OMEGA Stocks Gained as Much as 1,000% in a Year… Today, Charles Mizrahi Shows How Main Street Americans Can Get in on These OMEGA Stocks Months Before Wall Street

[Official Transcript]

Today, I’m going to reveal a special class of stock that had the power to turn $1,000…

Into as much as $10,000 — within 10 years, 5 years and sometimes…

In as little as ONE year.

All without any kind of risky leverage or complicated options.

Without crypto or any other speculative assets.

And without any special kind of expensive software.

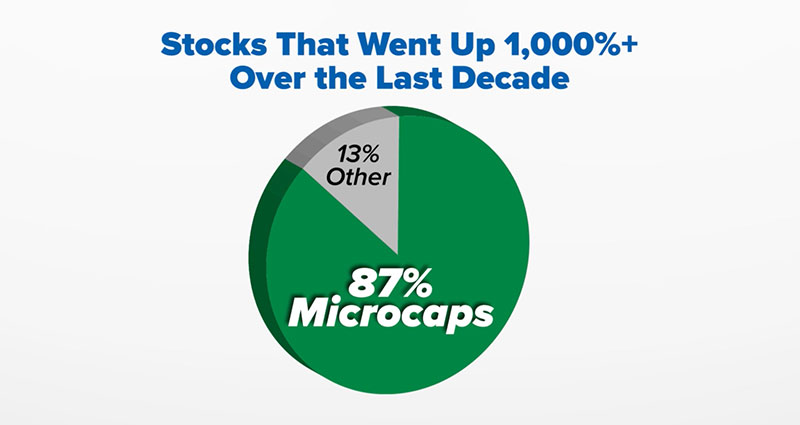

In fact, this special class of stock accounts for roughly 90% of ALL stocks that have gone up by 1,000% or more over the last decade.

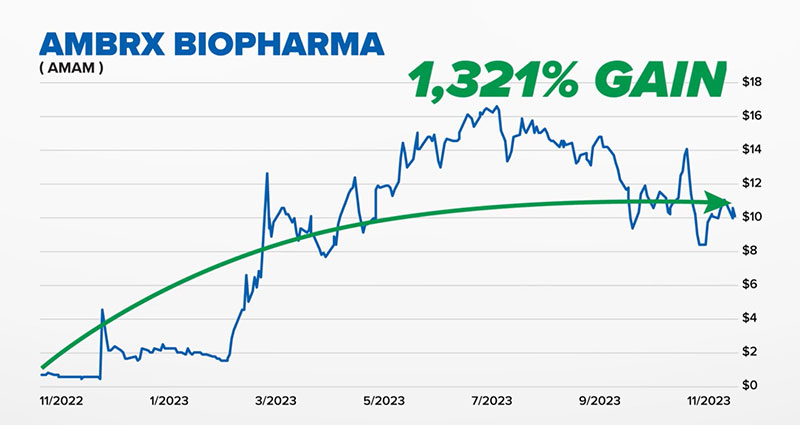

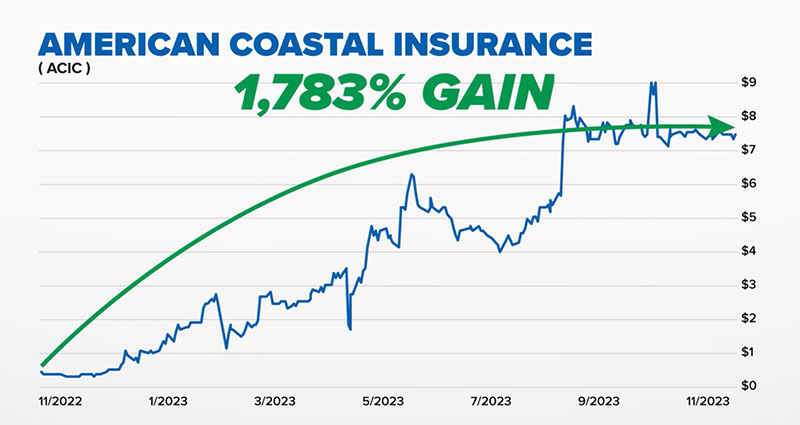

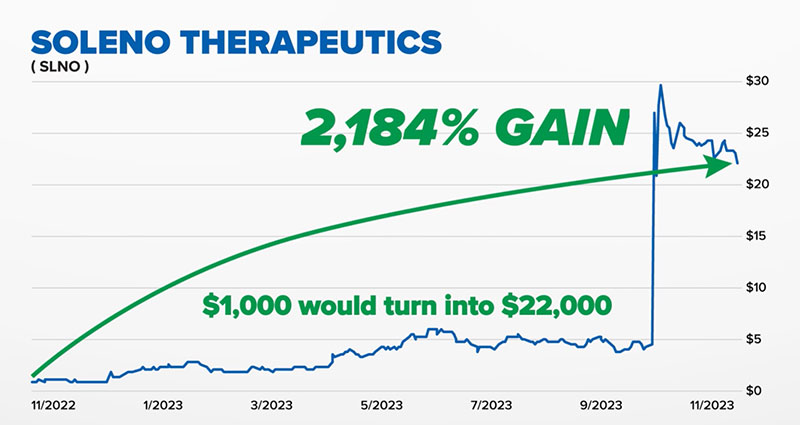

But often, the gains can come much faster. In the last year alone…

Ambrx shot up more than 1,300%.

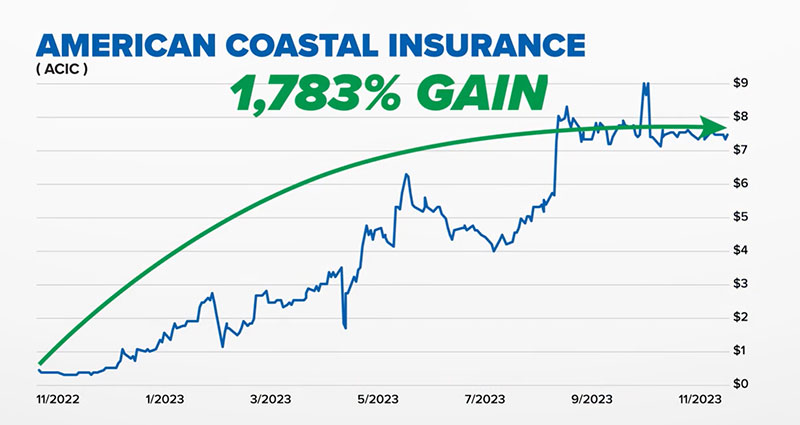

American Coastal rocketed more than 1,780%.

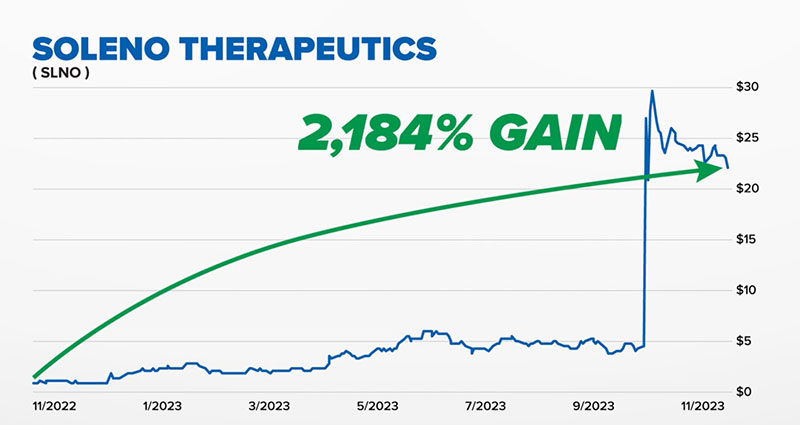

And Soleno Therapeutics gained more than 2,180%.

Anyone who invested just $1,000 into Soleno a year ago would be sitting on more than $22,000 today.

That’s how powerful this class of stock is.

In fact, more than 386 of these stocks gained 1,000% or more over the last decade.

And they form the key component in what I call OMEGA stocks…

Stocks with returns so large, they could be the last stocks you ever want to buy.

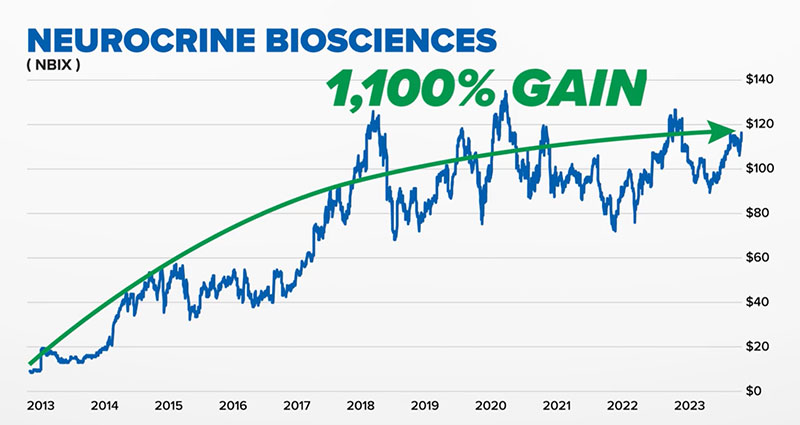

Over the last decade, OMEGA stocks like Neurocrine went up 1,100%.

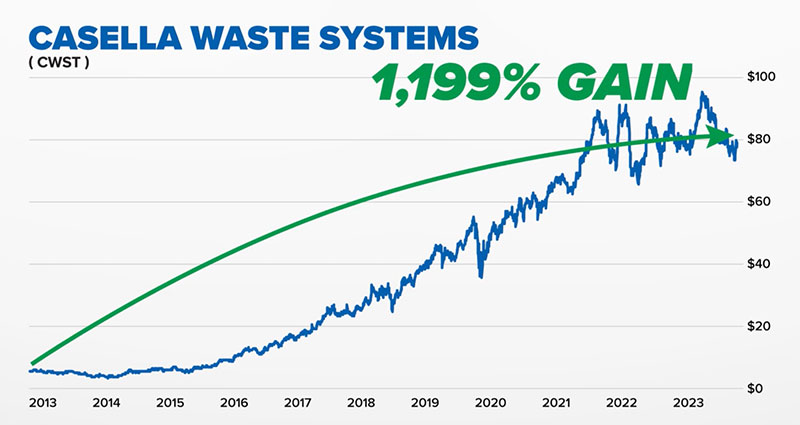

Casella Waste Systems went up nearly 1,200%.

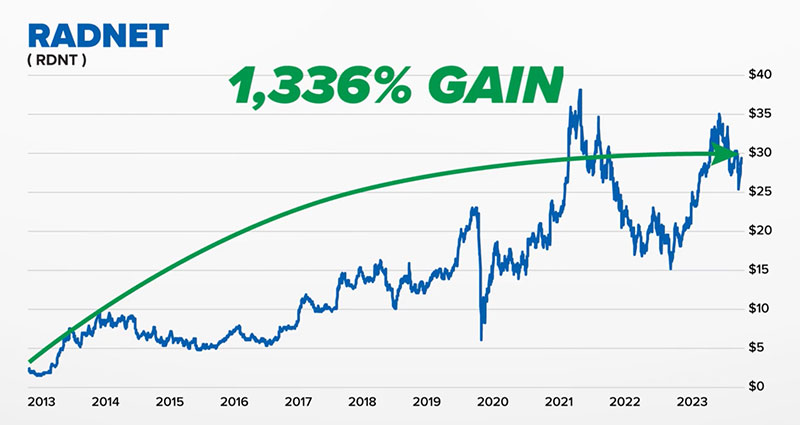

Radnet went up 1,300%.

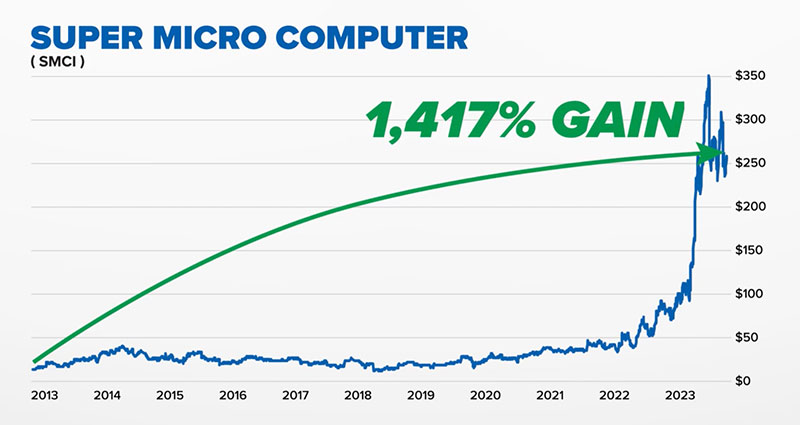

Super Micro Computer went up 1,400%.

And get this…

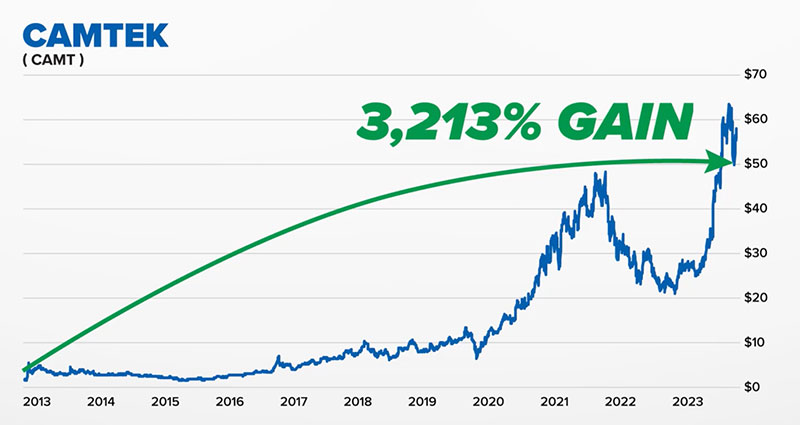

Camtek went up a massive 3,200%.

These are incredible, market-beating returns.

But chances are, you’ve never heard about OMEGA stocks before today. I’d wager 99.9% of investors haven’t.

They are not listed on the S&P 500.

They’re rarely talked about in the media.

And very few analysts even cover them.

So you’re not going to read about OMEGA stocks in the pages of The Wall Street Journal or hear people hyping them up on Fox Business or Mad Money…

At least, not until long after the biggest gains have been made … which, as you’ve just seen, can be substantial.

Yet, as you’re about to see:

OMEGA stocks are one investment Main Street Americans can get into before Wall Street.

So, here’s what I’m going to do…

Plus, I’m going to give you details on my top three OMEGA stocks to buy TODAY.

Each of these stocks has the potential to turn a $1,000 investment into $10,000 or more over the decade…

But, as you’ve seen, sometimes these gains have come within a year.

With the information I’m going to give you today, you could multiply your nest egg by as much as 1,000% or more.

And let me make it clear, that isn’t just a random claim I’m throwing about.

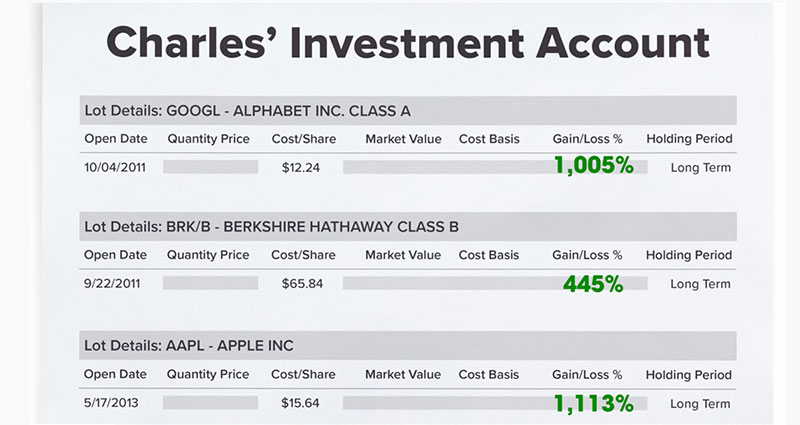

I’ve done it myself.

I got myself and my family in early on stocks like Apple, Google and Berkshire Hathaway. And I’ve used these investments to grow my own nest egg by as much as 1,100% since 2011.

Now I want to show you how you can do it, too.

And I’m going to show you exactly how you can get into them in just a minute.

But first I want to tell you how I started investing in OMEGA stocks.

I’ve been a professional investor for more than 40 years.

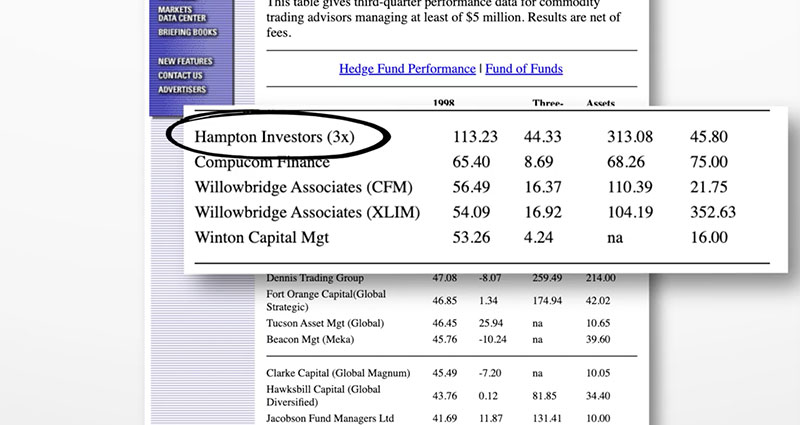

In the 1980s, my firm was ranked as the number one market timer in America for seven straight years.

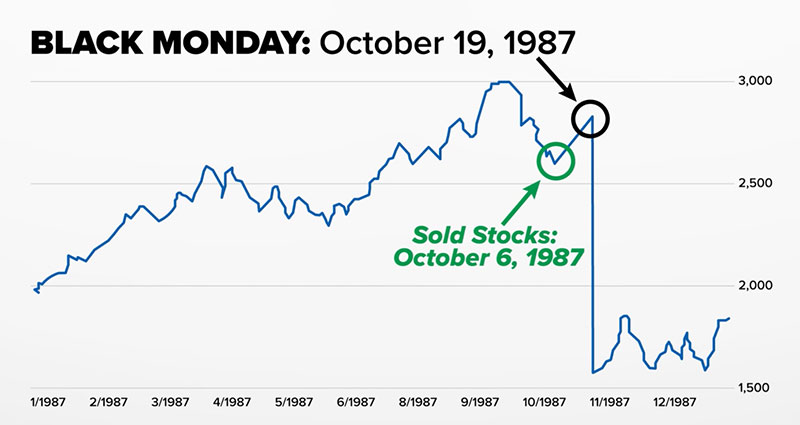

I even managed to help my clients sidestep the infamous 1987 Black Monday crash.

I moved them all to cash two weeks before it hit, and we closed out the year with a 22% profit — which was 4-times more than the market returned that year..

So, while many investors were underwater, my clients made a double-digit return.

After that CNBC, The New York Times and The Wall Street Journal started coming to me for my thoughts on the stock market.

And Wall Street titans, the big investment banks, asked me to manage their money.

By the late ‘90s, my investment firm was ranked as number one in its category by Barron’s, with a 313% return over three years.

By any metric I was a very successful investor by Wall Street standards.

My firm had just made a 300% return over three years.

But I knew I could do much better.

So, in the early 2000s I stopped taking on new accounts and started returning money to clients. It wanted to pour all my energy into researching OMEGA stocks…

Stocks with the power to gain 1,000% or more within 10 years, 5 years and sometimes…

In as little as ONE year.

I re-read every letter Warren Buffett wrote. I started with his partnership letters in 1956 all the way through his Berkshire shareholder letters…

I read 45 books on investing…

I learned to pick out tiny details on company 10-ks and quarterly reports.

And I combined this new knowledge with what I’d already learned over two decades on Wall Street.

By the end of it, I discovered five key traits that all the greatest companies have in common.

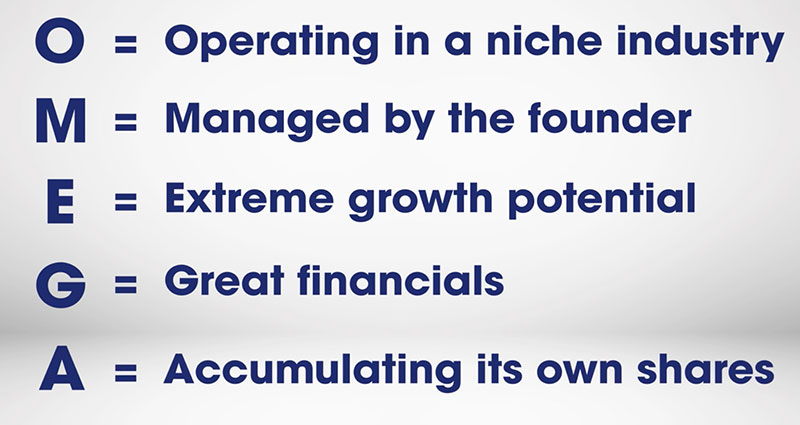

Each letter of OMEGA represents one of these traits.

If a company has at least three of these key traits, you know you’re on to a winner.

But on the very rare occasion a company has all five… that’s when you can get those 1,000% returns in 10 years, 5 years and sometimes as little as one year..

And over the longer term the best OMEGA stocks have made truly lifechanging returns.

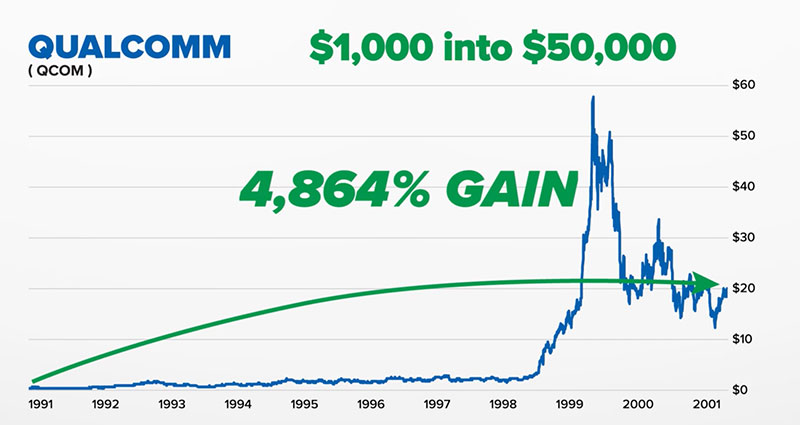

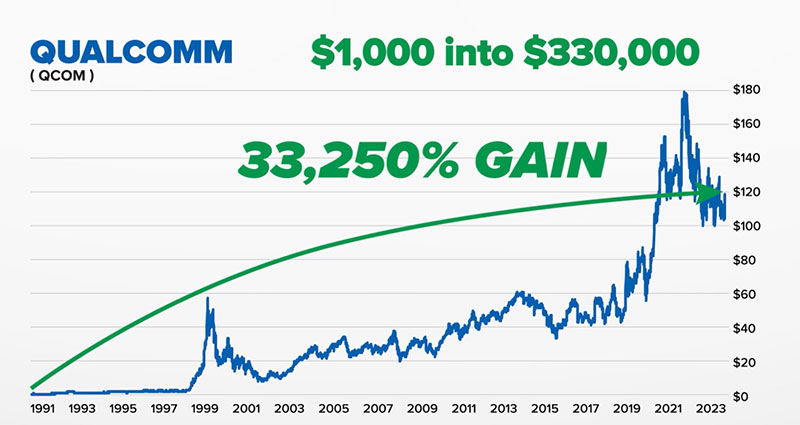

Take Qualcomm for example.

It first listed on the stock market in 1991, and in its first 10 years it gained more than 4,800%.

And it didn’t stop there.

Today, it’s up more than 33,000%...

So anyone who invested $1,000 in Qualcomm in 1991 was up around $50,000 in December 2001 — even after the dot-com crash.

And they’re up more than $330,000 today.

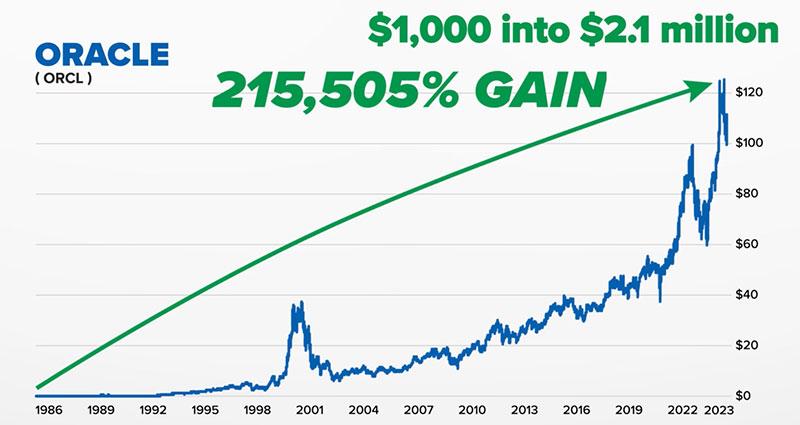

Oracle is an even better example.

Since its IPO in 1986, Oracle is up roughly 215,000%.

Anyone who invested $1,000 in Oracle when it first listed is up more than $2.1 million today.

Now of course, these are some of the most rare, once-in-a-lifetime type of gains the market has to offer.

But it goes to show what the best OMEGA stocks can do over the longer term.

And if you don’t want to wait that long, as you’ve seen, OMEGA stocks have still made upwards of 1,000% in as little as one year.

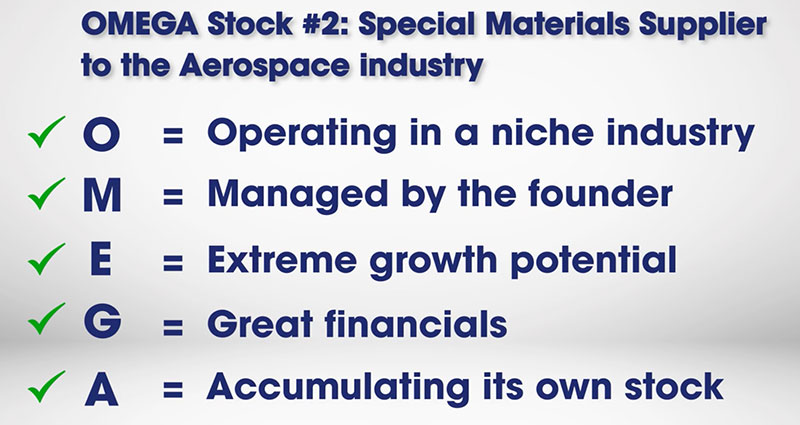

So what are the five key traits of an OMEGA stock?

Here, take a look.

O = Operating in a niche industry.

M = Managed by the founder.

E = Extreme growth potential.

G = Great financials.

A = Acquiring its own stock.]

An OMEGA stock is:

Operating in a niche industry.

Managed by the founder.

Has extreme growth potential.

With great financials.

And is acquiring its own shares.

This could be directly through share buybacks, or more indirectly through management holding a large amount of company stock. through share buybacks.

Both instances show that the people running the company believe it is undervalued.

Now, some of these are pretty obvious, once you start thinking of stocks as what they really are…pieces of a business.

You wouldn’t expect a business that doesn’t have great financials to last very long.

The same goes for O, operating in a niche industry.

For a stock to have 1,000%-plus potential, the business needs to be carving out its own niche, in an industry with a mega-trend behind it.

If you want to be a successful investor, those two traits should be the bare minimum you look for in any business.

But the next three traits are what can really turbocharge your returns.

Acquiring its own stock.

A lot of investors don’t know about this one. Or they don’t know how to dig through company records and find it.

But, let me put it this way.

Of all the stocks that went up by 1,000% or more over the last decade, roughly 70% of them had high levels of insider ownership.

And when a company is buying back its own stock, that’s because management believes it’s undervalued.

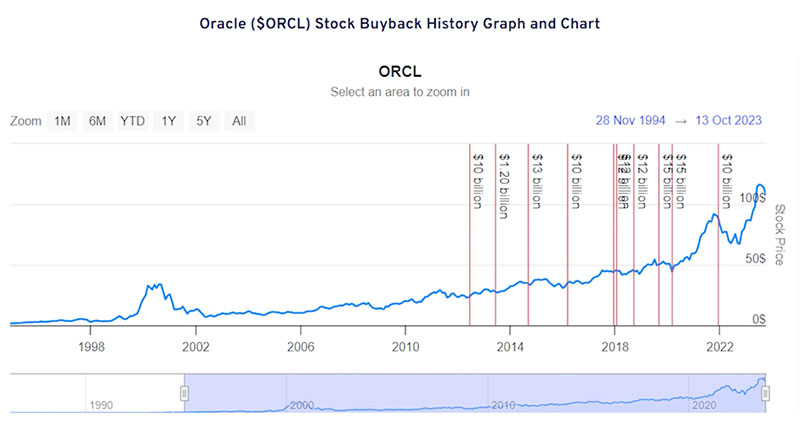

You can see here in Oracle’s stock chart that it performed big share buybacks right before most of its major upward moves over the last decade.

So if you find a business with great financials that’s outshining in a niche industry, while acquiring its own stock… you’re onto a very good thing.

You’re probably going to do better than 99% of investors out there.

But the way fortunes get made from OMEGA stocks is through their extreme growth potential.

And what I mean by that is very specific.

You see, in order for a stock to have extreme growth potential, the business needs to be small — really small.

All OMEGA stocks started out as microcaps.

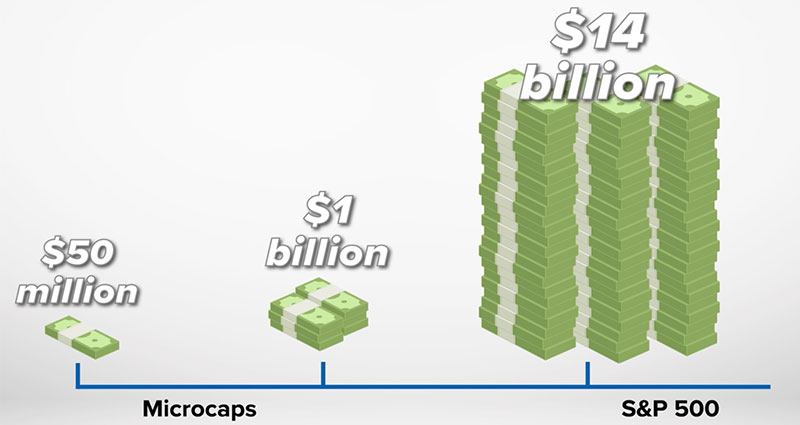

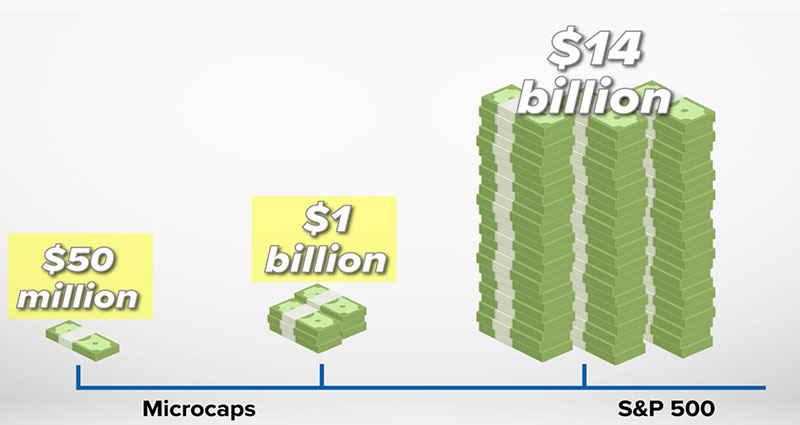

I consider all stocks with a market capitalization between $50 million and $1 billion to be microcaps.

That may sound like a big number.

But when you compare it to the minimum market cap of an S&P 500 stock, which is $14.6 billion , you start to realize just how much potential microcaps have.

Think of the massive power of an acorn…. It starts off tiny, but grows into a mighty oak tree.

It’s the same thing with these microcap OMEGA stocks.

Now I want to note here – because these businesses are small, they require investors to take on a bit more risk than large cap stocks.

But like it said, it’s their size that also gives these stocks much more upside than normal stocks.

And all three of the OMEGA stocks I’ll tell you about today, are all microcaps with TONS of room to grow.

So I believe you’ll want to act on these opportunities fast.

Because plain and simple, if you’re looking to make at least 1,000% from a stock, you MUST invest in microcaps.

And there’s a very good reason for that.

A definitive 2022 investment study discovered that 87% of ALL stocks that went up by 1,000% or more over the last decade were microcaps.

That’s the “one key component of OMEGA stocks” I mentioned earlier.

So, if you’re not investing in microcaps, you’re cutting your odds of making a 1,000% return by 90%.

That’s huge in itself.

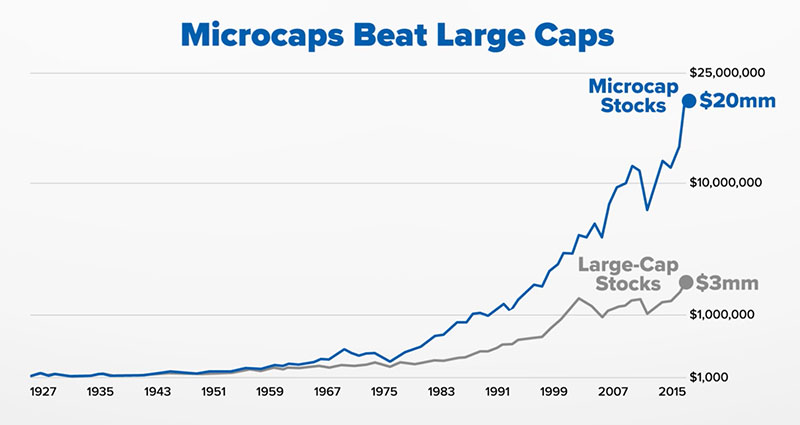

But what’s more, over the longer term, microcaps are proven to outperform large cap stocks — like those in the Nasdaq 100, S&P 500 and Dow — by 6-to-1.

As you can see in this chart if you’d invested $1,000 into large cap stocks in 1927, by 2015 you’d be sitting on $3 million.

However, if you’d put that same $1,000 into microcaps, your investment would have grown to $20 million.

That’s six times more than if you’d invested in the kind of stocks you find in the Nasdaq 100, S&P 500 and Dow.

That’s what I mean by extreme growth potential.

So, even without the other OMEGA factors, microcaps give you a 90% better chance of returning 1,000% than regular stocks.

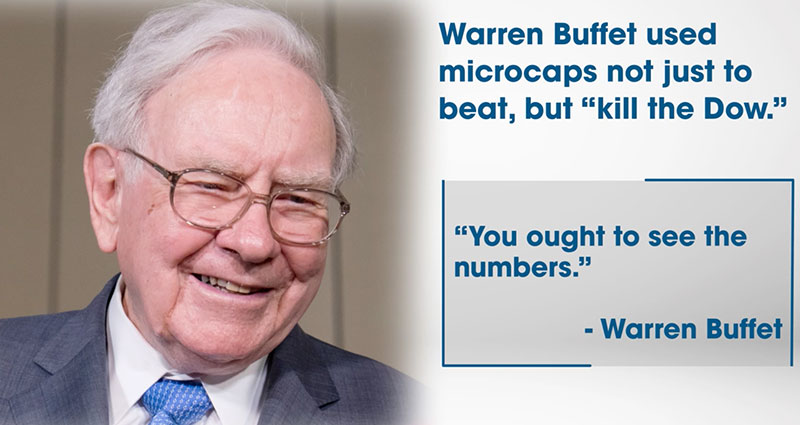

In fact, before Warren Buffett started Berkshire Hathaway, he used microcaps to not just beat, but “kill the Dow.”

“You ought to see the numbers,” he said.

Now if he wants to get into microcaps he has to wait until long after the biggest gains have been made, just like the rest of Wall Street.

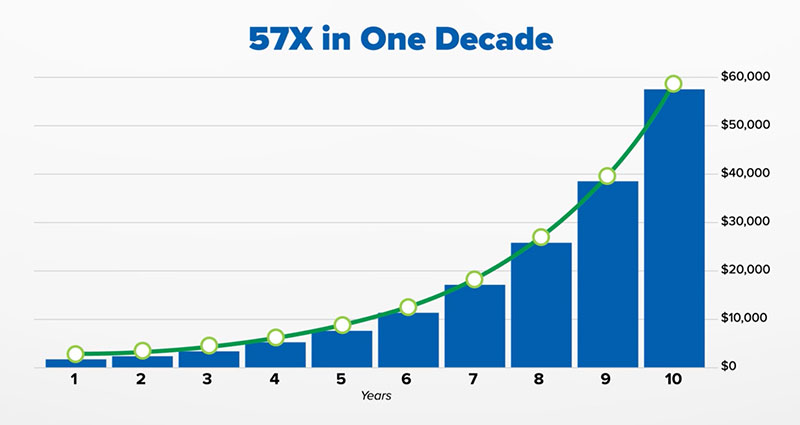

But in a rare interview, Buffett said if he could still invest in microcaps, he could “guarantee 50% profit per year”...

Now, 50% a year might not sound like much. But it would turn a $1,000 investment into more than $57,000 over a decade.- 57X your investment!

You just can’t get that kind of return from any other class of stock than microcaps, and Buffett knows it.

One of the main reasons for this is because microcaps flip the regular investment dynamic on its head.

Most investors know that the way to make serious money from an investment is to get in early — while it’s still small .

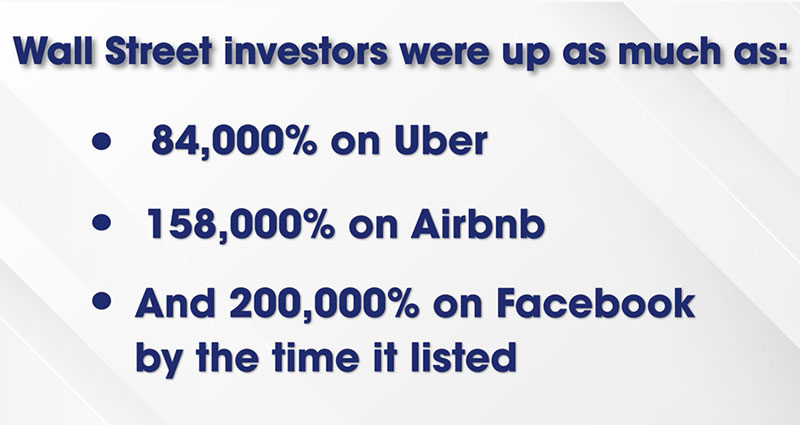

However, with bigger more established companies, Wall Street gets into them long before they’re listed on public exchanges — and makes a killing.

Wall Street icon Peter Thiel, for example, turned $500,000 into more than $1 billion by getting into Facebook before the public.

Or, to put it another way, he made $2 million for every $1,000 he invested.

This is what happens with every single stock that lists as a large cap.

Wall Street makes a fortune and Main Street gets the crumbs.

But with microcaps, it’s the exact opposite.

That’s because microcaps, by definition, are small. Remember, I’m looking for stocks with market caps between $50 million and $1 billion.

So by the time a microcap makes it onto the S&P 500 with the required $14.6 billion market cap, it’s already gained an absolute minimum of 1,300%.

And as much as Wall Street would love to beat Main Street to the punch with microcaps, like it does with large caps, there are two major reasons why it can’t.

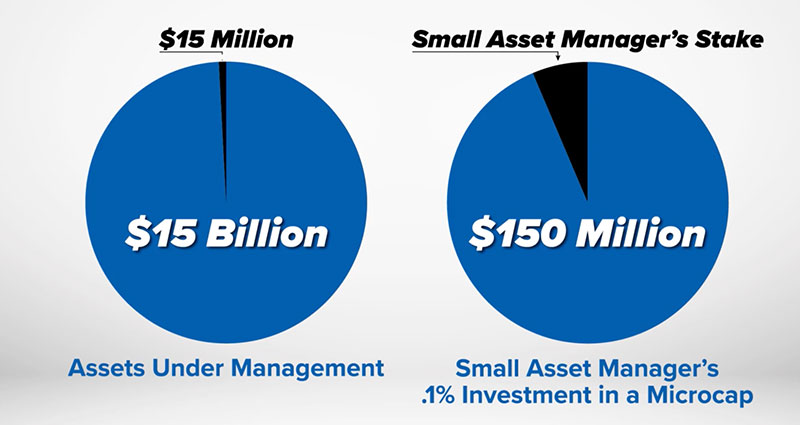

One: They’re simply too big.

Microcaps are small, and fairly illiquid. That means they don’t have a lot of trading volume. So even a fairly small buy or sell can move their price significantly.

This is good for Main Street investors, but disastrous for Wall Street.

On Wall Street, an asset manager is considered small if they manage less than $15 billion…

…0.1% of $15 billion is $15 million.

So even if a small asset manager wanted to invest just 0.1% of its money into a promising $150 million microcap, it would mean taking a 10% stake.

And a 10% stake is huge, especially in an illiquid microcap.

It would move the stock price significantly and change the investment case entirely.

But this would be the least of the asset manager’s worries, thanks to the Williams Act of 1968.

This law means any investor that owns 5% or more of a company has to file a Section 13D with the Securities and Exchange Commission, declaring themselves a “beneficial owner.”

A beneficial owner is basically one step below a company insider.

So any further trades the asset manager wanted to make could be considered securities fraud, unless they adhered to a very strict set of rules.

So, not only would they have blown up their investment case, but they’d also open themselves up to a securities fraud investigation.

No one wants this.

Which is why, asset managers usually do everything they can to stay under this 5% threshold unless they’re planning a takeover or to hold the stock for a very long time.

Whereas, a Main Street investor putting $1,000 into a that same $150 million microcap doesn’t have to worry about any of this.

$1,000 isn’t going to move the needle on a $150 million stock.

That’s why microcaps are the one area of the stock market where Main Street investors can get into promising stocks months BEFORE Wall Street can touch them.

It flips the traditional dynamic on its head.

You’re the one who gets in early, and Wall Street has to wait until long after the biggest gains have been made.

That’s why you have to get in early. Because with microcaps, things can move fast.

That same definitive study I just told you about also discovered that more than 386 microcap stocks gained 1,000% or more over the last decade.

And here’s the best thing about microcaps…

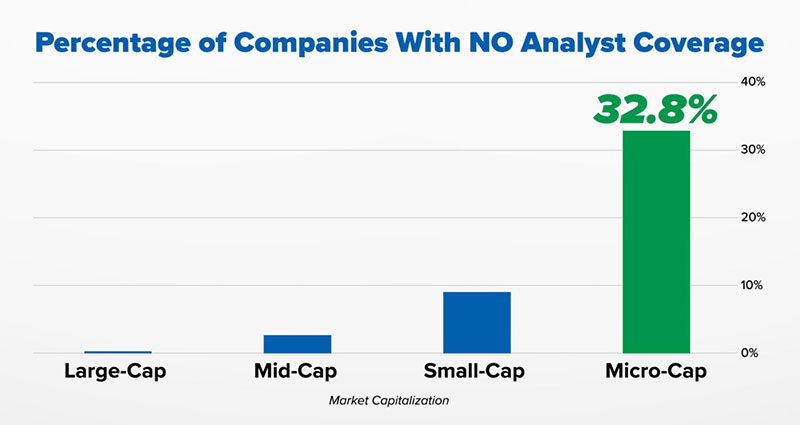

Because Wall Street can’t get into them, Wall Street analysts barely even cover them.

The average large-cap stock has 21 analysts covering it.

Whereas, the average microcap has just three.

And — according to a study by Furey Research Partners — one third of microcaps aren’t covered by any analysts at all.

This is what gives us a MAJOR advantage.

You see, with microcaps, you’re not competing against Wall Street, you’re playing against amateurs…

The kind of people who’ll buy a stock because it has a funny ticker symbol and won’t do any other research.

What that means is, if you actually do your research, you can clean up.

Barron’s agrees. It says:

And that’s what I do.

I pore over the quarterly reports, I listen to the shareholder meetings and later, go through the transcripts with a fine-toothed comb.

Then, once I’ve exhausted everything in their public filings, I turn to my Rolodex of contacts I’ve built over the past four decades.

I work my contacts to uncover the kind of details that don’t show up in financial statements.

And finally, I like to get on a call with the CEO and senior management, which helps me get an inside track on how the company is really doing.

This simply isn’t something amateur investors can do.

That’s why the other OMEGA traits are so important. They ensure you’re investing in a stud not a dud.

And as you’re about to see, my top-three OMEGA stocks excel in every single OMEGA trait.

I’ll give you all the details on these stocks in just a moment…

But for now, know this. When you combine the extreme growth potential of a microcap with the other four OMEGA factors … that’s how you target life-changing returns.

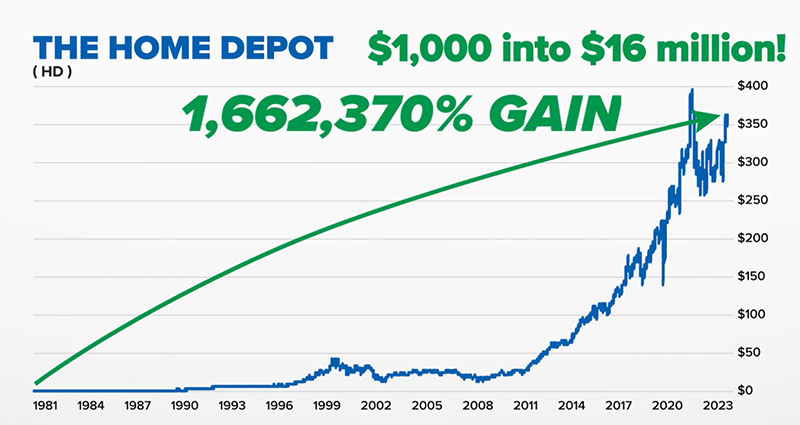

Home Depot is probably the best example of a great OMEGA stock that generated extreme wealth over the long term.

It’s up more than 1.6 million percent since its 1981 IPO.

And I appreciate, a gain that big is hard to get a handle on.

So let me put it this way…

Anyone who invested $1,000 into Home Depot when it first listed — and held onto it — is sitting on more than $16 million today.

You could never get a gain like that by investing into a stock once it was already trading on the S&P 500.

For even the smallest S&P stock to gain that much, it would need a $26 trillion market cap — more than the GDP of the entire country.

It’s not gonna happen.

And, look, clearly Home Depot is an extreme example, but it goes to show how powerful the best OMEGA stocks can be over the long term.

Home Depot…

Outshined in its niche. It adapted Walmart’s tried and true megastore model and applied it to the burgeoning home improvement market.

Started out as a microcap, with a $15 million initial valuation.

Had great financials.

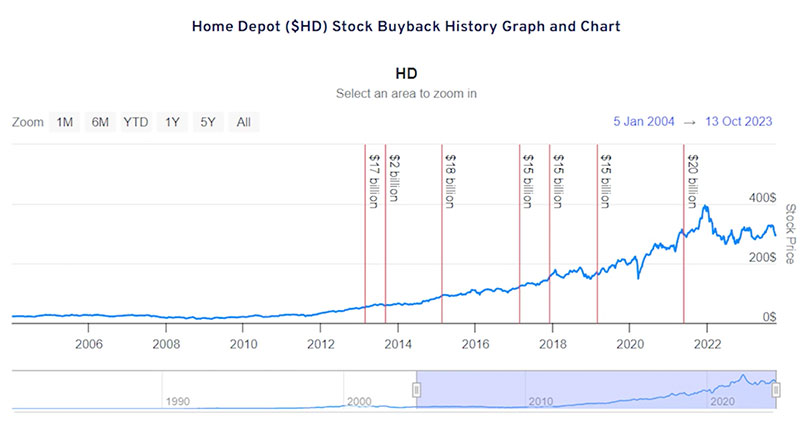

And was acquiring its own stock.

You can see here the seven major share buybacks that helped propel its mammoth run.

But the main thing that sets Home Depot apart … the main thing that sets all OMEGA stocks apart is that it was managed by a superstar founder with a true vision.

In fact, almost every single stock I’ve told you about today that gained 1,000% or more over the last decade or less was managed by its founder for a very long time — most still are.

Here’s why that’s so important.

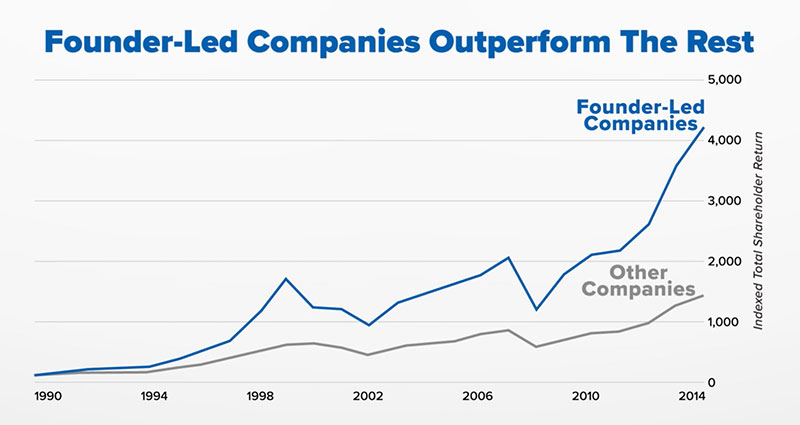

Founder-led companies outperform the market by 3-to-1.

A 2014 study by the Purdue’s Krannert School of Management showed that over a 15-year period, founder-led companies beat the overall market by just over 3X.

And when you think about it, it’s not that surprising.

In the book, The Founder’s Mentality , the authors found three features of founder-led companies that set them apart.

A great example of this is Fred Smith, who founded FedEx in 1971 and remained its CEO for 50 years.

He only stepped down in 2022 and still serves as its executive chairman.

Fred came up with the idea for FedEx in College.

He wrote a term paper on the need for a reliable overnight delivery service.

His professor shot the idea down, saying:

"The concept is interesting and well-formed, but in order to earn better than a “C,” the idea must be feasible."

That didn’t stop Fred. And a few years later, he launched the world’s first overnight delivery company … FedEx.

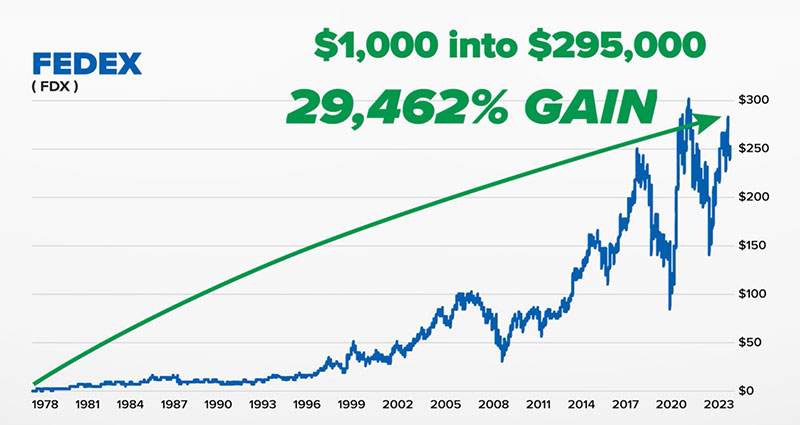

Fred had the founder’s mentality in spades, and his company, FedEx, is another great example of a strong OMEGA stock.

It carved out its own niche in the delivery industry.

Was managed by a superstar founder.

Started out as a microcap.

Had super strong financials.

Has bought back $14 billion of its own shares , and its founder still owns more than $5 billion of its stock.

And since it was first listed in 1978 , it’s gained more than 29,000%.

Which means anyone who bought $1,000 of FedEx stock when it first listed and held onto it until today is up more than $295,000.

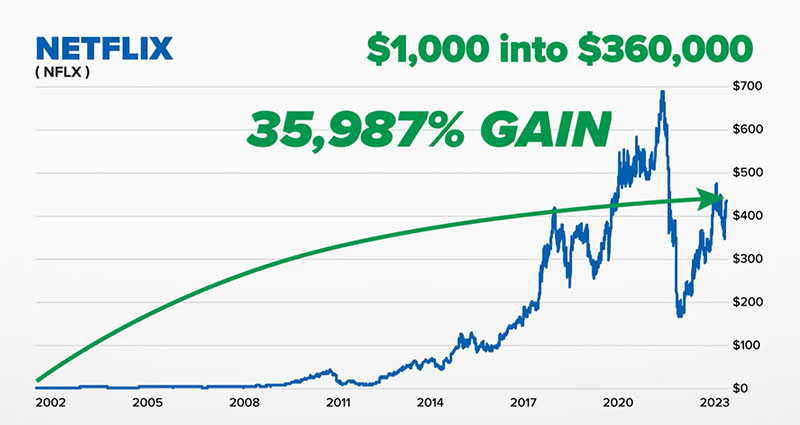

A more recent example is Netflix.

Reed Hastings founded Netflix after getting charged a $40 late fee by Blockbuster.

He waged war on industry norms twice … first by setting up the first ever mail-order movie rental business, and later by pivoting to streaming.

He remained Netflix’s CEO since its inception until January 2023.

Again, Netflix is a prime OMEGA stock.

It outshined in its niche … it reshaped the entire movie rental industry. Heck, it reshaped the entire movie industry.

Was managed by a superstar founder with a strong vision.

Started out as a microcap.

Had great financials.

And its co-founder owns a ton of stock. Reed Hastings still holds $2.3 billion of Netflix stock.

As a result, Netflix is up around 36,000% since it first listed in 2002.

So, anyone who invested $1,000 in Netflix when it first listed, and held onto it, is sitting on $360,000 today.

Look. These kind of stock gains don’t happen by chance. They happen when a company excels at all five OMEGA traits.

I’ve seen it time and time again.

And listen, like I said, these are extreme examples. The very best. They aren’t normal returns. I’m simply using them to illustrate the insane power of OMEGA stocks…

But here’s the truth.

Most investors will never even see a miniscule fraction of these returns — because they don’t even know what OMEGA stocks are … much less how to find them BEFORE they go on a meteoric price rise.

And that’s where I come in.

I’ve dedicated my life to finding the best OMEGA stocks on the market and bringing them to you.

As you’ve seen, OMEGA stocks like American Costal and Soleno made more than 1,700% over the last year.

And over the longer term, the best omega stocks, like Oracle and Home Depot have the power to turn $1,000 into more than $1 million.

Which brings me onto my top three OMEGA stocks to buy today.

These three OMEGA stocks are absolutely packed with potential … so you’ll want to get into them now … before Wall Street. That’s absolutely essential if you want to target the biggest gains.

Each of these stocks is absolutely nailing all five OMEGA traits.

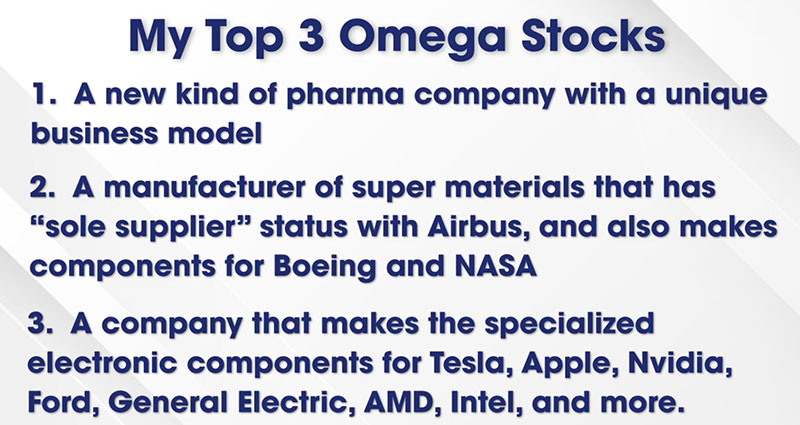

The first is an innovative pharma company that’s using a unique business model to conquer the eye-care niche.

Here’s what I like about it…

Operating in a niche industry.

Even though it’s still just a microcap company, it’s already dominating the eye-care niche.

It’s cut out the middleman and sells its products directly to customers, doctors and hospitals via its online pharmacy.

As a result, it now has one of the largest portfolios of eye-care pharmaceutical products in the U.S. market.

And its products are already used in 8 million surgeries per year.

Managed by the founder.

This company’s founder is a CEO with a mission.

He wants to help Americans preserve their sight by giving them access to innovative, affordable medication.

And that’s not just empty talk. He really means it.

For example, you might remember the story of Martin Shkreli.

Back in 2015, he bought up the patent on a prominent cancer drug and jacked its price by 5,000% — from $13.50 to $750.

The world was outraged.

And so was this CEO.

He got his company— to develop and ship a $1 alternative to that drug within two weeks.

So, when he says his company has a mission to provide affordable eyecare medication he means it.

That’s the person you want to invest with.

This company has extreme growth potential.

The CEO believes it will reach “annual revenues of $1 billion or more” within five years.

Thanks to our aging population, the pharmaceutical eye-care market is growing at record pace.

It’s currently valued at more than $33 billion, and it’s projected to exceed $60 billion by 2032.

And yet, while this company is one of the leaders of the industry, it’s market cap is only $329 million — less than 1% of the eye-care market.

And its stock is currently trading for less than $10.

The profit potential here is off the charts.

And, of course, this company also has great financials. I wouldn’t even be looking at it if it didn’t.

Its revenues have grown by 50% year-over-year and it has more than $65 million in cash.

Plus it’s acquiring its own stock. The CEO owns roughly $19 million of its stock — more than $400,000 of which he bought over the last year.

Make no mistake: This company is one of the best examples of an OMEGA stock I’ve ever seen. And the time to get in is now — before it goes on a monumental run.

Meanwhile, my next OMEGA stock is a supplier of super materials to the aerospace industry.

It has “sole supplier” status with Airbus , in addition to working with Boeing and NASA , where its composite materials are used to make engines and fuselage.

And its unique support struts made the James Webb Telescope possible.

It’s managed by the son of the founder, who’s worked for the business all his life.

This man is so committed to the business he’s refused numerous pay raises and bonuses to give his staff more money.

And he’s declared war on Wall Street analysts after they’ve continually ignored the company.

This company isn’t even covered by a single analyst…

Even though, it’s an absolute cash cow.

It’s paid nearly double its $306 million market cap in dividends since 2005.

And since 2015, it’s bought back $18 million of its own stock — roughly 5% of its market cap.

It’s buying back its own stock as fast as it’s legally allowed to.

This CEO knows what his company is worth better than anyone. He knows it’s criminally undervalued.

And since Wall Street analysts fail to see that, he’s buying back his own stock, as he knows that’s the best investment the company can make.

If you want to make life-changing money from the stock market THIS is the exact kind of company you want to invest in.

It’s excelling in all five OMEGA traits, and it’s extremely undervalued right now.

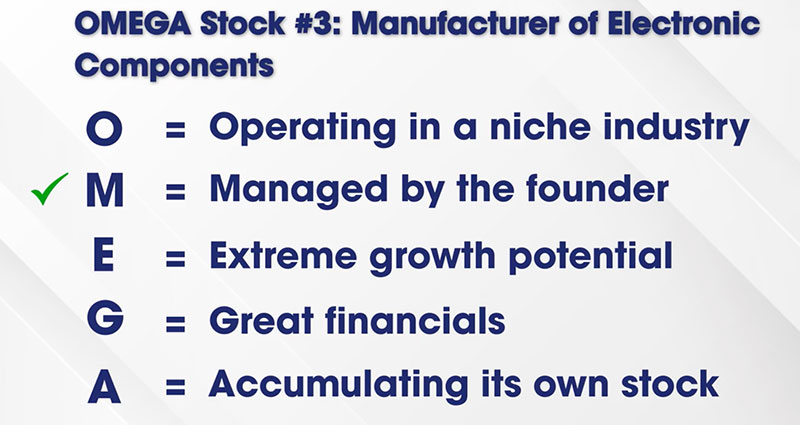

Just like my third OMEGA stock.

This company manufactures specialized electronic components for some of the world’s biggest companies, including Tesla, Apple, Ford, General Electric, AMD, Intel and Nvidia.

This stock is managed by the founder’s son, who’s been its CEO since 2001.

And in 2021 he hired a superstar chief financial officer, who’s more than doubled the company’s $25 million net profit to $53 million in just one year.

With this kind of momentum its stock price could explode at any moment … which makes now the perfect time to get in.

All three of these OMEGA stocks are on the cusp of greatness.

And all three are still — somehow — flying under Wall Street’s radar.

But I don’t expect that to last long.

The time to get in is now … while they’re still trading as microcaps.

That’s absolutely essential if you want to make the biggest gains.

I’ve put everything you need to get into these OMEGA stocks — today — in a special report.

It’s called: OMEGA Stock Superstars — Everything You Need to Get in on the Top 3 OMEGA Stocks of 2024.

In it you’ll find all my research on these three OMEGA stocks.

This is your chance to get in on my top three OMEGA stocks today — before they explode upward.

As you’ve seen, OMEGA stocks have had the power to gain 1,000% or more in the space of just one year.

And over the longer term, the best OMEGA stocks turned a small $1,000 investment into more than $1 million.

My OMEGA Stock Superstars report gives you everything you need to get in on my top three OMEGA stocks TODAY.

The best part is, I’m going to give you it for free.

It’s my personal gift to you for joining my premium research service: Microcap Fortunes.

Members of Microcap Fortunes enjoy complete access to all the best OMEGA stock opportunities I uncover.

And this is your chance to become one of them.

The second you subscribe you’ll get immediate access to my OMEGA Stock Superstars report, with full details on my top three OMEGA stocks to buy today.

But you’ll also get a lot more than that.

Inside Microcap Fortunes you’ll find an active model portfolio of more than 18 of the best OMEGA stocks on the market, including…

That’s just 3 of the more than 18 incredible investment opportunities you’ll get full details of when you join me in Microcap Fortunes today.

Plus, with Microcap Fortunes being a fairly new service, all of my current picks still have tons of room to grow.

So, if you’re quick, you’ll have the chance to get in on the pick that makes us our first 1,000%+ return in the coming years.

And the great thing about these stocks is, as you’ve seen, you don’t need to invest a lot of money to potentially make a life-changing return.

In fact, I recommend you don’t invest too much in each stock.

All investing — whether its microcaps, S&P 500 stocks, bonds or ETFs — carries inherent risks.

But properly managing those risks is the key to success.

So, you should never invest more than you can afford to lose.

And with these smaller companies, I always recommend investing just a small part of your portfolio into each one.

But as you’ve seen, small investments in these OMEGA stocks can potentially change your life.

That’s one of the things I love about OMEGA stocks … you don’t have to bet the farm to make a potential fortune.

Every time I recommend a new OMEGA stock, I issue a trade alert to my members.

I write in plain English why I’m recommending the company. I cover its competitive advantages, what the CEO is doing to maximize shareholder value, and I give you what I call my 3:30 a.m. pitch.

Basically, if you called me up at 3:30 in the morning, what would you tell me about the stock to get me out of bed?

If you can’t make a 3:30 a.m. pitch for it, then it’s not the right company to buy.

However, you won’t just be getting trade alerts.

As a member, you’ll also get weekly updates on all the companies in our portfolio. And I’ll share any important developments with you as they happen.

When I’m ready to make a recommendation, I’ll send you a trade alert directly to your inbox. You can expect to see at least one new recommendation a month.

You can even choose to get a text message, sent straight to your smartphone, whenever I release a new OMEGA stock alert.

And the Microcap Fortunes website gives you quick and easy access to everything that comes with your subscription.

All this — and much more — is yours when you choose to join me today as a member of Microcap Fortunes.

By now you’re probably wondering, what does all this cost?

Well, as you know. I put an incredible amount of research into each recommendation I make.

I work full-time scouring the market for the best OMEGA stock opportunities.

And I put just as much research into my OMEGA stock recommendations as I used to put into my investment strategies when I ran the number one ranked investment firm in America.

In fact, I put even more time in. Because a small information edge in an OMEGA stock can lead to a huge windfall.

As I’m sure you can appreciate, none of this comes cheap. The costs run up to more than $1 million a year to bring my services to my readers.

But because my research costs are divided among thousands of paying subscribers, I can keep the price down.

So, one year of Microcap Fortunes normally retails for $10,000.

But because you’ve watched this full presentation, I know you’re serious about the opportunity in front of you.

And I don’t want price to be a barrier.

So, you’re not going to pay anywhere near that much if you join me today.

I want to give you the opportunity to get in on my top three OMEGA stock superstars BEFORE Wall Street.

I want to get you in today … while these stocks are still flying under the radar.

As you’ve seen, OMEGA stocks like American Costal and Soleno Therapeutics all made more than 1,700% over the last year.

But you can only hope to target those kinds of returns if you put yourself in the game.

So, here’s what I’m gonna do.

I’d like to offer you a full one-year membership to Microcap Fortunes at a substantial discount off the regular price.

You can click the big orange button below now for full details.

I think you’ll be shocked at the discount I’m offering you if you join today.

Which is why, if you’re truly serious about growing your long-term wealth, and joining me, I’d like to make you an even better offer.

Remember, over the long term, OMEGA stocks like Oracle and Home Depot, turned $1,000 into more than $1 million.

That’s why I’m going to give you two options when you join.

As well as the steeply discounted one-year offer…

There’s also a five-year membership — with an even bigger discount — which I’d urge you to choose if you’re serious about this opportunity.

As you’ll see, if you join today, you can get a full five-year membership for less than the regular one-year price.

And of course, if you just want to “try this out,” you also have the one-year option.

The choice is yours.

And look. I know acting on an opportunity like this can be hard.

So I’m going to go one step further.

Here’s my guarantee to you.

If at any point in the first 90 days of your membership, you change your mind — for any reason whatsoever — just give my Maryland-based team a call or drop them an email.

They’ll give you 100% of your membership fee back in the form of a credit that you can use toward any of our other products. No hassle. No hard feelings.

This is your opportunity to get in on the next great OMEGA stock.

Don’t miss your one chance, and always leave yourself wondering, what if?

Take that first step now. Make that positive change — and see where it takes you.

Just use the big orange button below this video to go through to my secure order form now.

You’ll be able to review everything you get before you make your decision.

Click the big orange button now.

I can’t wait to welcome you on board.

Thank you for joining me today.

I’m Charles Mizrahi.

And I look forward to welcoming you on board Microcap Fortunes.

December 2023