[Official Transcript]

Hello, I’m Steve Gruber, and this is the BIG moment we’ve been waiting for…

Forty-year Wall Street veteran, Charles Mizrahi … the man who was ranked No. 1 by Barron’s … AND hailed as a “top performer” by The Wall Street Journal … is going to share the details of THIS...

It’s a pocket calendar. Charles’ pocket calendar.

Now, as some of you may know, Charles has spoken on Victory News, Newsmax and in The Epoch Times...

He’s been a recurring guest of former Arkansas Governor, Mike Huckabee, on The Huckabee Show.

And he’s been a frequent guest of mine on America’s Voice Live.

Hopefully you’ve seen some of our discussions, because Charles has an amazing ability for seeing around corners better than anyone I know.

And what’s written in here is a perfect example…

Today, for the very first time, Charles is going to give us all a look at what’s written in this calendar … and how it’s linked to some of the biggest stock opportunities on Wall Street.

Welcome Charles, thank you for being here today.

CHARLES: Thank you Steve, it’s my pleasure.

STEVE: Now, I’m sure many of you are wondering: What makes this calendar so special? I know I did when Charles first showed it to me.

Here, let me show you … Charles, may I?

CHARLES: Sure Steve, go ahead.

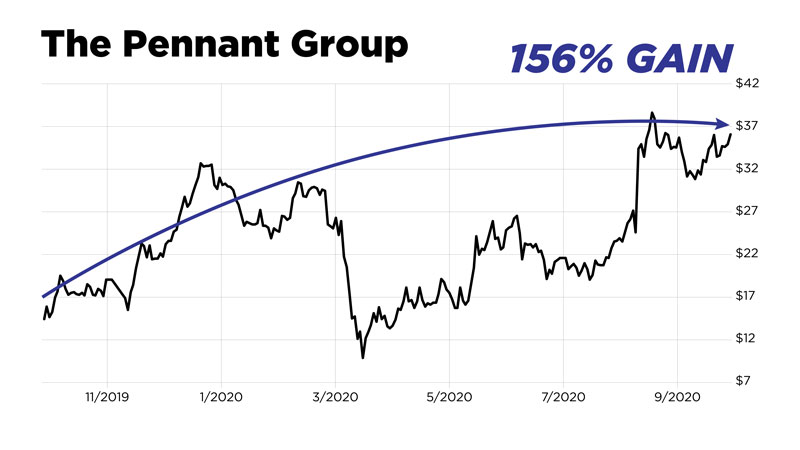

STEVE: If I open it up to October 1, 2019 … you’ll see the name written in it: Pennant.

A year later, shares were up more than 150%.

But here’s where things start to get interesting…

Just one day earlier, September 30, The Pennant Group didn’t exist as an independent company.

Now, this wasn’t an IPO. And very few people had any idea that a brand-new stock for The Pennant Group was about to be created…

But here it is in this calendar.

Here’s another one…

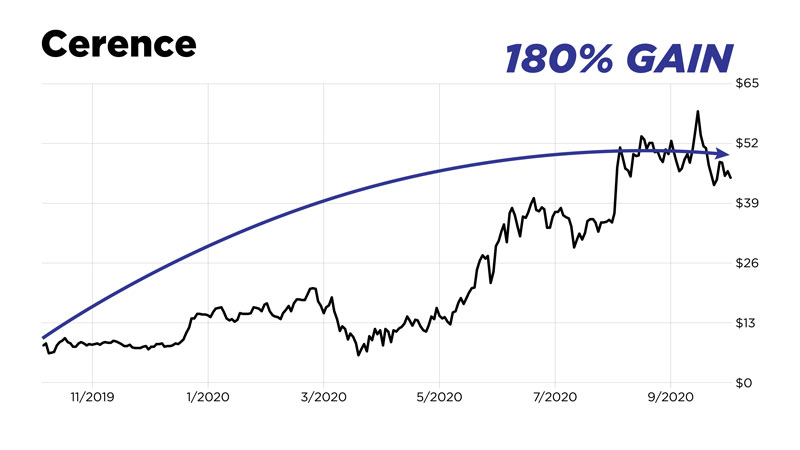

The name Cerence is written on October 2, 2019…

Just one day earlier, shares of Cerence didn’t exist.

One year later, they were up over 180%.

Again, this wasn’t an IPO. And very few people knew about it. But Charles recognized what was happening … and made a note of it right here in this calendar.

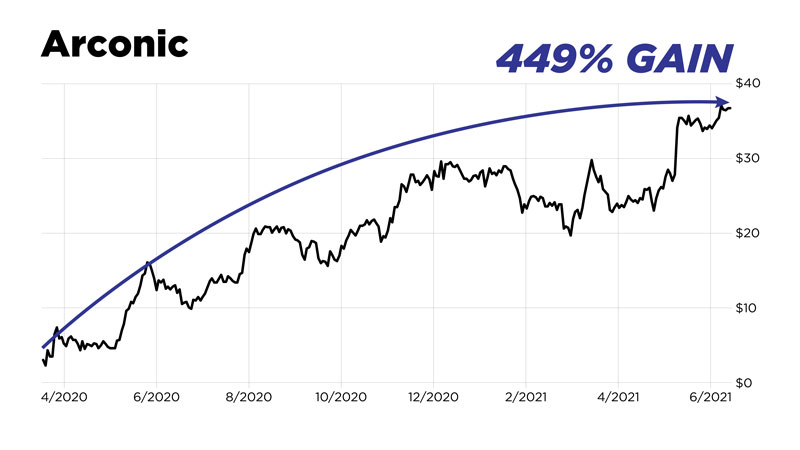

On April 1, 2020, you’ll see the name Arconic.

As you may have guessed, a day earlier, Arconic didn’t exist. And here again, very few people knew it was about to go public.

14 months later, Arconic was up 450%.

There are dozens of other names just like these…

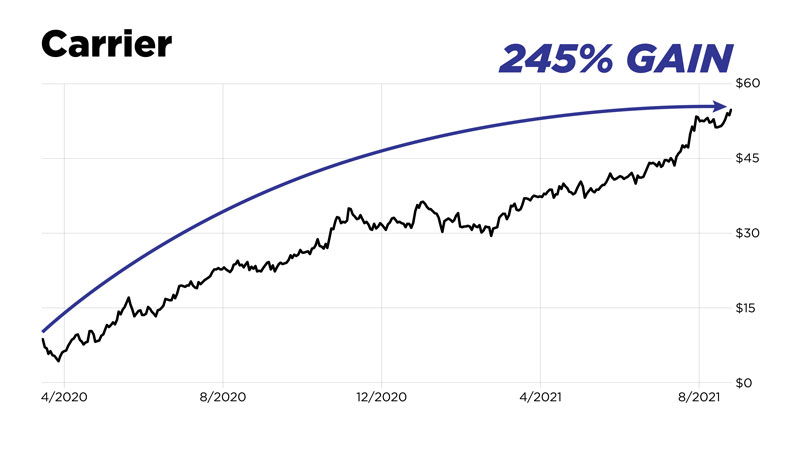

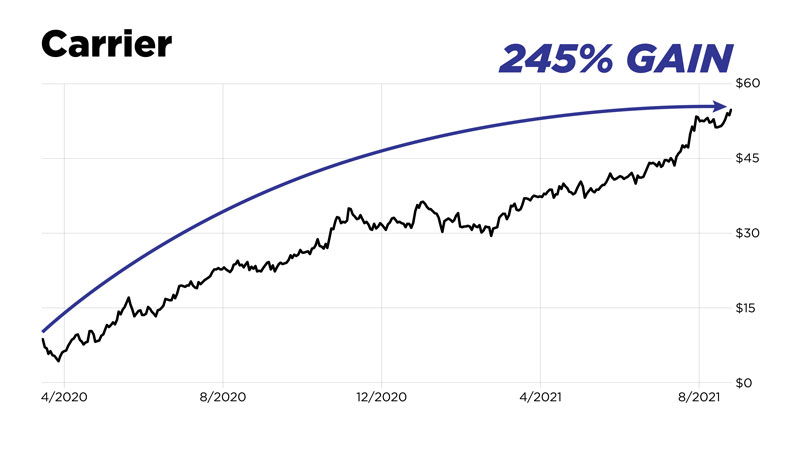

Carrier, soared 245% in just 18 months.

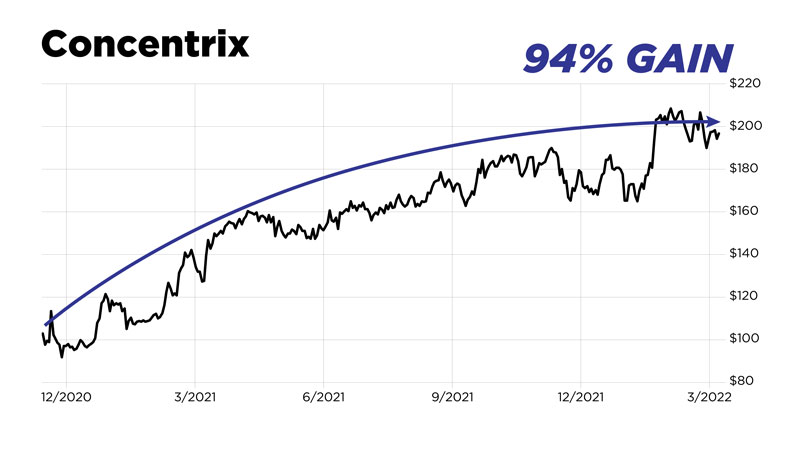

Concentrix, soared nearly 100% in just 18 months.

GXO Logistics. Jackson Financial. VMware.

Very few Main Street investors knew these stocks were about to go public … and yet they are all right here in this calendar.

Charles has spent years tracking stocks like these … and has even recommended a few to a small group of his readers.

Now, here today, he’s going to show everyone watching what makes these stocks so special … and why so few people know about them.

But Charles, there’s another twist to this story … another little secret about how the stocks in this calendar came about, isn’t there?

CHARLES: There is Steve, every stock in that calendar was created by the same unique catalyst.

STEVE: And again, to be clear for our viewers, that catalyst was NOT an IPO, correct?

CHARLES: That’s right, none of the stocks in that calendar were created by an initial public offering. They were created by something much better.

STEVE: OK Charles, I know … and most of our viewers know … that you don’t like to beat around the bush. So let’s just go straight to the meat…

All these new stocks weren’t created by IPOs … so, what kind of catalyst did create them?

CHARLES: Spin-offs. Steve, there are three big takeaways I want to give our viewers on how they can grow their money with spin-offs:

Here’s Takeaway #1:

Spin-offs have outperformed the S&P 500 by nearly 2-to-1 this century.

Ninty-five percent of money managers can’t even beat the S&P index … and yet a simple spin-off index can.

STEVE: So, if anyone watching is content making two times more than the market, they could close this video and go put their money in a spin-off index. Odds are they could beat the market 2-to-1.

But, we just saw spin-offs in this calendar that had gains of 130%, 245% and 480% … which is better than making 2 times more than the market. A LOT better.

You’ve predicted dozens of spin-offs in here. How do you know it, how do you know when there’s about to be a spin-off?

CHARLES: C’mon now, Steve … you know I don’t make predictions. Companies need to file a form 10B with the SEC when they’re about to have a spin-off. So there’s no guess work when they are expected to happen.

STEVE: And when you see that form get filed, you know when a spin-off is going to take place.

CHARLES: Correct.

STEVE: And … this pocket planner only covers the past three years, right?

CHARLES: Yeah, those are some I’ve followed since 2019. I could go back further and list a stack of other top performing spin-offs as well…

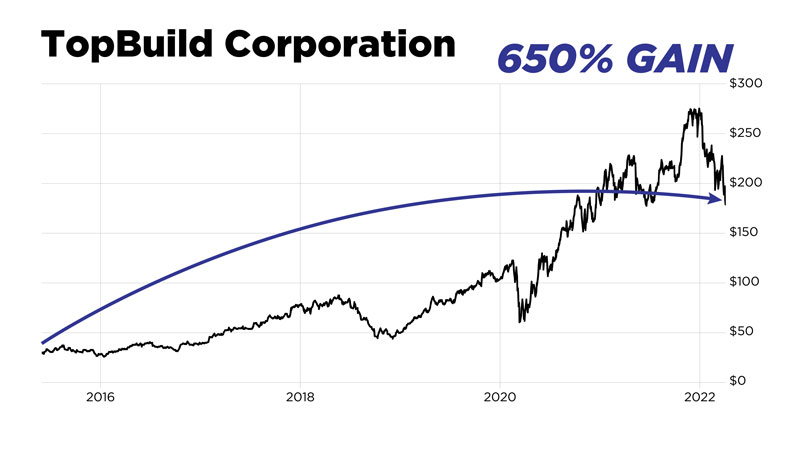

Like TopBuild Corporation, which was spun off in 2015.

Today, it’s up more than 650%.

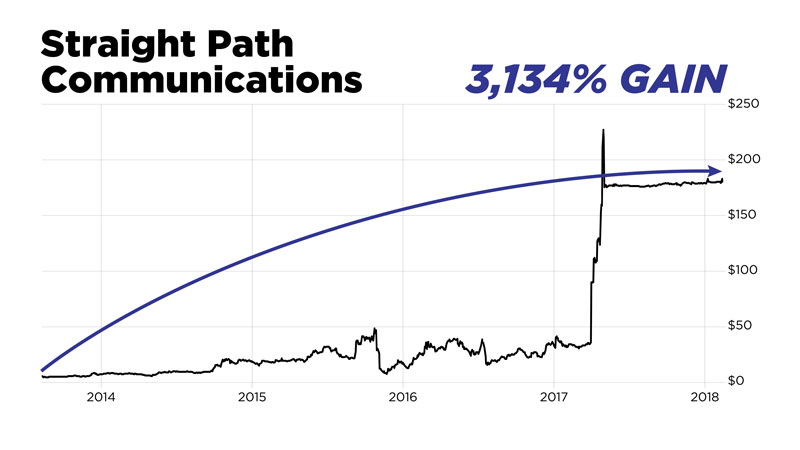

Or Straight Path Communications, which was spun off in 2013.

In five years, it rose more than 3,100%.

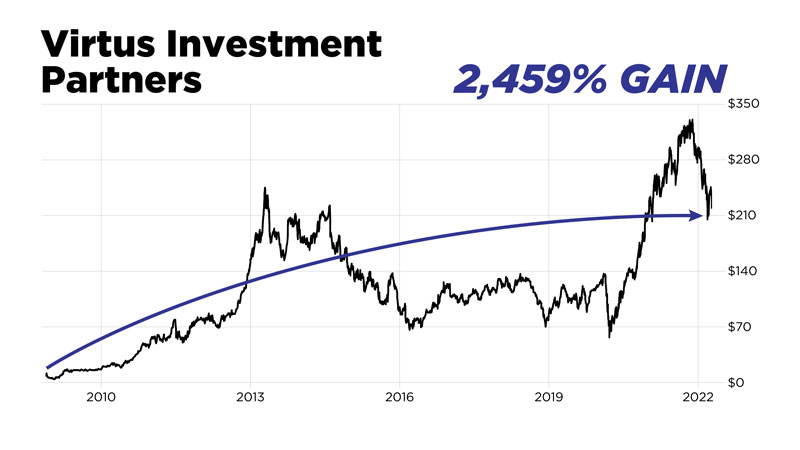

And Virtus Investment Partners was spun in 2009…

Today, it’s up over 2,400%.

STEVE: These historical examples paint an incredible picture, Charles. If someone were to put, say $10,000, into Virtus Investment Partners when it was spun off, today they’d have over $240,000.

CHARLES: Yes they would. But as exciting as this sounds, I want to take a step back here. Past performance is not indicative of future results. Because there’s no such thing as a sure thing other than a Treasury bill.

Every investment, even spin-offs, will always have some degree of risk. That’s why you should never invest more than you can lose.

STEVE: There you go folks, straight to the point with more real talk.

Spin-offs like these aren’t about rolling the dice and gambling.

They’re about investing prudently. Wisely.

And, when you invest in them the right way, they give you a chance to beat the market by two times or more.

But what is it … exactly … that makes spin-offs so much better than IPOs?

CHARLES: I wouldn’t even compare them to IPOs … which is Wall Street’s ultimate pump and dump game.

Investment banks and corporate insiders put IPOs together in such a way that the Main Street investor gets the worst possible deal. And let me show you why…

396 companies went public through IPOs last year, Steve…

And Wall Street banks … such as Goldman Sachs, JPMorgan, Morgan Stanley … took in a record … A RECORD … $10 billion in IPO revenue.

Can you guess how many of those stocks are trading above their IPO price today?

STEVE: Well, I’ve seen quite a few headlines about last year’s big IPO boom failing to deliver, so I’d imagine not very many.

CHARLES: Damn right. More than 80% of the IPOs are underwater.

STEVE: It sounds like a punch to the gut. If I had invested in one of the big IPOs last year … like Robinhood, Warby Parker or Rivian Automotive … there’s an 80% chance I would’ve lost money. It’s actually pretty frightening.

CHARLES: And that was just last year. Over the long term, the results are even more terrible…

Between 1980 and 2020, there were more than 8,600 IPOs…

And their average return, relative to the market 3 years after they IPO’d was minus … MINUS … 17%.

What slot machines are to casinos, IPOs are to Wall Street. Your odds of winning couldn’t be any worse…

STEVE: Yeah, the odds of hitting the jackpot on a slot machine are what … something like 34 million to 1…?

CHARLES: That’s why legendary investor Warren Buffett and his partner Charlie Munger never bought an IPO. Buffett said: “It just doesn’t make any sense.”

Once you know about IPOs, it’s like watching sausage get made. It leaves you sick to your stomach…

They’re terrible investments, Steve. That’s why spin-offs are in a different league.

That’s Takeaway #2:

Avoid IPOs of every kind.

You never want to be on the other side of a trade with Wall Street. Spin-offs are much, much better. They keep you out of that trap.

STEVE: OK, Charles, I don’t know about our viewers … but you’ve certainly convinced me: Spin-offs are like diamonds, IPOs are the coal.

And, judging by the examples we’ve seen, it looks like spin-offs can beat the pants off most other stocks as well…

But so do most of the stocks you already share with people in your Alpha Investor recommendations.

That begs the question: what makes spin-offs even better than your Alpha Investor stocks?

CHARLES: I wouldn’t say “better”, Steve, but they are definitely different.

STEVE: OK, Charles, I’ll bite … why would you say “different” rather than “better”?

CHARLES: Because, just like in Alpha Investor, I still want to own companies in industries with strong tailwinds, run by rock-star CEOs, and buy them when they trade for less than the underlying worth of the business. You then need to have patience and wait for that gap to close.

But, spin-offs have a baked in catalyst … the spin-off … that could close that gap between the stock price and the worth of the business much quicker.

Typically, the gap will close within 12 months of the spin-off.

STEVE: That’s what jumped out at me the first time you showed me this calendar … and prompted me to put together this interview.

Those first three examples I shared with our viewers really stuck in my mind…

Pennant group up 130% … Cerence up 180% … and Arconic up 450% shot up in just 12 months.

That’s a lot faster than the 3-to-5 year expectations we see in Alpha Investor, of which I’m a subscriber, by the way. Can you delve into the accelerated pace of spin-offs a little more for us?

CHARLES: Sure … the spin-off acts as catalyst, and many of these stocks are like a champagne bottle with the cork ready to pop.

Sometimes, on the very first day of the spin-off, the stock price will soar … and close the gap in just 24 hours.

With others, it could take up to 24 months.

Typically though, spin-offs close the gap in about 12 months.

STEVE: 12 months is pretty amazing. As I said, it certainly got my attention. And I’ll bet a lot of viewers’ ears have perked up now too…

But what has spin-offs so primed to climb, Charles … why is their cork ready to pop?

CHARLES: It’s because of a glitch in the way Wall Street operates, Steve. To see this glitch, let me share with you how and why a spin-off takes place.

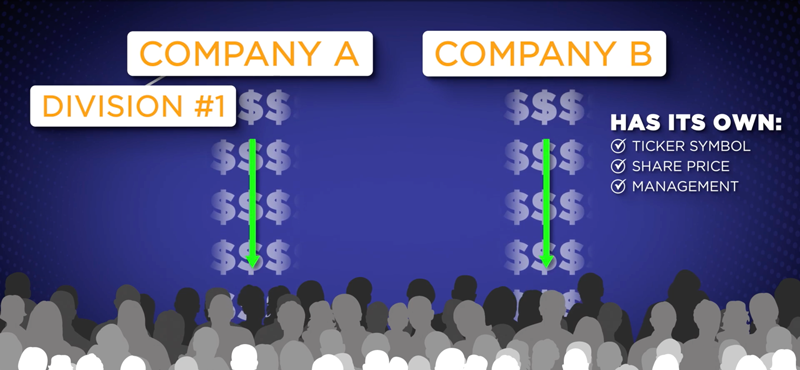

When a company has a division or business segment that they want to separate from the parent company, they create a new, independent company.

What they do is they spin off the new company to existing shareholders…

The day it is spun off, the new company starts life with its own ticker symbol, share price and management.

STEVE: Like the Carrier example in your calendar… I see commercials for Carrier air conditioners on TV all the time. It’s a name many people are familiar with…

So, to be clear, the day after United Technologies spun off Carrier into a brand new, stand-alone company, investors who held shares of United Technologies automatically got shares of Carrier. Is that right?

CHARLES: Yep. And, 18 months later … Carrier was up 245%.

STEVE: But anybody can take advantage of a new spin-off, right…? It wasn’t just people who happened to be shareholders of United Technologies at the time…

CHARLES: Yes, anyone could’ve bought shares of Carrier the day after it was spun off…

BUT … and this is the important part: existing shareholders of any company doing a spin-off automatically get shares of the new company. And that’s where we find the glitch, Steve.

STEVE: I think you’re going to have to clear the water a little more for our viewers, Charles. How is that a glitch?

CHARLES: The whole freaking way Wall Street is set up to distribute shares in a spin-off. It’s terribly inefficient, which we take advantage of. And that’s the glitch.

You see, the spin-off stock isn’t sold. Instead, it’s given to existing shareholders.

All the investors in the parent company get these shares of the spin-off.

STEVE: The way the new shares of Carrier were automatically given to shareholders of United Technologies…

CHARLES: And that’s my point. Those new shares are distributed, by and large, to the wrong investors...

STEVE: Alright, Charles. Now, I know you’re not talking about some kind of delivery error … this isn’t like my Amazon order accidentally getting delivered to my neighbor’s door…

CHARLES: No, it’s a different kind of distribution glitch. Let me show you what I mean. Let’s stick with Carrier as an example…

Institutional money managers … banks, hedge funds, mutual funds, pension funds are the largest owners of stocks.

In this case, they held a lot of United Technologies shares.

When shares of a spin-off show up in their portfolios, they usually sell them immediately.

In this example, for every share of United Technologies they held, one new share of Carrier showed up in their portfolio.

But they don’t care what the spin-off is…

They couldn’t care less how good of a business Carrier was, they just wanted to get those shares out of their portfolios. In other words, they sell the spin-off regardless of the fundamentals of the business.

And the reason they sell them is because they bought the parent company, in this case United Technologies.

It was the parent company that they researched, followed, and did their analysis on. Not one of the divisions like Carrier.

STEVE: So that’s why the spin offs are so often mispriced. The wrong investors get shares of a company they don’t want ... so they sell them.

CHARLES: You got it. And they do so without ANY regard to the stock price … or the underlying fundamentals of the new business. There is nothing better than buying something from a seller that wants to get rid of something and doesn’t care about the price.

That was the story with Circuit City … most people don’t know that CarMax was their idea.

STEVE: Hold on, the electronics super store that went out of business a few years ago … they were also selling used cars?

CHARLES: It sure was.

In 1991, Circuit City came up with an idea to sell used cars.

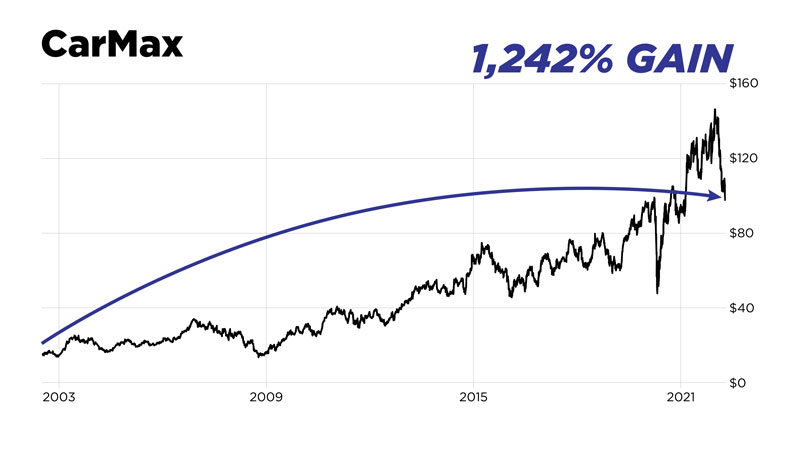

And by 2002, their used car idea had grown into CarMax.

At the time, CarMax was only in 12 states and had around 33 superstores.

It was producing solid sales and earnings growth. And it no longer needed Circuity City to support it.

So, Circuit City made the decision to spin it off to shareholders. The reason they gave was … and I quote:

Which in simple English means: Wall Street wasn’t recognizing the value of CarMax because it was buried in Circuit City’s retail business.

So Circuit City spun off shares of CarMax to shareholders. And who do you think the majority of those shareholders were?

STEVE: Institutional investors: big banks and money managers.

CHARLES: Bingo. And what the heck would they want with a small used car dealer … do you think they wanted those shares in their portfolios?

STEVE: No, they only wanted shares of the electronics giant, Circuit City.

CHARLES: That’s right, Steve. And besides, CarMax was a small $1 billion company. It had no place in their portfolios if they managed an index fund or a large cap fund.

STEVE: Well, considering that Circuit City went out of business a few years later, they should’ve held on to CarMax…

CHARLES: Heck yeah.

Now check this out: Since being spun off in October of 2002, the stock is up about 1,250%.

STEVE: Wow! And since big Wall Street investors sold most of their shares right after the spin-off, it was Main Street investors who had the greatest chance to profit from it.

CHARLES: Yeah. But unlocking shareholder value isn’t the only reason spin-offs occur … or offer us so much potential…

There are also two other reasons as well…

The second is when a division just doesn’t fit with the rest of the business.

STEVE: Can you give us an example?

CHARLES: Sure. In 2010, Wes Bush became CEO at defense contractor Northrop Grumman.

Soon after, he decided that the company’s shipbuilding operations weren’t a good fit. It didn’t fit in with Northrop’s main businesses: aerospace and electronics.

And that’s because shipbuilding is a low-margin business with uneven performance. And it was dragging down their other businesses.

Bush wanted the company to focus on areas where they had a strong competitive advantage. And shipbuilding didn’t fit Northrup’s culture.

STEVE: So, he spun off the shipbuilding?

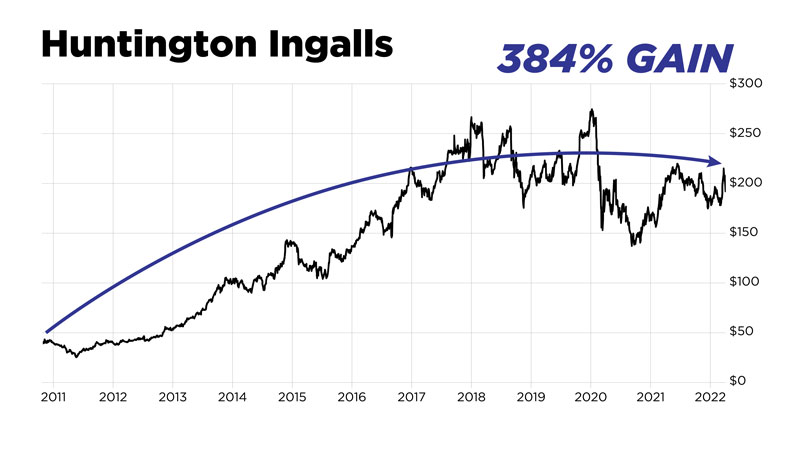

CHARLES: Yes … on the morning of March 31, 2011.

I remember this one like it was yesterday … because I shared a LOT of details on this one with my readers at the time…

Northrup shareholders woke up the next morning to find shares of a new shipbuilding company called Huntington Ingalls Industries in their portfolios…

They received one share of Huntington for every six shares of Northrop that they owned.

STEVE: And that was the distribution glitch in action again … because, I take it big money managers who bought Northrop bought it for the aerospace and electronics business, not the shipbuilding?

CHARLES: Exactly. But, because of the glitch, they ended up receiving shares anyway. Many of them had no choice but to hit the sell button and dump shares of Huntington. And here’s why…

If they were large cap or index fund managers, they couldn’t hold shares of a small cap stock … or one that wasn’t in the S&P 500 index.

So, they sold regardless of the fundamentals of Huntington’s business or its stock price. I mean, this made no sense to me…

Huntington was the only company in the U.S. that could design, build and refuel nuclear-powered aircraft carriers for the U.S. Navy. They are a mission critical partner for the U.S. Navy! Talk about having a monopoly.

STEVE: It sounds like a remarkable situation. After all, we all know whose checks never bounce: the U.S. government’s.

CHARLES: It was ideal, Steve. Once Huntington became an independent company … free of Northrop … with a new CEO, and sharper focus of its own, it was able to increase its bottom line, and increase profit margins like crazy.

Since the spin, Huntington Ingalls is up almost 400%.

STEVE: That’s a fantastic gain to say the least … I wish I’d been following your insights back then Charles.

Now, you’ve shown us how spin-offs are often done to unlock shareholder value … or to set free part of a business that doesn’t quite fit. Are there any other reasons?

CHARLES: There’s one more and this one actually makes the most sense to me: focus.

And by focus, I mean a company’s ability to concentrate on its CORE business.

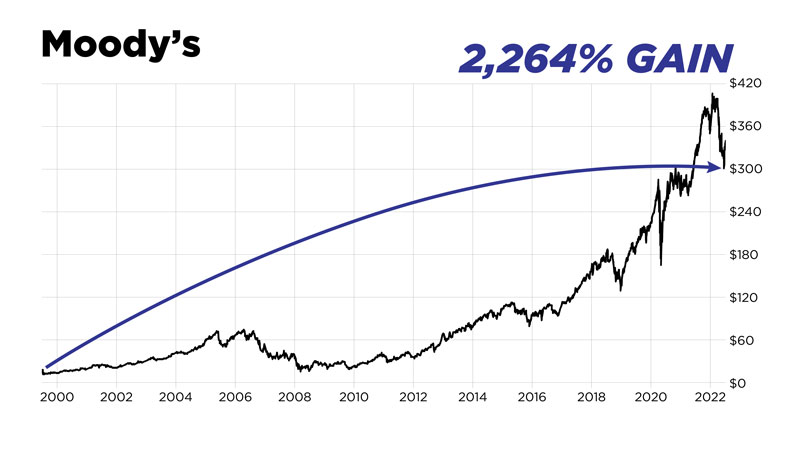

Look at the bond-rating company, Moody’s…

Before 2000, Moody’s credit-rating business was extremely profitable and was part of Dun & Bradstreet. But it was overshadowed by the weakness at D&B’s commercial credit business.

STEVE: Just to keep things clear, Moody’s was a business segment within Dun & Bradstreet … and was trapped in its shadow?

CHARLES: Yes, like a young oak tree trying to grow in the shade of its parent. Management realized the Moody’s segment was being held back by the rest of D&B. So, they decided to split the company in two.

The goal was to create two companies … each sharply focused on their own core business, and nothing else.

As a separate company, Moody’s would be able to use their capital to better expand THEIR business … and unlock value.

So, in late September of 2000, Moody’s was spun off from D&B. And since it was no longer in D&B’s shadow, investors were better able to value the company.

Since the spin-off, Moody’s shares have soared more than 2,200%.

STEVE: I have to say, Charles, from where I’m sitting, spin-offs are sounding better and better for us by the minute…

But, after hearing about opportunities like CarMax and Moody’s … and seeing spin-offs like the ones you tracked in here for the last 3 years … what I want to know is, how many spin-offs can we expect over the next 3 years?

CHARLES: Well … under normal circumstances there are around 200 or so spin-offs worldwide each year.

STEVE: Ah, but we’re not under normal circumstances, are we…

I cover the news on the radio and online all the time, Charles. And I’ve seen some interesting headlines recently…

Here are a few from The Wall Street Journal:

Reuters reported that GE and Johnson & Johnson were at the forefront of “a renaissance in corporate splits” last year, “all opting to spin off various units.”

And many, such as Brown Advisory and The Wall Street Journal, are also using the word, “De-conglomerate-ization.”

What say you?

CHARLES: You’re right, we’re not under normal circumstances. Those headlines are right … over the past few years, there have been significantly more spin-offs than usual.

As for, de-conglomerate-ization … it’s just a $5 word that means big companies are having a makeover.

Big companies are usually lumbering, bureaucratic, and move at the pace of sloth. So they are slimming down and spinning off divisions.

STEVE: So they are slimming down and becoming more nimble. More competitive.

CHARLES: Pretty much, but that’s just a part of it…

There are other, deeper reasons behind the growing number of spin-offs too. Pressure from shareholder activists, ESG-environmental, social issues, and governance issues to name just a few.

What’s important is that many more companies than usual are considering … or already in the process of … doing spin-offs right now.

Tech giant IBM spun off Kyndryl.

Healthcare giant, Danaher spun off Envista.

Merck, the pharmaceutical giant, spun off Organon.

AT&T, GE, and GlaxoSmithKline … the home builder Lennar … they’ve all done, or are planning to do spin-offs.

And it’s not just American companies…

You mentioned the Universal Music spin a moment ago. They were spun off by Vivendi, the French mass media company headquartered in Paris.

And the big, British insurance company Prudential plc recently spun off its U.S. unit into a new company called Jackson Financial.

STEVE: That’s another one we saw written in your calendar a few moments ago…

CHARLES: Yeah, it spun off in September and shot up around 70% within four months.

And here’s a name I’m sure you’ll recognize: Daimler, the company that makes Mercedes-Benz.

STEVE: Of course, who wouldn’t recognize it… Their cars are iconic. Status symbols.

CHARLES: This past December, the parent company decided to adopt the name of its flagship brand, Mercedes-Benz … AND to spin-off its truck building segment.

That way, they could each focus on what they do best — luxury cars for Mercedes. And trucks for Daimler.

It’s clear as day, a wave of spin-offs is growing all around the world.

STEVE: Well, with all of these spin-offs taking place, I’ll bet there’s one very BIG question on our viewers’ minds…

Which spin-off, above all others, do you have your eye on … RIGHT NOW?

CHARLES: Ahhhh, Steve, you’re really trying to get me to show all my cards, aren’t you…?

STEVE: What can I say, Charles, I’m sure our viewers would like to know too…

CHARLES: As a matter of fact, Steve, THERE IS a big spin-off I’m watching right now … which brings us to ...

Takeaway #3:

If you want to zero in on some of the most promising spin-offs the market has to offer RIGHT NOW, look at the health care sector.

I’ve got my eye on a BUNCH of spin-offs that are in the works…

And the healthcare sector contains one that is at the top of my list.

STEVE: C’mon Charles, you have to give us more than that…

Alright, let’s start with this … why the healthcare sector?

CHARLES: Because of my first filter: look for industries that have a huge tailwind…

You can’t get much bigger than the tailwind that’s propelling the healthcare sector…

Healthcare accounts for close to 20%, or $4 trillion of America’s GDP.

STEVE: Wow, that’s insane. I mean, we all know that millions of boomers hitting retirement age is going to have a tremendous impact on our healthcare system.

But 1 out of every 5 dollars' of worth of goods and service created in the U.S…?

It’s crazy to think that our healthcare spending has ALREADY grown that large.

CHARLES: And it’s getting bigger by the day, and here’s why…

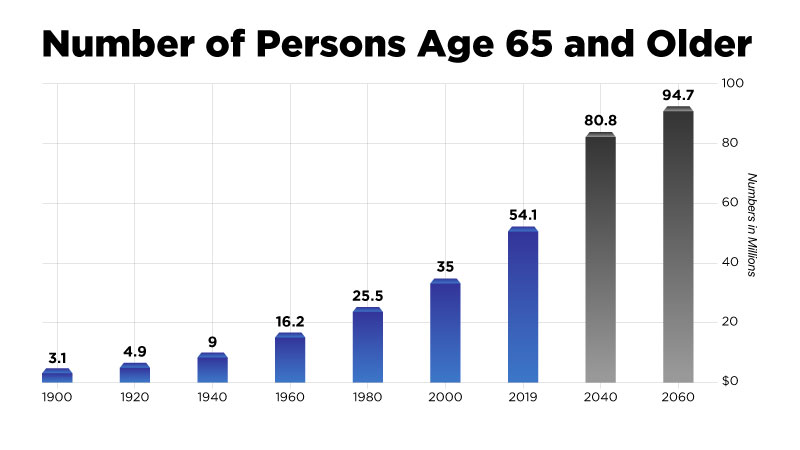

Look at this chart…

By 2040, 81 million Americans … 1 out of every 5 people … will be 65 or older.

STEVE: A MASSIVE tailwind wind for sure. But what about your second filter, outstanding … or, as you often like to say, “rock-star” CEOs?

CHARLES: Well, healthcare is no different than any other industry, Steve. There are only a few truly good CEOs. And you have to look really close to find them.

But they are out there…

Take Ari Bousbib, chairman and CEO of $45 billion IQVIA …

STEVE: I recognize that sharp-looking guy on the right, Charles … so that must be Mr. Bousbib on the left.

CHARLES: Yeah, that was just after we had a conversation at a recent meeting that I moderated.

Ari worked his way up to become the CEO of Otis Elevator … where he grew Otis’ revenue from $6 billion to $11 billion.

Then he left Otis to became CEO of IMS Health … IMS Health was the dominant provider of pharmaceutical data.

CHARLES: This guy is a brilliant CEO and saw an opportunity to increase shareholder value by joining his company with Quintiles, another business in the healthcare industry.

So, in 2016, he merged the two together to create a company called IQVIA, in a deal worth $9 billion.

From a $9 billion merger, Ari built IQVIA into a $45 billion giant that it is today.

He increased the market cap by 5x in 6.5 years! If there was a CEO Hall of Fame, Ari would be one of the first inductees.

STEVE: You make the point very well … that the right CEO at a healthcare company or any company for that matter, can make shareholders a TON of money. Just look at Steve Jobs and Apple. Or Jeff Bezos and Amazon.

But what about your final filter: an attractive stock price?

CHARLES: The way I see it … Wall Street is focused on things like computer chips, artificial intelligence, and whatnot…

I’m not focusing there as much because I’m not seeing as many attractive investments.

Where I’m seeing much more opportunity is in healthcare. Wall Street is underpricing the ones I’m looking at.

ADD IN the catalyst of a spin-off, and watch out … because the sky’s the limit.

And yes, one of these healthcare companies checks ALL of my boxes…

It’s going to spin off in the next few months.

In fact, I’ve put all the details in a report called The Mega Spinoff.

STEVE: That’s great, I can’t wait to get my hands on it. And we’ll show everyone how to get a copy of your report in just a moment.

But we’re talking about more than one big opportunity here, aren’t we? Since we’re at the start of a huge, new surge in spin-offs … I take it there are bound to be many more after this one.

CHARLES: There sure are. I wouldn’t be surprised to see more than 250 new spin-offs over the next 12 months. So I’ll be sharing only my best ideas with my readers.

STEVE: Because, as we’ve shown, not every spin-off in the market goes on to be a big winner.

CHARLES: Exactly … only the best spin-offs have the potential to deliver gains like…

LendingTree … which has risen nearly 1,500% since its spin-off in 2008.

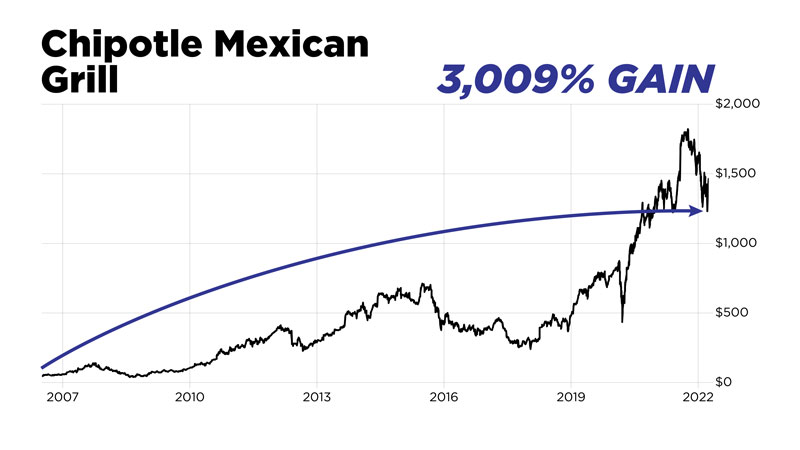

Or Chipotle Mexican Grill … which has soared 3,000% since it was spun off by McDonald’s in 2006.

Or Expedia Group … which is up nearly 600% since its spin-off in 2005.

STEVE: Granted, as you said, these past historical examples are no guarantee of future results … and all investments carry risk. But Charles, that’s where your Catalyst Fortunes service becomes indispensable…

I said this before and I’ll say it again: You have an amazing knack for looking around the corner to see what’s coming … to connect the dots better than anyone I know. You do it in your flagship service Alpha Investor…

And now you’re taking it to a new level by applying those same three filters to stocks that are involved in spin-offs.

CHARLES: Not just spin-offs, Steve. Although they happen to be one of my favorite catalysts, there are others I look for too…

Stocks that fly under Wall Street’s radar. Activist investors buying up shares. Businesses that are misunderstood by Wall Street. Mergers and acquisitions…

Any one of them can result in huge returns when we catch Mr. Market taking a nap and kick the stuffing out of the S&P 500.

STEVE: Beating the market is an understatement, Charles. From what I’ve seen, they can be life-changing...

I’ve seen some of the emails sent in by members of the Catalyst Fortunes community. There are a few that really stood out to me … and I’d like to share a them with our viewers.

The first is from Alan. He wrote:

CHARLES: Ah, that’s great to hear Alan. Yeah, Concentrix was a good one. We closed out a gain of about 140% in 24 months with that spin-off.

STEVE: The next one is from Robert. He wrote:

CHARLES: That’s really great to hear. ExOne wasn’t one of our best performers … but it certainly wasn’t too shabby either. We were able to lock in a gain of around 40% in just 4 months.

STEVE: I love your modesty, Charles…

Granted, we’ve seen examples of stocks that have risen 1,500% … 3,000% … and 600% because of catalysts like spin-offs.

But 40% in 4 months … I don’t think anyone in their right mind would turn down a chance to make that kind of gain. Especially given how crazy and chaotic the markets have been lately…

I mean, even in a bull market, there’s no guarantee a stock will go up. There’s always risk … it’s a simple fact of investing.

But it wasn’t all the talk about gains that jumped out at me as I looked through the emails that you’ve gotten…

It was the number of the comments like Brett’s…

Brett wrote:

CHARLES: That’s what I try to do everyday, Steve.

STEVE: A “breath of fresh air” … “the best financial move” he’s ever made. Charles, your insights, and recommendations have restored Brett’s faith in investing. It’s amazing.

Here’s another one…

Rupinder emailed to say:

CHARLES: And I want to say, Steve. We have MANY subscribers that are members of both my services.

STEVE: Charles, you’ve shown Rupinder more than gains…

You’ve given him the inspiration … and the confidence … to stay the course even when most other investors panic. That’s invaluable.

CHARLES: And that’s the key … not to panic when you see prices head lower.

Warren Buffett summed up investing in one sentence:

For most people, it is easier said than done. You can’t let yourself get sucked under by the emotional currents of the market … or what’s going on in the world. You need to stay calm, cool, and confident. You let the facts and your analysis guide you … not the crazy volatility of the stock market.

STEVE: Well, the calm, confident insights you bring to the table are certainly helping John.

John wrote:

Signing up for Catalyst Fortunes has helped change John’s life. It has empowered him. You have empowered him … you’ve empowered each of them.

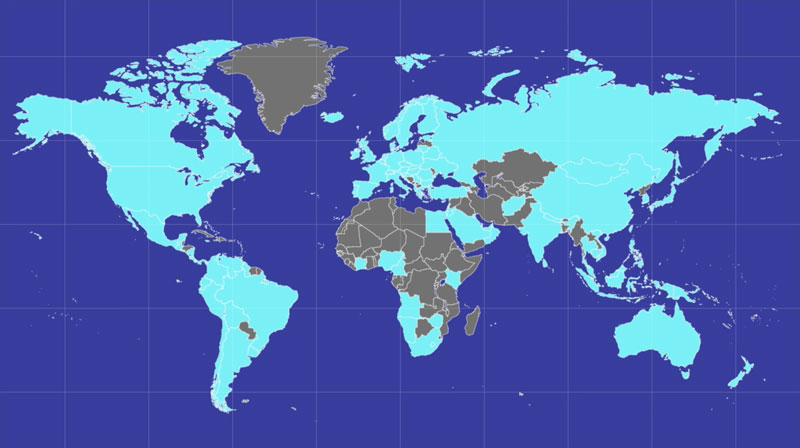

CHARLES: That’s my goal. I try to make investing in the stock market simple. Because it’s not hard. It’s just that most people never learned how to invest. That’s why I founded Alpha Investor … and so far we have more than 100,000 readers in 127 countries. So we must be doing something good.

And with Catalyst Fortunes, I want to help our viewers to take it to the next level … just like John, Rupinder and Brett have … by investing in stocks that have a catalyst … a reason to move higher.

Alpha Investor is a great start. I recommend stocks of great businesses that have tailwinds pushing them higher, run by rock star CEOs and trading at an attractive price. Once we recommend them, we sit back and wait until Mr. Market closes the gap. I really have no idea of how long it could take. I know what will happen, but I don’t know when it will happen.

In Catalyst Fortunes … this is a different service. I’m recommending stocks with a timetable … a catalyst that should close the gap between my valuation of the business and Mr. Market’s mispricing.

Alpha Investor AND Catalyst Fortunes are two services that should help investors slay the stock market.

STEVE: These catalysts could boost their gains even more. And help them to see those gains sooner … like the champagne bottle analogy you used earlier — the corks are already primed to pop.

CHARLES: Exactly. And the spin-off in my new report, The Mega Spinoff, is the perfect place to start.

STEVE: That report is the very first thing our viewers will get when they sign up for Catalyst Fortunes … but they’ll also get so much more.

You were kind enough to give me access to Catalyst Fortunes, Charles … to make me a part of the Catalyst community. And I have to tell you, I’ve been amazed with what I’ve seen.

Don’t get me wrong, the insights and recommendations I get as a part of Alpha Investor are fantastic.

However, with Catalyst Fortunes, I feel like I’m stepping into your inner sanctum … like I’ve graduated to being a next-level investor.

CHARLES: Well Steve, you are.

STEVE: I think what amazed most is how simple you make it for everyone.

Really, I shouldn’t be surprised given your penchant for clarity and real talk.

But I love how concise you’ve kept everything…

Each month, I get a short email with details on a new stock recommendation. No fluff. Just a quick overview on the company you’re recommending … the catalyst that could send its shares higher … and your “buy-up-to” price for the stock.

You’ll also send a short email when it’s time to close a position. Again, nothing fluffy. Just a recap of how much gain we saw on the stock … and why it’s time to sell it.

Twice a month you also send out a video update on how our positions are doing … and what you expect to see in the weeks ahead.

Everyone who signs up has access to your entire library of special reports … which contain details on other, special stock opportunities outside of your monthly picks.

Plus, we also have access to your dedicated customer care team. If a member has any questions whatsoever about their subscription, they can email or call them directly.

I mean, if you ask me, Charles, you literally go above and beyond. And you make it all so clear. As you say, nothing but real talk. No fat or fluff, just the concise details we all need.

It’s like having you right there next to me whenever I invest.

But I still have to ask Charles … is there any chance I can keep this? It looks like there are a LOT of great spin-offs coming up.

CHARLES: Sure you could, but they’re constantly changing. There’s no telling when I might circle one, or cross out another.

Besides, you’ll find all the full details on my spin-offs in your emails … and in the members’ area of the Catalyst Fortunes website. So will everyone who signs up.

But, I’ll even do you one better, Steve…

I’ll send you … and everyone who joins tonight … a brand-new Apple watch. With a simple tap on your wrist, you can open up the Catalyst Fortunes app and see current details on all the spin-offs I’m watching … at anytime, from anywhere.

STEVE: Are you serious Charles?! Apple watches go for $400 or more. And you’re going to send one to everyone who joins today for free…?

CHARLES: What can I say, Steve. I want to make investing in these stocks as simple and convenient as I can for my members.

It’s my number No. 1 priority. I want it to be as easy as logging in on your laptop or tapping the app on your watch.

Just tap the app, review my notes, and check if the stock is still trading below my buy-up-to price.

If it is, and you want to own shares, simply log into your own stock account and place a trade.

Five minutes. That’s all it should take. It really is that easy.

STEVE: Well, that’s a very generous extra bonus for everyone who joins today.

And I have another surprise for everyone watching as well…

One of our producers handed me a note just before we before we came on camera…

You know how one year of your Catalyst Fortunes research is normally priced at $5,000…?

CHARLES: Yeah.

STEVE: Well, it seems that your publisher has decided to offer 1 year of Catalyst Fortunes for a VERY significant discount to everyone watching tonight.

They can get an entire year for $1,995. A savings of 60% off.

CHARLES: Wow, that’s fantastic. He’s a great publisher to work with … he is just as passionate as I am about making investing as simple as we can for everyone. You know, Steve, there were three big takeaways I shared with everyone tonight…

One: Avoid IPOs like the plague.

Two: Spin-offs are a MUCH better way to go — they’ve outperformed the market 2 to 1 over the last two decades.

Three: The healthcare sector has some of the most promising spin-offs taking place right now.

But, in light of that note you just held up, here’s a fourth big takeaway for everyone watching: don’t procrastinate. I have no idea how long my publisher will be able to keep the discount on the table … so take advantage of it while you can. Procrastination is the thief of all profits. Don’t let it rob you!

STEVE: And all our viewers have to do is click the orange button below this video to see the details.

Now, there’s one last thing I’d like to touch on before we wrap up, Charles…

Something else stood out in A LOT of the emails your subscribers have sent in…

And it really speaks to value they’re getting … and the results they’re seeing…

I was blown away by how many of them said they upgraded to a lifetime subscription … right after joining.

In fact, it seemed so unusual that I asked your customer service team to tally up the numbers for me…

You may not realize it, but 1 out of every 3 community members took advantage of your lifetime subscription. ONE out of THREE…

That’s a phenomenal indicator of the level of satisfaction, and belief they have in you and Catalyst Fortunes.

CHARLES: Damn right. I give them 100% in everything I do. I’m glad they recognize that and become partners with me.

We constantly get emails from all around the world. At last count, there were members of Catalyst Fortunes in 69 countries. We still have another 130 or so countries to go in order to have members in every country on the planet. I’m so glad so many are getting so much out of Catalyst Fortunes.

STEVE: Given what I’ve seen as a member … and what we’ve all seen, and HEARD here today, I think you’ll reach that goal in no time at all.

And with that, I’d like to say thank you for taking the time to be here tonight, Charles.

CHARLES: It was my pleasure, Steve.

STEVE: Well, there you have it folks…

You’ve seen which stock catalyst you should avoid like the plague: IPOs.

You’ve seen which stock catalyst is one of Charles’ favorites: spin-offs. The right spin-off ETF alone could help you beat the market 2-to-1. And the right individual spin-offs could give you the chance to grow your money even more. Much, much more.

You’ve also seen which sector Charles is watching the closest for spin-offs: the healthcare sector.

And you even have the chance to claim a copy of Charles’ new report, The Mega Spinoff … which has full details on the No. 1 spin-off he’s watching right now.

The moment you sign up to try Catalyst Fortunes, a copy will be emailed straight to your inbox.

Click the orange button below to see the details.

This is it. This is your chance to take your investing to the next level … with stocks that are primed to soar in 12 to 24 months rather than 3 to 5 years.

It’s also your chance to try Catalyst Fortunes at a very significant discount — 1 year for $1,995 … 60% off the regular price.

Just click the orange button below to see everything you get when you sign up.

It’s up to you now: stick with the results you’re already getting … or take your investing to the next level like John, Rupinder and Brett have.

Getting started is easy…

Just click the orange button beneath this video.

You’ll see how to get access to Charles’ most current stock catalyst research within minutes … including all of his current spin-off recommendations.

Click the button below for more details.

I’m Steve Gruber. Thank you for joining us. And have a good night.

March 2022