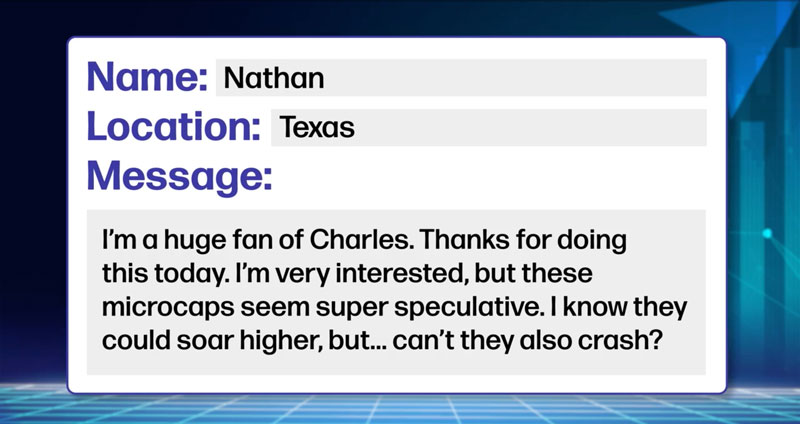

CORRINA: This one comes from Nathan in Texas. He says:

CHARLES: Thanks for writing in, Nathan. Yes, they sure are more volatile than speculative. In other words, you’ll see them go up and down, a lot. But the stocks we’re selecting — the best of the best microcaps — are not as risky as you might think. In fact, when we analyze potential recommendations, reducing risk is my number one focus.

So bottom line: With Super Stocks, you have to be able to withstand some volatility of the stock price. Because let’s be real … 1,000% returns don’t come without having any bumps along the way. But I want you to remember, Nathan, you’re not doing this alone. I got your back.

CORRINA: I actually read a story recently about this exact thing. Back in 1987, the guy, I forget his name, invested equal amounts in 10 microcap companies he thought had good potential.

As it turns out, 9 of them didn’t work out. But the 10th one not only made up for the 9 losses … but returned 800 times his total investment before he sold it in 1994.

With that said, Nathan shouldn’t be going “ALL-IN” on these stocks, right. What’s the term, “don’t bet the farm” on them?

CHARLES: Great point, Corrina. I don’t have my entire portfolio in these Super Stocks. I just have a small but meaningful portion of my portfolio invested… Not the stocks I recommend, of course. That wouldn’t be ethical.

CORRINA: Believe me, Charles, no one who knows you would ever doubt your honesty. But going back to Super Stocks, you only need a little bit of money to make a lot of money. Just $1,000 into a 1,000% winner … and you’re up $10,000. And some of these stocks have gone on to make 5,000% or more. So, that $1,000 could turn into even more money.

Frankly, Charles, if I were sitting at home watching right now, I wouldn’t hesitate to sign up. I mean, why wait?

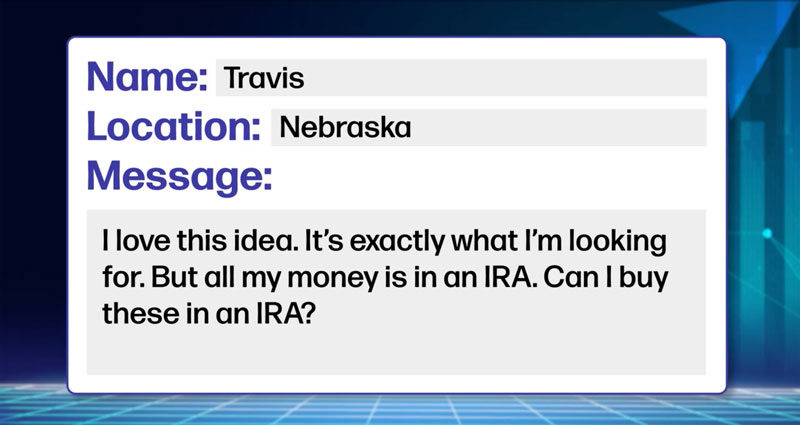

OK, a lot of questions still coming in. This one is from Travis in Nebraska.

He says:

CHARLES: Thanks, Travis. Yes, you can. In fact, I think this is perfect for an IRA because your tax liabilities are deferred on these massive gains.

CORRINA: For me, I have a Roth IRA, so … it’s great to know that I’ll never have to pay any taxes on any big gains.

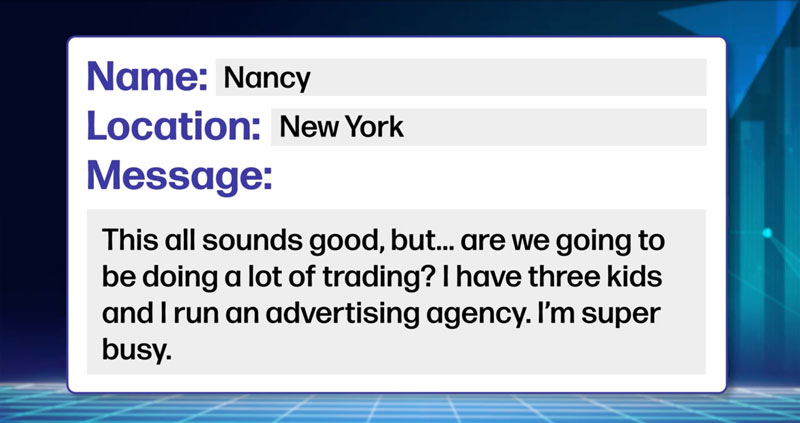

This next question is from Nancy in New York. She says:

CHARLES: Thanks, Nancy, for writing in. The great thing about Microcap Fortunes is that I only give one recommendation each month. Sometimes two. So this is not trading. Not at all. We are investors … not traders in these microcaps and our goal is to make money over the long term.

CORRINA: Just like we would with a company like Amazon, Netflix or Southwest. It would be a shame if a person sold Amazon after five years. They’d only make about 1,000%.

CHARLES: Exactly. They would have missed out on tens of thousands of percent. What a shame that would be. Now, if something changes with the company … say, the company’s product is not taking off and sales aren’t growing as fast as we projected … we might get out of the position and move on to a better opportunity. We want to be fleet-footed. But in general, we want to hold these stocks for the long term.

CORRINA: Let’s look at this one, from Martin in Springfield. He wants to know:

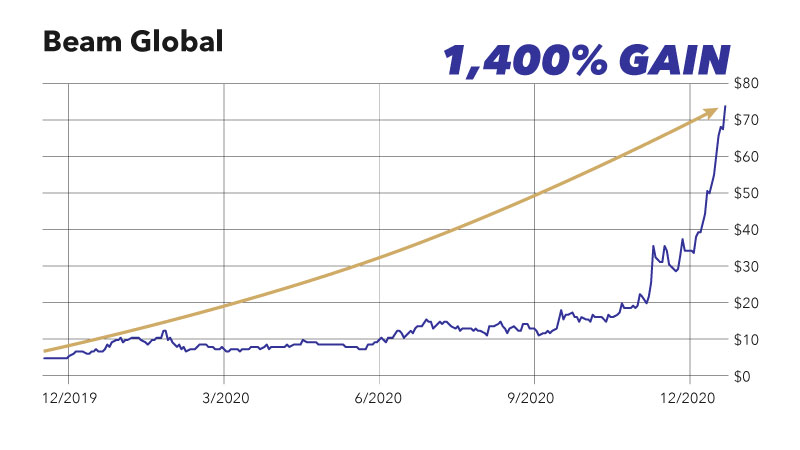

CHARLES: I’ve got my eye on a few opportunities. Let’s look at electric vehicles. Everyone’s talking about EVs … and there’s a lot of buzz about traditional carmakers such as GM, Ford, Toyota, etc. vying to be the “next Tesla.”

CORRINA: You mentioned EVs, earlier.

CHARLES: I drive one, actually. And I LOVE IT. But EV stocks are not where the big money will be made.

There are small companies that make batteries … charging stations … software … and so on. They’re already making investors a fortune...

Beam Global, for instance, designs and manufactures electric vehicle charging stations. But it also makes energy storage infrastructure for the grid. The stock shot up 1,400% in less than a year.

CORRINA: That’s more than double the gain for Tesla over the same time frame, as we saw earlier.

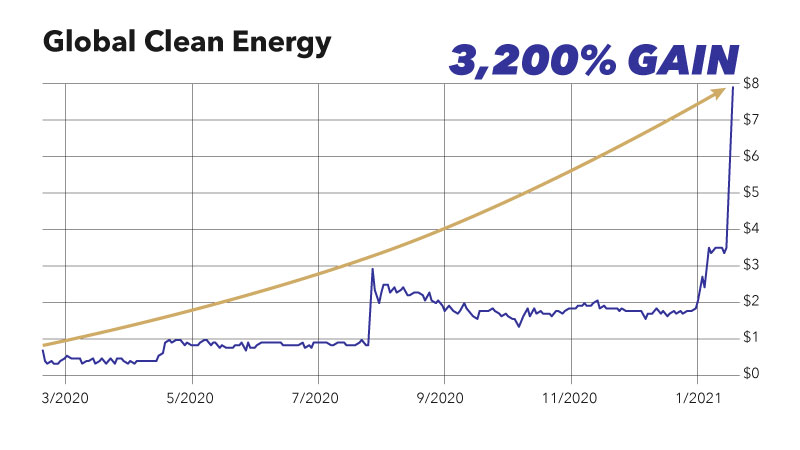

CHARLES: Right. Global Clean Energy Holdings is another one. The refiner and distributor of renewable fuels used in the transportation sector popped more than 3,200% within a year.

CORRINA: 3,200%. That’s impressive. Just one or two of those kind of investments and you could be set for life.

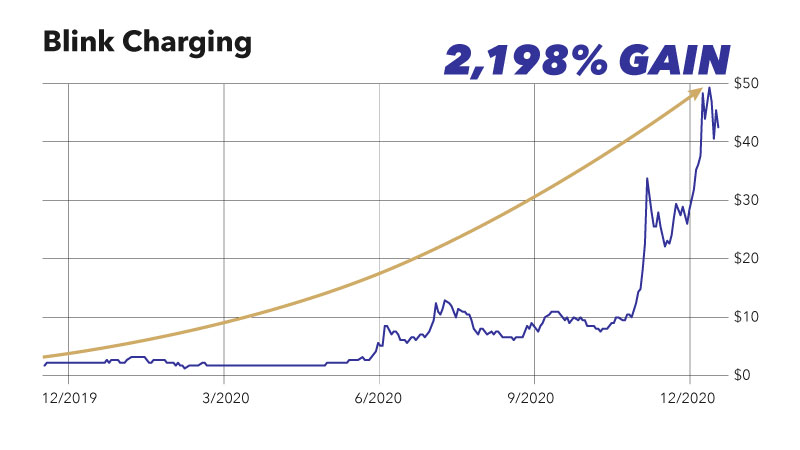

CHARLES: Right. Blink Charging Company is another one. It owns and operates EV charging stations across the country. The stock shot up 2,100% in less than a year.

CORRINA: 2,100%. Wow. That’s an incredible return. Life-changing, really. And these are the type of stocks you’re looking at right now.

OK, I just got an update from our sales team. It’s so exciting. A ton of people are buying Microcap Fortunes. But spots are limited. Remind us again why that is, Charles?

CHARLES: Simple. If you have 1,000 people buying shares of a microcap at the same time, it will drive the stock price up because they are thinly traded. So instead of paying $2 a share, subscribers who decide to buy the next day might have to pay $5, $7 or even $10 a share.

CORRINA: That wouldn’t be fair to them. So … if you are interested, please reserve your spot today by clicking the button below. You can also order by phone by calling 1-877-422-1888. Can we put that up on the screen? Again, the number is 1-877-422-1888. And remember, this is the lowest price you’ll see for this service. Moving forward it is going to retail for $5,000.

OK, Charles … but is your new service, Microcap Fortunes, right for everyone?

CHARLES: That’s an important point you make, Corrina. This is only for serious investors that want to make serious money. And again, you should only invest money you can afford to lose.

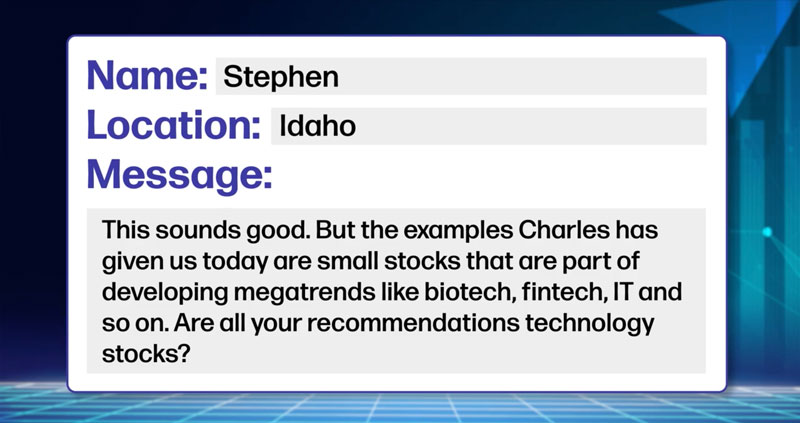

CORRINA: OK. We're going to keep these questions going because we're all learning so much. This one’s from Stephen in Idaho. He says:

CHARLES: The answer to that one is no. Many likely will be … but I don’t want to limit our opportunities by ignoring other industries. When you get the recommendation, I want you to know that many weeks and sometimes months have been spent researching the company. That my team and I have spent many hours doing our homework. If I’m not completely confident that the stock has the potential to be a Super Stock, I wouldn’t recommend it.

CORRINA: Charles, we could go on and on about this today … it’s fascinating. But if they’re like me, viewers are ready to jump on this opportunity. So let’s wrap this up. If you look underneath this video, you’ll see an order button. All you need to do click it, and it will take you to the order page.

Remember, when you subscribe to Microcap Fortunes, you get a copy of Microcap Millionaires — 3 Stocks to Buy Right Now.

You’ll also receive the proprietary Charles Mizrahi’s Super Stock Blueprint … trade alerts every single month … instant access to his model portfolio … weekly updates … and access to our customer care representatives if you have any questions.

All for just $2,950.

Charles … thank you for sharing your insight today.

CHARLES: It’s been my pleasure, Corrina. And to our viewers, thank you for joining us today.

November 2021